If you spend time on Twitter then you might have seen a recent tweet from the CEO of MicroStrategy, Michael Saylor, declaring, “I am a Bitcoin Maximalist.”

This is no surprise, as Saylor has become one of the most vocal and persuasive advocates for bitcoin since making the decision, in August 2020, to acquire bitcoin for MicroStrategy’s balance sheet.

An influential but anonymous Twitter account known as Hodlonaut also tweeted something curious, stating:

“I’ve never seen more people turning bitcoin maximalists than right now. The Norwegian bitcoin-only scene has literally exploded last 6-12 months. And, most of these new bitcoin-only people were 'crypto' and 'open minded' before turning into maxis.”

All of which raises the questions of what exactly a bitcoin maximalist is, why anyone would take that route, and why more people might be joining.

What Is Maximalism?

Taken in a positive light, bitcoin maximalists tend to have a comprehensive understanding of the history of money, and of how money actually functions. They believe that bitcoin can serve as a superior replacement for fiat currencies and our current monetary system.

Maximalism includes the belief that other cryptocurrencies either cannot serve that purpose, or are not required since bitcoin already exists and is positioned as a digital sound money network.

There’s a related concept referred to as hyperbitcoinization, which, if it were to occur, would see the world shifting to a bitcoin standard, in which all goods and services are priced in bitcoin.

However, bitcoin maximalism doesn’t require the removal of all other currencies, and realistically, one would expect that there will always be multiple means and methods of transaction.

When it comes down to it, if we are focused on cryptocurrency as a kind of money, then bitcoin maximalists believe that bitcoin alone has a shot at replacing fiat currencies, and as such is the only cryptocurrency required and worth supporting.

Why Might People Be Turning to Maximalism?

One factor is that we’re in the midst of a bear market, following an enormous crash in which several major participants have been not just wiped out, but revealed as, depending on your perspective, recklessly mismanaged, hopelessly ill-prepared or outright sociopathic.

At times like these, crypto participants turn conservative, and within crypto, bitcoin is without question the most reliable and secure purchase.

There is an aspect to what is occurring, though, that goes deeper than just temporary conservatism. A wildfire strips away waste, and among the bare bones of a market bottom, it becomes easier to identify where the true value lies.

Bitcoin has made no empty promises and is clear in its intent. It has simply stated its case, and whether or not you choose to climb on board is entirely up to you. What’s more, bitcoin has simply been around the longest, and acts now as a crypto Schelling Point.

On a more surface level, cultural eddies around what may or may not be 'cool' come and go, but bitcoin is starting to transcend such distractions. Sure, Ethereum, Solana, or a particularly stylish NFT set, may seem to be of the moment, but bitcoin? Well, bitcoin doesn’t really care, and when you’re tired and need a break, its habits are refreshingly simple: stack sats and turn off the charts.

Avoiding Scams

A negative connotation that follows crypto around is that it’s overloaded with scams and bad actors. And, this reputation has not appeared from out of nowhere, as, due to its nascent, unregulated nature, there is an excess of unethical and sometimes explicitly criminal behaviour in the crypto space.

For examples of how spammy and scammy crypto can be, go to a big influencer/analyst account on Twitter. Find someone reputable and trustworthy who offers informed takes, and even then, when you scroll through the replies to their tweets you’ll find fake accounts attempting phishing hooks and bots pushing sketchy projects.

In this environment, it’s clear why many investors want to play it safe, and staying with bitcoin-only is one way to do this. This is not to say that fragile enterprises cannot be built around bitcoin (take a look at Celsius or Mt Gox), but that’s where the adage, 'not your keys, not your coins' comes into play.

Take a couple of hours to learn basic security, move bitcoin into self-custody, and you don’t need to worry much about the perilous fringes. This also ties in with and reinforces the bitcoin culture of self-reliance and having a secure hard-money back-up plan.

If We Don’t Need 20,000 Coins, Do We Even Need Two?

It's reported that there are around 20,000 different cryptocurrencies in existence, but there are very few people who would argue that we benefit from having that many.

In that case, how many do we need? Considering that crypto is digital and portable, meaning it exists in a borderless, global environment, what purpose is there in having multiple currencies?

Ultimately, while there can potentially be as many cryptocurrencies as there are developers, there’s no compelling reason to have more than one. There is an argument to be made that something like Ethereum will come to function as a kind of blockchain-based world computer, but then we’re straying away from the currency part of cryptocurrency.

In that world, ether has computational utility while bitcoin fulfills its purpose as digital money, which would be an overall outcome that is not in conflict with bitcoin maximalism.

No CEO of Bitcoin

The fact that bitcoin lacks a central leader is a positive feature, not a drawback. There are compellingly eccentric, capable characters helming other crypto projects, but the fundamental core of crypto is decentralization, along with trustless, peer-to-peer transactions.

Figures, such as Vitalik Buterin and Charles Hoskinson, may be working towards those endpoints, but theirs are top-led marches towards non-hierarchical goals. With bitcoin though, such a dynamic (with an official leader at the top) has long-gone if it ever existed at all, since bitcoin's maker is unknown and stepped away from his creation once it had been set in motion.

There was no pre-mine, no ICO and no central authority. Instead, there is simply the conversion of energy into sound money through a non-negotiable, proof-of-work mining process.

Can a Maximalist Hold Other Coins?

Crypto sometimes appears less like fintech and more like a funfair, inviting newcomers to try out DeFi, flip some apes, or gamble on blockchain gaming. Within what’s referred to as web3, we have crossovers with metaverse development, AI and virtual reality, all of which sounds like cyberpunk-oriented digital fun, with a casino element thrown in for good measure.

However, there doesn’t need to be any conflict here, but simply a clearly defined space between bitcoin and crypto (encompassing web3 and NFTs). From this perspective, it’s entirely possible to cleave to the maximalist ethos while exploring other elements of blockchain development, in the same way that holding bitcoin doesn’t preclude you from buying an Xbox or shares in Apple.

In fact, it’s plausible there are a significant number of gradual maximalists, who experiment with various parts of the crypto landscape, while calmly shifting profits into the one blockchain that is categorically distinct from crypto.

If you spend time on Twitter then you might have seen a recent tweet from the CEO of MicroStrategy, Michael Saylor, declaring, “I am a Bitcoin Maximalist.”

This is no surprise, as Saylor has become one of the most vocal and persuasive advocates for bitcoin since making the decision, in August 2020, to acquire bitcoin for MicroStrategy’s balance sheet.

An influential but anonymous Twitter account known as Hodlonaut also tweeted something curious, stating:

“I’ve never seen more people turning bitcoin maximalists than right now. The Norwegian bitcoin-only scene has literally exploded last 6-12 months. And, most of these new bitcoin-only people were 'crypto' and 'open minded' before turning into maxis.”

All of which raises the questions of what exactly a bitcoin maximalist is, why anyone would take that route, and why more people might be joining.

What Is Maximalism?

Taken in a positive light, bitcoin maximalists tend to have a comprehensive understanding of the history of money, and of how money actually functions. They believe that bitcoin can serve as a superior replacement for fiat currencies and our current monetary system.

Maximalism includes the belief that other cryptocurrencies either cannot serve that purpose, or are not required since bitcoin already exists and is positioned as a digital sound money network.

There’s a related concept referred to as hyperbitcoinization, which, if it were to occur, would see the world shifting to a bitcoin standard, in which all goods and services are priced in bitcoin.

However, bitcoin maximalism doesn’t require the removal of all other currencies, and realistically, one would expect that there will always be multiple means and methods of transaction.

When it comes down to it, if we are focused on cryptocurrency as a kind of money, then bitcoin maximalists believe that bitcoin alone has a shot at replacing fiat currencies, and as such is the only cryptocurrency required and worth supporting.

Why Might People Be Turning to Maximalism?

One factor is that we’re in the midst of a bear market, following an enormous crash in which several major participants have been not just wiped out, but revealed as, depending on your perspective, recklessly mismanaged, hopelessly ill-prepared or outright sociopathic.

At times like these, crypto participants turn conservative, and within crypto, bitcoin is without question the most reliable and secure purchase.

There is an aspect to what is occurring, though, that goes deeper than just temporary conservatism. A wildfire strips away waste, and among the bare bones of a market bottom, it becomes easier to identify where the true value lies.

Bitcoin has made no empty promises and is clear in its intent. It has simply stated its case, and whether or not you choose to climb on board is entirely up to you. What’s more, bitcoin has simply been around the longest, and acts now as a crypto Schelling Point.

On a more surface level, cultural eddies around what may or may not be 'cool' come and go, but bitcoin is starting to transcend such distractions. Sure, Ethereum, Solana, or a particularly stylish NFT set, may seem to be of the moment, but bitcoin? Well, bitcoin doesn’t really care, and when you’re tired and need a break, its habits are refreshingly simple: stack sats and turn off the charts.

Avoiding Scams

A negative connotation that follows crypto around is that it’s overloaded with scams and bad actors. And, this reputation has not appeared from out of nowhere, as, due to its nascent, unregulated nature, there is an excess of unethical and sometimes explicitly criminal behaviour in the crypto space.

For examples of how spammy and scammy crypto can be, go to a big influencer/analyst account on Twitter. Find someone reputable and trustworthy who offers informed takes, and even then, when you scroll through the replies to their tweets you’ll find fake accounts attempting phishing hooks and bots pushing sketchy projects.

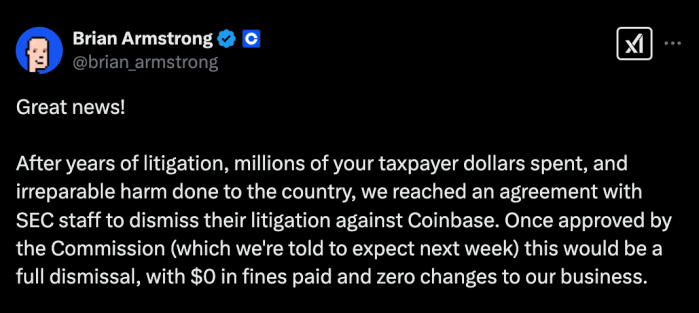

In this environment, it’s clear why many investors want to play it safe, and staying with bitcoin-only is one way to do this. This is not to say that fragile enterprises cannot be built around bitcoin (take a look at Celsius or Mt Gox), but that’s where the adage, 'not your keys, not your coins' comes into play.

Take a couple of hours to learn basic security, move bitcoin into self-custody, and you don’t need to worry much about the perilous fringes. This also ties in with and reinforces the bitcoin culture of self-reliance and having a secure hard-money back-up plan.

If We Don’t Need 20,000 Coins, Do We Even Need Two?

It's reported that there are around 20,000 different cryptocurrencies in existence, but there are very few people who would argue that we benefit from having that many.

In that case, how many do we need? Considering that crypto is digital and portable, meaning it exists in a borderless, global environment, what purpose is there in having multiple currencies?

Ultimately, while there can potentially be as many cryptocurrencies as there are developers, there’s no compelling reason to have more than one. There is an argument to be made that something like Ethereum will come to function as a kind of blockchain-based world computer, but then we’re straying away from the currency part of cryptocurrency.

In that world, ether has computational utility while bitcoin fulfills its purpose as digital money, which would be an overall outcome that is not in conflict with bitcoin maximalism.

No CEO of Bitcoin

The fact that bitcoin lacks a central leader is a positive feature, not a drawback. There are compellingly eccentric, capable characters helming other crypto projects, but the fundamental core of crypto is decentralization, along with trustless, peer-to-peer transactions.

Figures, such as Vitalik Buterin and Charles Hoskinson, may be working towards those endpoints, but theirs are top-led marches towards non-hierarchical goals. With bitcoin though, such a dynamic (with an official leader at the top) has long-gone if it ever existed at all, since bitcoin's maker is unknown and stepped away from his creation once it had been set in motion.

There was no pre-mine, no ICO and no central authority. Instead, there is simply the conversion of energy into sound money through a non-negotiable, proof-of-work mining process.

Can a Maximalist Hold Other Coins?

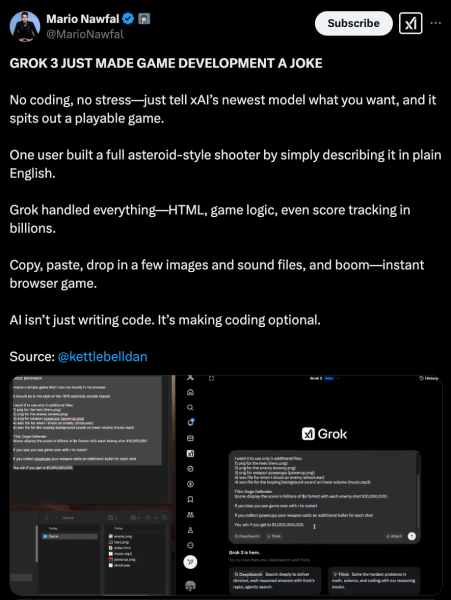

Crypto sometimes appears less like fintech and more like a funfair, inviting newcomers to try out DeFi, flip some apes, or gamble on blockchain gaming. Within what’s referred to as web3, we have crossovers with metaverse development, AI and virtual reality, all of which sounds like cyberpunk-oriented digital fun, with a casino element thrown in for good measure.

However, there doesn’t need to be any conflict here, but simply a clearly defined space between bitcoin and crypto (encompassing web3 and NFTs). From this perspective, it’s entirely possible to cleave to the maximalist ethos while exploring other elements of blockchain development, in the same way that holding bitcoin doesn’t preclude you from buying an Xbox or shares in Apple.

In fact, it’s plausible there are a significant number of gradual maximalists, who experiment with various parts of the crypto landscape, while calmly shifting profits into the one blockchain that is categorically distinct from crypto.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments