Alameda Research, the trading firm affiliated with the collapsed cryptocurrency exchange FTX, has initiated legal action against Aleksandr Ivanov, the founder of Waves, in a bid to recover approximately $90 million in assets as part of Alameda’s broader efforts to repay creditors affected by FTX’s insolvency in 2022.

Waves Founder Under Fire

In a detailed complaint filed on Sunday, Alameda Research claims that Ivanov, along with affiliated companies Numeris Ltd. and DLTech Ltd., engaged in fraudulent activities that resulted in significant financial losses for the firm.

Alameda alleges that it deposited around $80 million in stablecoins with Vires.Finance, a liquidity platform operated within the Waves ecosystem, only to find those assets now trapped due to Ivanov’s alleged mismanagement and deceitful practices.

The complaint outlines a series of transactions orchestrated by Ivanov that “artificially inflated” the value of the WAVES token, while simultaneously diverting funds from Vires. As a result, the WAVES token lost over 95% of its market capitalization, leading to $530 million in losses for Vires users.

The lawsuit further accuses Ivanov of “manipulating public perception” by blaming Alameda Research for destabilizing the Waves ecosystem, while privately attempting to extort funds from them.

Alameda asserts that Ivanov threatened to freeze their assets unless they provided financial support for the Waves and Vires platforms. When Alameda refused to comply, Ivanov allegedly used his control over the Vires decentralized autonomous organization (DAO) to block access to their funds.

Alameda Research Seeks Recovery Of $90 Million

In November 2022, Ivanov acknowledged publicly that Alameda had deposited $90 million worth of stablecoin collateral, yet he took steps to freeze those funds under the pretext of ensuring repayment to FTX users.

Since the bankruptcy filing, Alameda has struggled to reclaim its assets, with Ivanov reportedly ignoring multiple attempts to engage in dialogue.

The lawsuit seeks not only the recovery of the deposited assets but also damages related to violations of the Bankruptcy Code, including fraud and conversion of property. Alameda plans to pursue all avenues to recover additional assets that may have been transferred to Ivanov or his companies.

In the wake of these developments, Ivanov has reportedly dissolved the legal entities operating Vires and Waves, raising further concerns about the recovery of funds and accountability.

Alameda Research retains the right to amend its complaint, potentially expanding the scope of the lawsuit as more information comes to light.

At the time of writing, FTX’s native token FTT is currently trading at $2.067, up 10% in the 24-hour time frame amid the broader market uptrend led by Bitcoin (BTC).

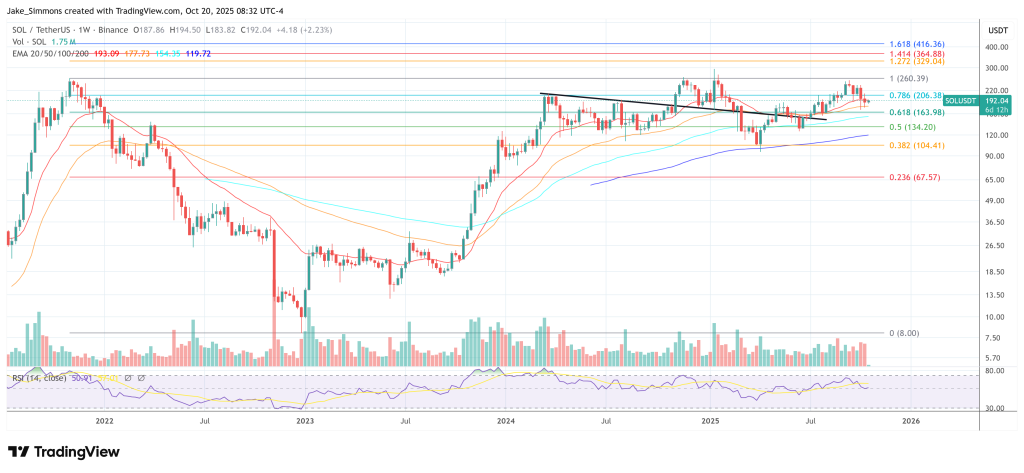

Featured image from DALL-E, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments