Financial markets are a rollercoaster of uncertainty and unpredictability. Warren Buffett once said: “The only value of stock forecasters is to make fortune-tellers look good.” Crypto is like that, but on steroids. No wonder, then, that every once in a while, we see the emergence of an event that market thought leaders define as a “decisive moment.” Just like the gods of war and prosperity in ancient mythologies, people seek reasoning for past events, predictions for what’s about to come, and most importantly, a playbook for ensuring a better future.

A New Tenant on Mount Olympus

The Bitcoin maximalists can tell you all about the magical forces of the Bitcoin halving. Much virtual ink has been spilled to explain the cycles before, during, and after the halving, in a desperate attempt to make sense of the insensible pricing of this asset.

In the past few months, a new magical event has emerged in the Bitcoiner (and degen) jargon, the Bitcoin ETF. Now, the halving can share crypto’s Mount Olympus with a new colleague.

Since the news that institutional giants like BlackRock and Fidelity are pursuing SEC approval for a Bitcoin ETF, Bitcoiners have been infused with optimism. News site headlines and TV talking heads have competed over who could give a higher forecast on what such an approval would do to BTC’s price (and consequently, the prices of other tokens), $100K, $500K, you name it. Others have fantasized about the prospect of government and institutional recognition, and subsequently, mainstream adoption.

HISTORY IS RUNNING IN REVERSEThe Bitcoin ETF is the spiritual reversal of Executive Order 6102. Back in 1935, they seized the gold. But now, digital gold is back.Ninety years ago, FDR and his fellow travelers rode the 20th century arc of centralization. The chokepoints of… pic.twitter.com/oZ7I8q1sQZ

— Balaji (@balajis) January 11, 2024

ETF - Extreme Teasing Farce?

This week’s debacle regarding the SEC’s fake tweet about a blanket approval of all 11 Bitcoin ETF requests was a comic moment for outsiders and an emotional rollercoaster for the traders. The crypto feed celebrated the occasion with memes and “ratioing” Gensler’s clarification tweet, dubbing this event as “teasing.”

But, this was a climax and anti-climax packed into a few short minutes. With the BTC price jumping by $1,000 (just before crashing below the pre-fake-announcement moment) and the crypto feed exploding with joy (just before turning into a huge disappointment).

This bizarre chain of events (which has already triggered an FBI investigation into the fake tweet) is a great metaphor for the miscommunication between the SEC and the crypto community.

JUST IN: Cathie Wood’s ARK dropped a new #Bitcoin ETF commercial ???? pic.twitter.com/zSB9mQ9T1p

— Bitcoin Archive (@BTC_Archive) January 11, 2024

Managing Expectations

Now, the real question is whether the January 9th scandal was a metaphor for the consequences of the approval announcement. I’m wondering whether we received a glimpse into what the near future might look like: complete euphoria morphing into a hangover the morning after.

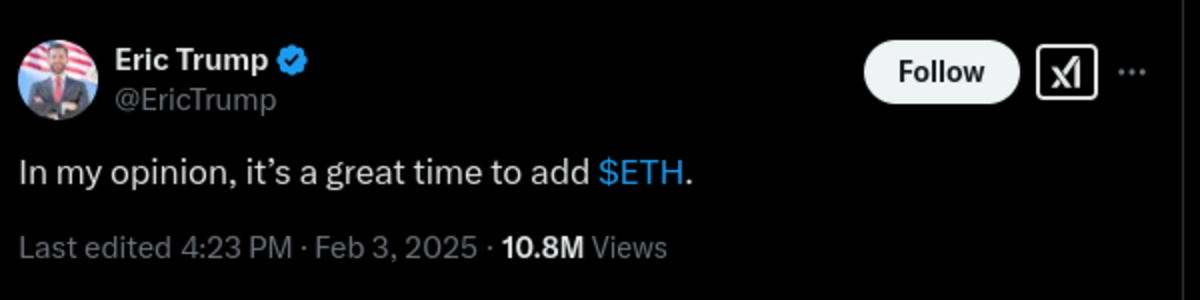

Will Bitcoin’s price rise? It probably will and also trickle down to other tokens. It is reasonable to think that positive news items in the mainstream media will push retail, and more importantly, institutional investors to diversify with some crypto. We can also assume that the expectation for an Ether-based ETF, now on the table, will push the Ethereum ecosystem to a better position on the charts.

But, the bold statements made by crypto thought leaders and champions will likely turn out to be highly exaggerated. Many analysts have mentioned that the recent rise rally is probably due to the market already pricing in the upcoming announcement and internalizing the huge purchases made by the “magnificent 11.”

But, on a deeper level, we must ask ourselves: Is a TradFi vehicle, led by the biggest names in the fiat-driven industry, what we wanted crypto to be? Crypto, and Bitcoin in particular, was supposed to be the alternative to this entire system. Crypto wasn’t envisioned as another tool on BlackRock’s belt, but as an alternative to the asset manager giant’s line of business.

#Bitcoin ETFs were (finally) just approved for trading tomorrow, after ten years. Maybe the politics in Congress around cryptocurrency will get better once they realize it's backstopping pension funds and retirement accounts.

— Edward Snowden (@Snowden) January 10, 2024

A Golden Cage?

Those who celebrate the announcement mention it as being a seal of legitimacy to Bitcoin and crypto, in general. But, does adding an ETF badge to crypto turn it into a legitimate, deflationary, and reliable store of value and means for exchange (or in other words, the ultimate currency)? For instance, ETFs are used for commodities, such as natural gas, livestock, corn, etc. Is that what crypto is all about?

Moreover, when the institutional giants stockpile BTC, sucking up all the available liquidity, this may undermine the decentralized nature of the coin and its free-market-based pricing, especially given that we’re talking about heavily regulated companies with massive government scrutiny and interests.

That’s the point where all the Maxis get off their seats to explain how the code prevents them from doing that and that the more BTC someone buys and HODLs, the better it is for the rest of the community.

So what? Was that your vision for BTC to begin with? Just like the rare fine art collectibles stored in some warehouse in the ports of Hong Kong or Dubai, BTC may become a meaningless item for diversification mechanism for the rich, with no use whatsoever. And, so will other coins that follow the ETF path.

The purpose of this article is not to pour rain on the Bitcoin ETF parade; it merely aims to show the entire picture and present several alternative scenarios to what this approval actually means for the future.

This article was written by Michael Pearl at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments