Scenario 1: Invest 70k into a down payment in a rental property. Get tenants, insurance, set aside money for repairs, blah blah. Maybe clear $100 a month after expenses. Property gains value over time. Pay property taxes each year. Rent controls on how much I can increase rent over time. Have a mortgage attached, pay interest rates.

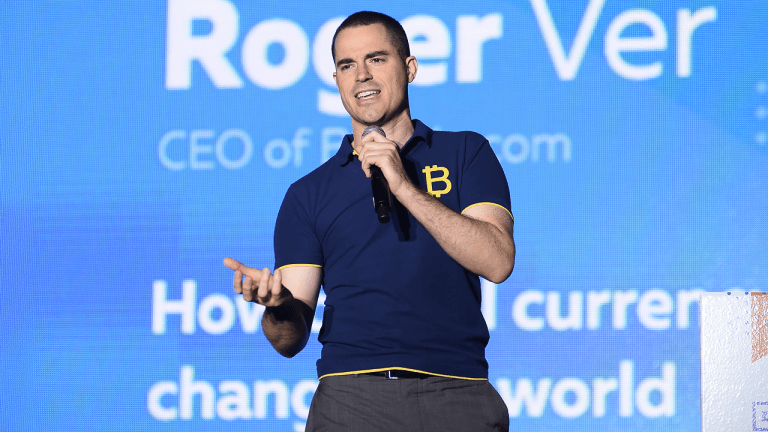

Scenario 2: Buy 2 Bitcoin at current spot price. Hold them in Celsius. Get 6.5% APY, about $400 a month currently. No expenses. No tenants. Bitcoin appreciates in value well beyond and faster than the real estate property. No property tax. And the 6.5% in interest scales with the value of the Bitcoin. If Bitcoin 2x in price, now that’s $800 a month. No mortgage associated. Not interest payments. ????????????????

Jesus Christ is Bitcoin and CeFi/DeFi disruptive to traditional wealth building.

I understand there is risk using a custodial wallet. There’s always risk in finance. I think it’s important to embrace CeFi and DeFi as a healthy way to grow this monetary network.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments