I've been in this space actively since 2015. I'm very familiar with a large array of cryptos, how they function and what their purpose is. But one problem has always gone unanswered in all that time. So I'm going to attempt to see what this community has to say about it. As well as a couple others if you feel like answering. Keep in mind THIS IS FOR BITCOIN MAXIMALISTS ONLY.

I am in no way trying to start a fight. I just want an honest to God answer to my question and nobody on Twitter seems to have an answer for me. Please keep it civilized. I'm just looking for straight forward answers to this question. Because to my understanding, the answers don't exist. And I'm going to try to word this as carefully as I can and in segments so you can counter or answer each point by point As to avoid people dodging the question or starting arguments.

1: So my understanding as to the purpose of Bitcoin, is to become the global reserve currency and defeat inflation with it's fixed supply cap and unchangeable monetary policy.

If you agree to that statement then I'll continue. If not then feel free to comment what you think it's purpose is and try to answer my question based on that.

2: Having established the purpose of bitcoins existence, I'd like to ask how exactly that's going to actually work do to bitcoins limitations. It's been quite a long time since bitcoins inception and complex smart contracts to enable things like defi and NFTs just aren't possible to create and run on the Bitcoin Blockchain. There is no secret Satoshi left us to solve. It's just not physically possible or it would have been done by now and other smart contract chains would be deemed completely irrelevant.

If you agree with that statement then I'll continue if not please answer as to why I'm wrong.

3: without the ability to use native on chain smart contracts bitcoins use and ability to function in a monetary sense is gone. Yes you can send coins from wallet A to B. For simple transactions that's perfectly fine. But the world we live in is much more complex than that. People need to use money to take loans to buy cars and houses for example. Interest rates need to be calculated, automatic payment systems for Interest and principal and insurance need to be calculated and applied to each payment. And the Bitcoin Blockchain does not have the capability to do any of those things Natively. Not to mention investment vehicles like 401ks, IRAs, pensions, payroll, and countless other things. So in order to make that happen. Bitcoin needs to rely on an outside party. Centralized banks for example. Which clearly wouldn't work because then Bitcoin is no longer decentralized and your coins would be in control of a 3rd party. Or an EVM side chain like stacks as another example. But stacks isn't native Bitcoin as it requires bridges and smart contracts. BUT Bitcoin maximalists claim that Everything aside from Bitcoin is a scam, or centralized, or a shitcoin. So from a maximalists perspective that shouldn't be allowed as an option either.

Thus, since neither option is allowed to exist from a maximalists perspective, how is Bitcoin supposed to function as a reserve currency without the assistance of a physical 3rd party like a centralized bank, or a smart contract side chain???

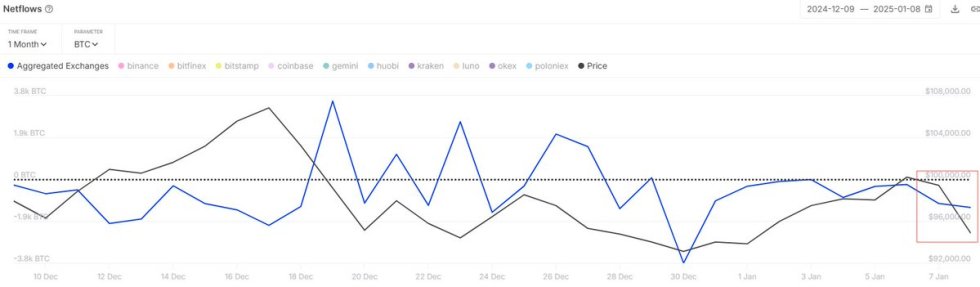

4: Blockchains reason for existing, is to sell blockspace. That blockspace is filled with transactions that are then processed by miners and passed along to nodes to very and keep track of. Miners receive revenue in 2 ways. Token issuance and transaction fees. Token issuance or inflation is paid to miners by the network and is reduced over time via the halvening events. Miners currently rely on that issuance AND transaction fees paid by users to operate profitably. Currently the vast majority of miners Revenue (90+%) comes from token issuance the rest from fees. Some miners are having a hard time staying above water right now because of the lack of demand for Bitcoin blockspace. As seen here at Cryptofees.info

Bitcoin is struggling to maintain consistent fees above Other chains and even the apps that run on those chains. At times it's several numbers down that list. So if demand for Bitcoin blockspace doesn't increase and the halvening events reduce the issuance that gets paid to miners how are miners going to operate in profit? And if they cannot operate in profit, then Bitcoin becomes vulnerable to attacks.

Now I know that as miners drop off the network the revenue gets passed to the miners that stay on and should theoretically keep the network alive but all that does is kill off the smaller miners and centralize the mining pools/operations more and more overtime.

5: if you agree with the above statement then that means nobody can mine Bitcoin from home, only the people with access to vast amounts of capital or take enormous loans from centralized banks can afford to house and run miners. Keep in mind, miners are very loud and hot and expensive to maintain as large warehouses and expensive cooling is required. So with that being said. That means that Bitcoin can only survive on life support from corporate entities loans from banks, miners produced by ~5 companies and is no longer decentralized in any regard right??

Please take your time and answer everything point by point so it's easy for myself and other to read and digest. Thank you.

//////////////

Yes the original purpose was a p2p currency. But that's obviously not a possibility anymore. Narratives change. The current Bitcoin maxi narrative is a store of value, reserve currency, digital gold narrative. This is what I'm referring too.

////////

I would ask this in the Bitcoin sub. But I've been permanently banned for being a filthy heathen.

/////////// Plz do not shill your bags.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments