The Bank of International Settlement (BIS) has decided to expand its tentacles beyond the walls of central banks’ oversight and Central Bank Digital Currency (CBDC) development.

The Swizz-based Bank of Central Banks announced that it would launch a new project to monitor stablecoins in addition to its ongoing Central Bank Digital Currency research.

The BIS also noted that it would heighten its focus on Central Bank Digital Currencies in 2023 to bolster global payment systems and included Project Pyxtrial in its 2023 work schedule.

Project Pyxtrial is a new experiment that the London branch of the BIS Innovation Hub would launch to monitor stablecoins.

BIS To Explore Tools To Facilitate Stablecoin Regulatory Framework Development

This new development comes amid the increasing global concern to increase stablecoins oversight and mitigate potential risks associated with stablecoins.

According to the BIS, Pyxtrial will create a platform to monitor stablecoins balance sheets. It also noted that most central banks lack the tools to monitor stablecoins systemically and avoid asset-liability mismatches. The project would also explore and assess various technological tools that could help regulators and supervisors to develop policy frameworks based on their in-built data.

The BIS’s stablecoin monitoring program is part of the global movement to provide clear and extensive regulatory oversight for stablecoins. Meanwhile, Hong Kong recently banned algorithmic stablecoins due to associated risks which became apparent after the collapse of Terra algorithm stablecoins.

The bank aims to shape the future of financial regulation and supervision by ensuring a safe and secure financial sector.

BIS To Increase Focus On Improving Payment Sytems Using CBDC Case Study

As for CBDC-related projects, the BIS noted that it would increase its focus on retail CBDCs. Among the retail CBDCs mentioned by the BIS is the two-phased system called Aurum, which the bank piloted in Hong Kong in July 2022.

The bank stated that CBDCs and payment systems improvements took 15 slots out of the 26 active projects it has been running over the past couple of years. It also outlined the increased awareness of Central Bank Digital Currencies in central banks as its driving factor. According to the report, improving the payment systems is part of the BIS’s approach to promoting a safe and secure financial ecosystem.

The interests and priorities of central banks and the cross-border payment improvement program launched by the G20 countries emphasize the need to heighten its focus on CBDCs, the BIS highlighted. The bank also intends to conduct a retail Central Bank Digital Currency distribution pilot through an open API ecosystem in a joint experiment with the Bank of England (BOE).

Plans for the CBDC project have already been put in place by the BIS. In September 2022, it conducted a pilot for Multiple CBDC Bridges called mBridge. Participants of this pilot include the central banks of Thailand, China, Hong Kong, and the UAE and 20 commercial banks from these countries.

Many countries have been moving forward with their CBDC projects. According to Atlantic Council’s CBDC tracker, eleven (11) countries, including Nigeria, have fully launched a CDBC.

The CBDC tracker also indicated that 17 countries, including China, Russia, Kazakhstan, India, South Korea, Thailand, and Malaysia, are in the pilot phase of their CBDC development.

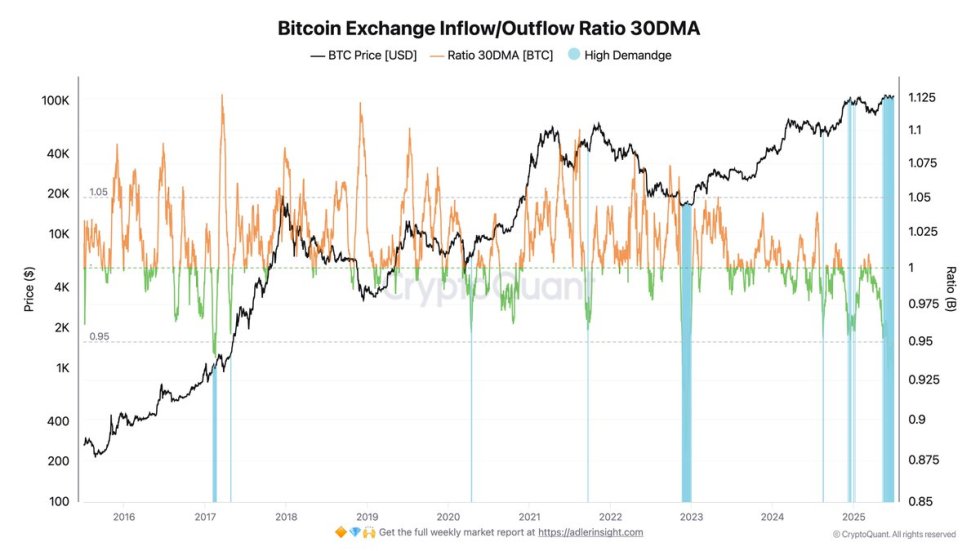

Featured image from Pixabay, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments