On-chain data shows the Bitcoin exchange whale ratio has surged recently. Here’s what it may mean for the price of the cryptocurrency.

Bitcoin Exchange Whale Ratio (72-Hour MA) Breaks Above 85%

As pointed out by an analyst in a CryptoQuant post, the BTC whale ratio is rising right now. The “exchange whale ratio” here is an indicator that measures the ratio between the sum of the top 10 Bitcoin transfers to exchanges and the total exchange inflows.

Here, the 10 largest transactions going toward exchanges are assumed to be coming from the whales, which means that the indicator’s value tells us what part of the total exchange inflows is being contributed by these humongous holders right now.

When the whale ratio has a high value, it means a large percentage of the exchange deposits are being made by the whales currently. As one of the main reasons investors use exchanges is for selling purposes, this kind of trend can suggest whales are putting high selling pressure on the market, and thus, can be bearish for the asset’s value.

On the other hand, low values imply whale inflow activity isn’t too significant compared to the rest of the market, which is a trend that could be either neutral or bullish for BTC.

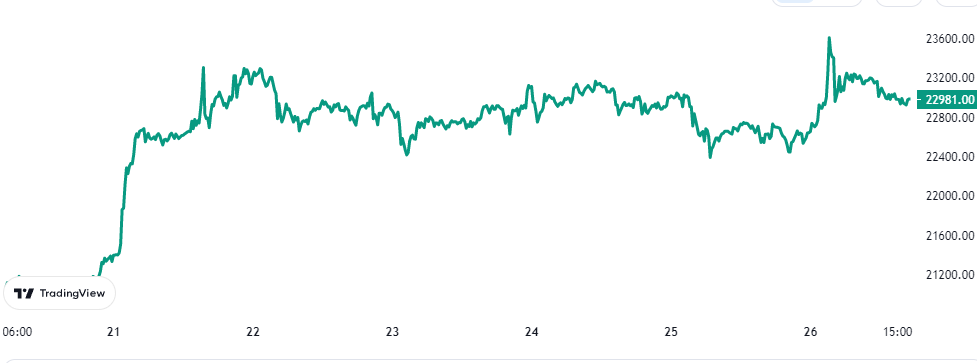

Now, here is a chart that shows the trend in the 72-hour moving average (MA) Bitcoin exchange whale ratio over the last few months:

As displayed in the above graph, the 72-hour MA Bitcoin exchange whale ratio has climbed to a high value recently. This suggests that whales are highly active in terms of exchange inflow contributions right now.

In the past, the metric breaking above the 0.85 mark for prolonged periods has generally proved to be bearish for the price of the crypto. At this value, 85% of the inflows come from whale entities.

With the most recent surge in the indicator, its value has once again broken into the region above the 0.85 level, which could mean that whales may be preparing for another major selloff.

However, for a bearish scenario to become probable, the Bitcoin whale ratio would need to stay at these elevated levels for at least several days. Earlier in the month, right before the rally kicked off, the indicator did enter into this zone, but since the spike didn’t last for too long, the coin’s price didn’t feel any bearish impact from it.

The chart also shows that the bottom that formed soon after the collapse of the crypto exchange FTX was accompanied by pretty low values in the indicator, implying that low selling pressure from the whales may have helped it take shape.

BTC Price

At the time of writing, Bitcoin is trading around $22,900, up 11% in the last week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments