The long-awaited day of the 4th phase of Bitcoin's halving is looming in the cryptocurrency sector. The countdown to this event shows that it could happen around the final hours of Friday evening if you are located in the Americas or Saturday morning if you are in Asia or Europe.

According to the market metrics, the event is much anticipated and should be discounted well in advance of its actual occurrence. In contrast to unpredictable overnight barrages of rockets in the heat of the Middle East, the halving event has a clear outcome; the amount of BTC rewards that miners get for completing a block will be reduced in half to 3.125 BTC from the current 6.25.

This will inevitably lead to less supply from miners, but does it change the liquidity of the overall market? We will attempt to answer that question in the coming paragraphs, and while at it, we will highlight some challenges related to the current geopolitical landscape and the resulting jittery market conditions we have recently observed.

Are Previous Halvings Linked to Liquidity Squeezes?

Every time 210,000 blocks are mined, the Bitcoin network's protocol cuts the amount of new rewards in half. As highlighted by the institutional research team at Coinbase, therefore, the newly minted supply will drop from 900 Bitcoins per day to 450 Bitcoins per day. At current market prices ($65,000 per BTC), this equates to roughly $30,000,000 worth of new supply per day or $900,000,000 per month.

These figures are rather low compared to the average daily trading volumes across crypto exchanges, especially since the launch of BTC ETF trading, which triggered increased interest in the asset class.

The amount of tradable Bitcoin has been on the rise during the recent bull run that accelerated since early Q4 2023. According to the team at Coinbase Institutional Research, active BTC supply, defined as Bitcoin moved in the past three months, rose to 1.3 million. This figure is in comparison to 150,000, which was mined during that time.

In a statement shared with Finance Magnates, Coinbase's Research Analyst, David Han, mentioned that the decline in BTC mining issuance could create new supply-side dynamics that are constructive in the longer term.

Han expressed his doubts as to whether that can result in an imminent supply crunch: “We find that the largest contributors to increased BTC supply during bull markets come from long-term wallets beginning to activate instead of from newly mined BTC.”

Crypto and Fiat Liquidity Cycles – the Signal and the Noise

A widely held belief in the cryptocurrency community is thathalving events are usually followed by a significant rally in the value of their digital assets. While there is some historical correlation to corroborate this notion, science has long established that correlation does not imply causation.

The logical fallacy where two events that occur at a similar time have a cause-effect relationship is at the center of spurious relationships: two events can be correlated, but that connection may not be causal.

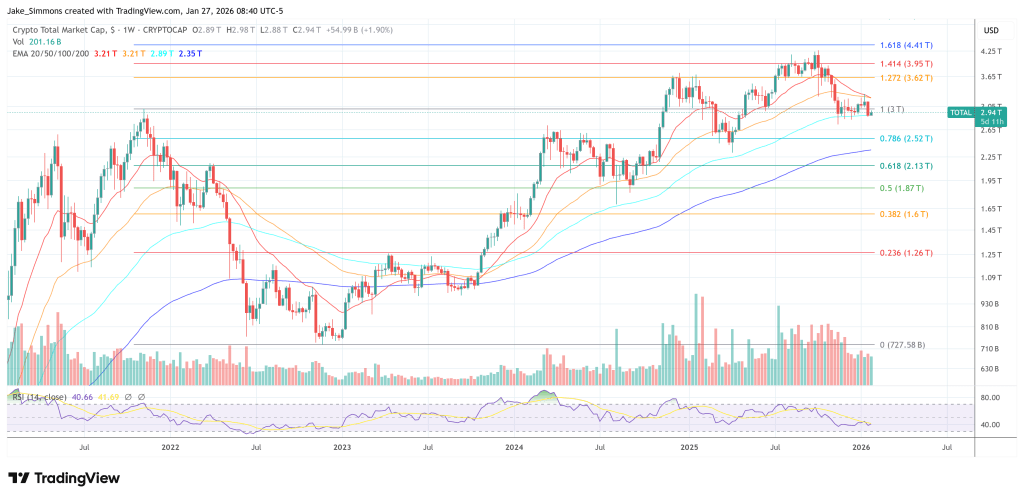

With only three halving events behind us and a fourth one brewing, one can observe correlations, but not necessarily cause-effect relationships. Halving events don’t perfectly coincide with central bank liquifying cycles, but as the chart below shows, there is some food for thought for risk-management teams and traders alike.

Around the first halving in 2012, the Fed launched the third chapter of its post-financial crisis quantitative easing program (QE3), shortly followed by the first US debt ceiling crisis and the loss of the reserve currency issuer’s AAA rating.

The second one, in 2016, was followed by the Bank of England’s post-Brexit ramp-up of bond buying in tandem with the ECB’s asset purchase program. Fast-forward to 2020, and we all remember the central bank and fiscal policy bazookas firing left and right with fiat liquidity so ample that it ultimately caused the sharpest spike in inflationary pressures globally since the 1970s.

Geopolitical Blocks

It was an early morning in the Middle East, as a well-telegraphed attack by Iran had been unleashed upon Israel. With all other financial markets closed, it was up to crypto to reflect the current state of mind (or compute).

The old Wall Street saying, “up the stairs, down the elevator,” came to mind as BTC and ETH dropped in tandem in rapidly dwindling liquidity conditions. That night, Coinbase registered about $2 billion worth of liquidations, the company’s institutional research team highlighted in a recent weekly market call.

In contrast to the rather gradual price action that unfolded in the aftermath of the October 7th attack on Israel by Hamas, the Iranian attack, despite being well-telegraphed before the weekend, did result in material price action across the crypto market.

At one point, Pax Gold, a crypto token supposed to be fully backed by gold, spiked about $1,000 at a time when the physical gold market, which is underpinning the coin's value, wasn’t open. The magnitude of the attack certainly surprised market participants, while some automatic “stop trading” commands must have been unleashed across algorithmic trading strategies.

Events centered around geopolitical stress have certainly caused some leveraged players to rethink, not only in the crypto market. Jerome Powell's, the Chair of the Federal Reserve of the United States, higher rates for a longer period re-pivot raise questions about a widely expected easing of monetary policy.

Speech by Chair Powell on the economic outlook @StanfordGSB: https://t.co/y6oLUN0LYwWatch live: https://t.co/a0ApMRHum2

— Federal Reserve (@federalreserve) April 3, 2024

To Bid, or Not to Bid

As the halving cycles come and go, the impact of these events could lessen in time. Since most bitcoins have already been mined, the current market liquidity state is much more about the existing supply of BTC on the market than newly mined coins.

A supply crunch overnight is the least likely event, and if very recent history is any guide, geopolitical tensions can create more volatility or liquidity waves on cryptocurrency and traditional financial markets.

Guided by risk-on and risk-off flows, cryptocurrencies have been defying the trend occasionally, but at their core they remain a high-risk asset with a digital store of value component behind it. Only time will tell whether or not that narrative has become a well-established characteristic, but so far, so good.

As the halving event comes and passes us by, it is the central banks that will have the ball in their court: ready to do whatever it takes to address inflationary challenges or supply more fiat liquidity to the monetary system.

With Bitcoin ETFs breaking new ground, the liquidity situation for the king of crypto has significantly improved. As David Han outlined: “Net US spot ETFs inflows to date approximately offset the BTC that was mined in the previous six months.”

This article was written by Victor Golovtchenko at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments