The benchmark cryptocurrency slipped briefly under the $29,500-level on June 22 as a Glassnode report indicated the possibility of miner capitulation in China.

Bitcoin (BTC) plunged 7.38% to hit a five-month low of $29,313 on June 22 as the market faced the prospect of another sell-off, this time led by miners affected by a recent crackdown against cryptocurrency entities in China.

The People's Bank of China said on June 21 that it had summoned multiple regional institutions — including the Agricultural Bank of China, China Construction Bank, Industrial and Commercial Bank of China, and Jack Ma's payment platform, Alipay — to “strictly implement” its recent ordinances on curbing Bitcoin- and other cryptocurrency-related activities, including mining.

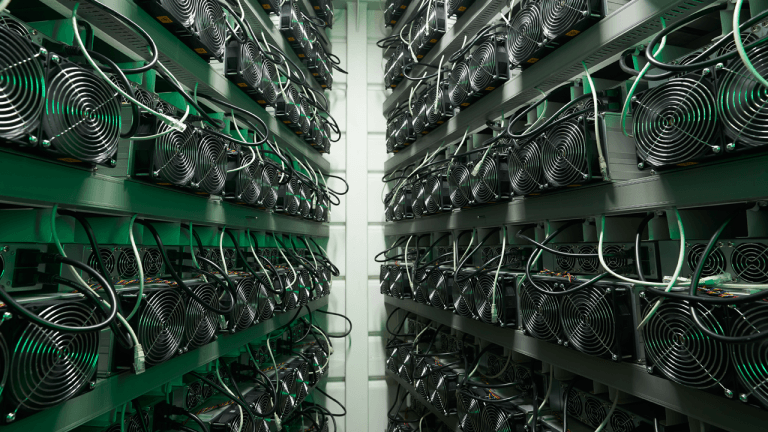

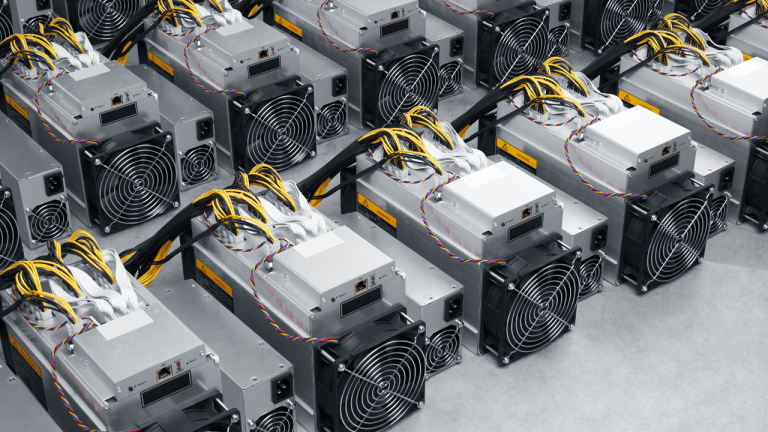

The Sichuan province, a hydropower-rich region in Southwest China, ordered its 26 largest crypto mining farms to stop operating, Chinese media reported on June 18. The province had been contributing 75% of the total global hashing power required to run the Bitcoin blockchain network.

The regulatory warnings followed a decline in the Bitcoin market, which in mid-April traded near $65,000, spurred by backings from high-profile advocates including Tesla CEO Elon Musk.

Miner capitulation FUD

A recent report published by Glassnode reveals a "seismic mining shift" taking place in China. The data analytics platform noted that many miners are in the process of either shutting down or migrating their hashing power outside of China to comply with the mining ban.

"One of the largest migrations of Bitcoin hash-power in history appears to be underway," wrote Glassnode, adding that the estimated mean hash rate (the seven-day moving average) has declined from circa 155 exahashes per second to around 125 EH/s in the two weeks since the latest round of FUD (fear, uncertainty and doubt) from China.

Glassnode anticipated that the Chinese mining industry would likely liquidate a portion of its Bitcoin holdings when coming to grips with relocating farms abroad or selling hardware. Those sell-offs might reflect "miners hedging risk" and "obtaining capital to facilitate and fund logistics."

Meanwhile, for some miners, it may be a general exit from the industry entirely, the report adds.

Recent on-chain trends have shown a spike in miners' BTC distribution and a decline in accumulation.

For example, the miner net position change metric, which tracks the transactional flow of Bitcoin mining pools, showed miners distributing BTC at a rate of $4,000 to $5,000 per month over the period in which the hash rate fell 16%.

"This has reversed the trend of net accumulation which was active since April," the report states.

Big investors absorbing miners' OTC distribution

Miner capitulation is not necessarily a bad thing, as long as the market absorbs the selling pressure. During the first quarter of 2021, bids for BTC/USD rose from as low as $28,700 to $61,788 even as miners sold their Bitcoin holdings en masse.

Jonathan Ovadia, chief executive of OVEX — a South Africa-based cryptocurrency exchange — credited institutional investors as being behind the latest sell-off absorption, drawing evidence from MicroStrategy's ongoing Bitcoin accumulation spree. He said:

"The continuous accumulation of Bitcoin by institutional investors, particularly MicroStrategy, is based on a very deep conviction of the potential future upside beyond this current correction."

Meanwhile, taking a look at over-the-counter (OTC) desks, which miners utilize to match their large size distributions with institutional buyers, also showed demand among large volume buyers.

"During both the May Sell-off and over the last two weeks, between 3.0k and 3.5k BTC in net inflows have been observed," Glassnode reported. "However in both instances, almost the full inflow size was absorbed by buyers over just a few weeks."

As a result, OTC Bitcoin balances have been relatively flat since April.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments