It has been a rough week for crypto investors.

After briefly dipping to $20,293 per unit early Friday, the bitcoin (BTC-USD) price has fluctuated between $20,000 and $21,200 and is currently trading at $20,591, a loss of 2.37% in the last 24 hours and 29% over the past week.

Ether (ETH-USD), which is more intertwined with crypto’s DeFi segment that has lately wrecked havoc on the risk management strategies of significant industry players, trades at $1,086 per coin, a loss of almost 3% on the day, and around 36% in the last week.

Crypto’s total market capitalization has dropped by almost $300 billion since last Friday’s hot inflation data, from $1.19 trillion to $893 billion as of Friday afternoon, according to Coinmarketcap.

"We are in the throes of a crypto winter," Future Perfect Ventures partner Jalak Jobanputra told Yahoo Finance Live. Jobanputra notes that despite bitcoin’s sizable drawdown, it has so far held above $20,000, an important psychological level for buyer support.

"If we see more contagion within the crypto markets and more funds start to fail [things] could change, but I still think of [bitcoin] as the most blue-chip crypto that’s not as exposed to questionable risk management practices," Jobanputra added.

Inside the sector, a liquidity crisis has pressured a string of crypto hedge funds and lenders. Firms including Coinbase (COIN) have announced layoffs, while some firms have been forced to liquidate positions or freeze customer accounts.

Following the crypto lender Celsius Network’s move to freeze all customer accounts, Babel Finance has also cooled trading, citing “unusual liquidity pressures” according to a customer note.

Amidst the panic, several crypto firms including BlockFi, Genesis Trading and FTX have come out publicly stating they’ve liquidated certain overleveraged counterparties on their platform with some speculation and evidence pointing to Three Arrows Capital.

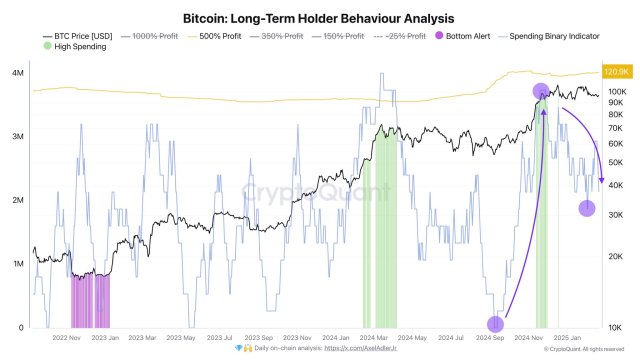

"Crypto is going through a classic deleveraging cycle and it has to continue that cycle until it hits bottom," Matt Hougan, chief investment officer of Bitwise told Yahoo Finance Live, adding that volatility will persist over the next few weeks.

Some data shows, however, that investors are still eager to snap up crypto-related exchange traded products, with digital asset manager 21Shares reporting they've seen $30 million in net inflows since Terra's collapse in mid-May, with the majority going to Bitcoin-related products.

Other crypto movers

Major cryptocurrencies such as Binance's BNB token (BNB-USD) down 24.63%, Solana (SOL-USD), down about 15%, Cardano’s ADA token (ADA-USD), down 16%, Chainlink (LINK-USD), down 22%, Polkadot's DOT token (DOT-USD), down 16%, Avalanche's AVAX token (AVAX-USD), down 29%, Tron (TRX-USD), down 24%, Polygon's MATIC token (MATIC-USD), down over 34% have all seen losses in the past week.

—

David Hollerith covers cryptocurrency for Yahoo Finance. Follow him @dshollers.

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments