ETFs are currently buying 12x the mining supply meaning retail investors must be selling their sats to them.

The halving is going to hit in April dropping the mining supply meaning the ETFs will then be buying 24x the mining supply. That means 96% of all ETF buying will have to be coming from retail selling their sats.

At this point we reach new all time highs and like clockwork in anticipation of an epic bull run retail are going to stop selling and miners will start holding their mined coins instead of selling them. This is going to leave the ETFs with no supply at all.

The only way the ETFs can buy will be to offer a price that makes retail want to sell. But not only that, the bitcoin seller will effectively be able to accept the highest bid. So the ETF buyers wont just have to offer an enticing price they will have to outbid all the other ETF buyers.

This bidding war is how we get a so called omega candle, a $100k green daily candle.

ETF demand trying to bid sats out of the hands of retail that refuse to sell is going to cause insanely wild price rises. It will be historical to witness because these supply and demand dynamics have never happened before in human history.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

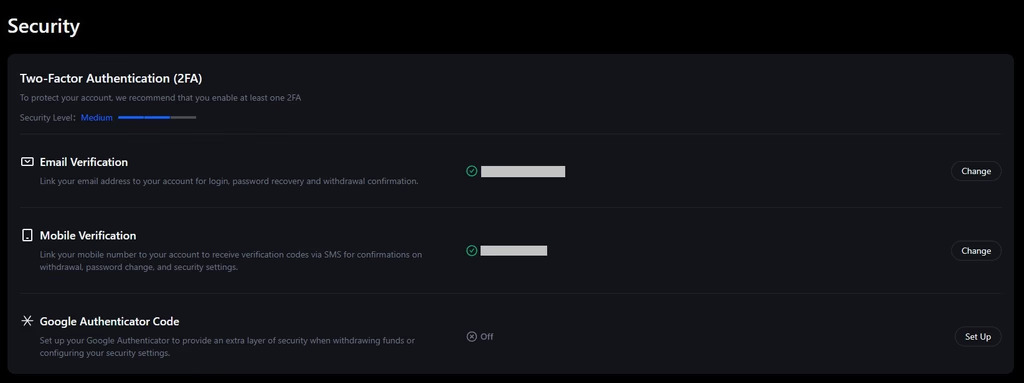

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments