Data shows the crypto futures market has observed around $212 million in liquidations during the past day as Bitcoin has surged above $24,000.

Crypto Liquidations Measure About $212 million In Last 24 Hours, 88% Shorts

To open any contract on the crypto futures market, the holder has to first put forth some initial collateral. A “liquidation” occurs when the holder’s bet fails (meaning that the price of the asset moves in a direction opposite to the one the investor bet on) and a specific percentage of this initial collateral has been eaten away by the losses.

This percentage may differ from platform to platform, but when the losses hit this mark, derivative exchanges generally forcibly close the position (or “liquidate” it).

One factor that increases the risk of any contract being liquidated is leverage. Against the initial position, any holder can opt to take on some leverage, which is a loan amount that is often multiple times more than the position itself.

While leverage means that any profits that the holder accumulates now also become multitudes more (as compared to if the holder hadn’t taken on any leverage at all), the same applies to losses as well.

In the crypto market, mass liquidation events (called squeezes) aren’t an uncommon sight due to mainly two factors. First, the assets in the sector are generally quite volatile, meaning that the prices can sometimes observe large unexpected swings.

And second, leverage as high as 50, or even 100, times the original position is usually pretty accessible on many derivative exchanges. High leverage trading in a volatile market like this can be a deadly combination, especially for uninformed traders.

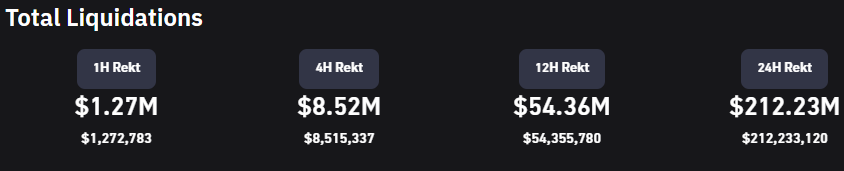

A huge amount of futures liquidations have also taken place during the past 24 hours, as the data below shows:

As you can see above, the crypto futures market has seen liquidations amounting to a massive $212 million in the last 24 hours. The main trigger behind this flush was a market-wide price surge led by Bitcoin as the asset shot up and broke above the $24,000 level.

Since the cause of the liquidations here was a price rise, it isn’t a surprise that 88% of the contracts flushed were shorts. As such, this was an example of a “short squeeze.” Squeezes are events where a large number of liquidations cascade together and amplify further the price move that caused them (thus causing even more liquidations in the process).

It also looks like only $54 million of the liquidations came during the last 12 hours, suggesting that the preceding 12-hour period carried the majority of the blow. This trend also makes sense, as the bulk of the volatile price action took place within that period.

Bitcoin Price

At the time of writing, Bitcoin is trading around $24,500, up 8% in the last week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments