Summary:

- Babel Finance plans to repay creditors with a two-prong approach – a decentralized finance platform and a crypto-backed stablecoin token.

- The troubled crypto lender could soon move to keep creditors at bay by filing a six-month moratorium extension.

- Babel was hit by last year’s crypto crash alongside other crypto lenders like Genesis.

Troubled crypto lender Babel Finance hopes to repay creditors with a new crypto-backed stablecoin token and a decentralized finance (DeFi) platform after pausing withdrawals amid spreading contagion in 2022.

Babel Finance Hopes To Repay Creditors With UST-Type Stablecoin

Bloomberg reported that the crypto lender was close to filing a moratorium extension to the high court of Singapore. Under the leadership of sole Director and Co-Founder Yang Zhou, the company hopes to secure at least six months of legal protection. If successful, creditors will be unable to sue Babel or pursue recovery of around $766 million in debt.

Director Zhou plans to settle creditors by rolling out a DeFi platform combined with a stablecoin token that leverages other cryptocurrencies as collateral or reserve. Per reports, the stablecoin token dubbed ‘Hope’ will be backed by two leading digital assets – Bitcoin (BTC) and Ether (ETH).

The design for Babel’s Hope token could mirror Terra’s UST coin, an algorithmic stablecoin also backed by cryptocurrencies before the token crashed and triggered a wider market downturn. Indeed, the losses from UST’s collapse are estimated over $40 billion including institutional and retail investments.

Furthermore, Babel’s decision to adopt a crypto-backed model could draw a parallel with other stablecoins like Tether’s USDT and Circle’s USD Coin (USDC) which are backed by cash, treasuries and other traditional financial equivalents.

Babel Finance, Crypto Lenders Pick Up The Pieces

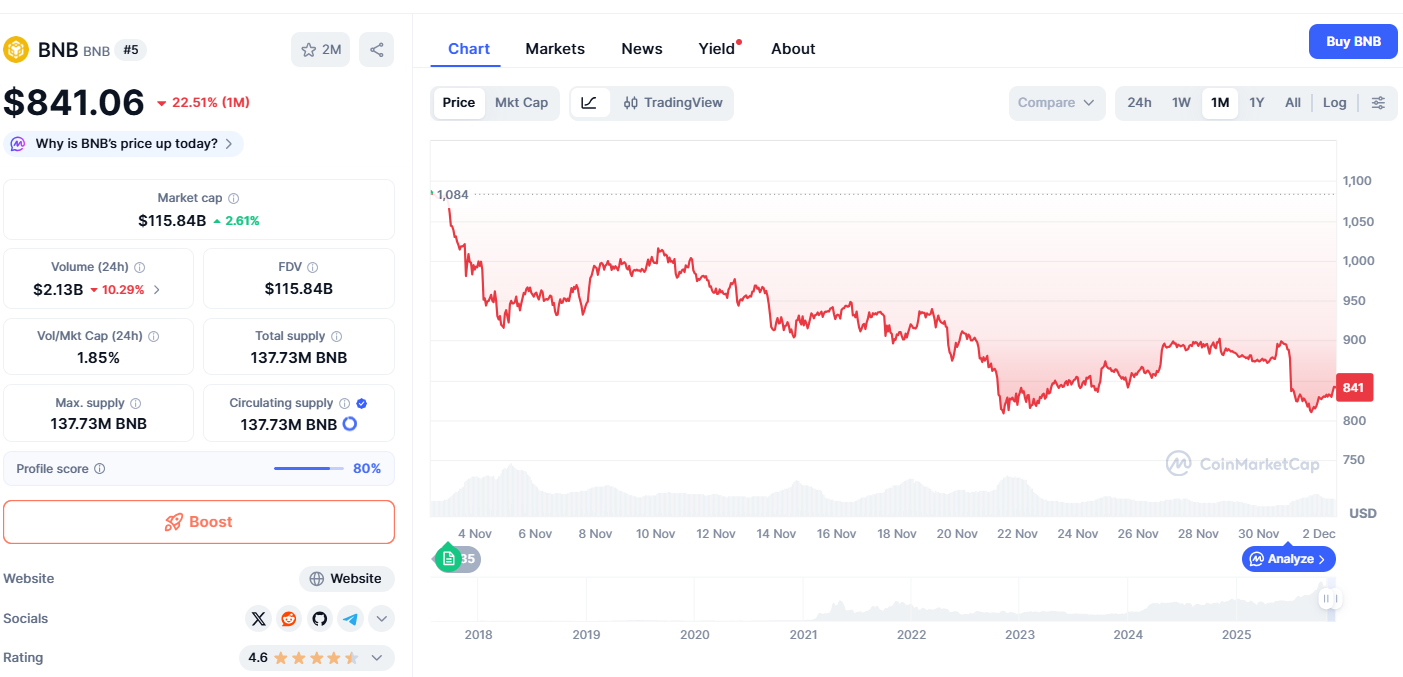

The news comes months after the crypto lending market was rocked by failures from industry heavyweights like Terra, Three Arrows Capital, and FTX. Babel Finance reported a liquidity crunch last year and halted withdrawals in June 2022.

The filing aimed at a moratorium extension said that Co-Founder Wang Li stacked over $500 million in trading losses. Lenders liquidated an additional $200+ million in loan collateral, bringing Babel’s total debt to over $700 million.

Other crypto lending businesses like Genesis were also significantly affected.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments