Bitcoin has surged to a record-breaking all-time high, courtesy of the strategic moves made by pioneer BTC miners within the crypto space. While the incredible uptick has caused excitement among the broader crypto community, it has not been without its fluctuations.

Miners Fueled BTC ATH Rally

On Tuesday, March 5, 2024, BTC hit a new all-time high, soaring to $69,200, and surpassing its previous peak in November 2021 when the price of the cryptocurrency traded at around $69,000. This unprecedented price surge has been attributed to the strategic efforts and patience of early Bitcoin miners who recently sold off a considerable portion of their BTC holdings during this all-time high.

Following Bitcoin’s rally to $69,200, data from CryptoQuant revealed that addresses over a decade old, identified as early Bitcoin miners, had initiated a transfer of 1,000 BTC worth about $67 million at the time, to the crypto exchange Coinbase. This large-scale sell-off indicated that these pioneer Bitcoin miners were finally liquidating their block rewards of ten years ago.

Typically, when BTC miners sell off their BTC holdings, it often influences the market dynamics of the cryptocurrency, resulting in significant price fluctuations. As exemplified by the recent 1,000 BTC sell-off, this event considerably impacted the Bitcoin market, leading to a sharp drop in cryptocurrency’s price, which is presently trading at $65,771, according to CoinMarketCap.

Bitcoin’s rise to its new all-time high could be said to be significantly tied to the strategic decision of early Bitcoin miners to withhold the sale of cryptocurrencies until a certain time. Given Bitcoin’s historically low liquidity levels, a sell-off of that magnitude would greatly induce a substantial price correction, with traders scrambling to acquire the sold assets.

In other words, if the BTC miners had opted for an earlier sale of their longstanding BTC assets, the cryptocurrency may have encountered a comparable price decline, potentially postponing the achievement of reaching a new all-time high of $69,200 on Tuesday or even missing the mark entirely.

Other Contributors Of Bitcoin’s Surge To New ATHs

Since the beginning of the year, BTC has been on an upward trajectory, experiencing exponential gains that have steadily pushed its price to achieve a fresh record high. Many analysts have linked this continuous price increase to the success of the Spot Bitcoin Exchange Traded Funds (ETF) and the upcoming Bitcoin halving event in April.

Following the approval of Spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC) on January 10, Bitcoin gained massive adoption globally. The launch of the ETF facilitated broader exposure to the asset for everyday investors, leading to substantial capital inflows into the cryptocurrency.

Additionally, the 2024 Bitcoin halving set to take place in the next few months, is anticipated to trigger a significant Bitcoin price increase. This expectation is based on the halving impact of enhancing BTC’s value by reducing mining rewards and limiting the cryptocurrency’s supply.

These developments have effectively fueled high demand for BTC, contributing to its consistent growth over the past few months and ultimately attributing to its new all-time high.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

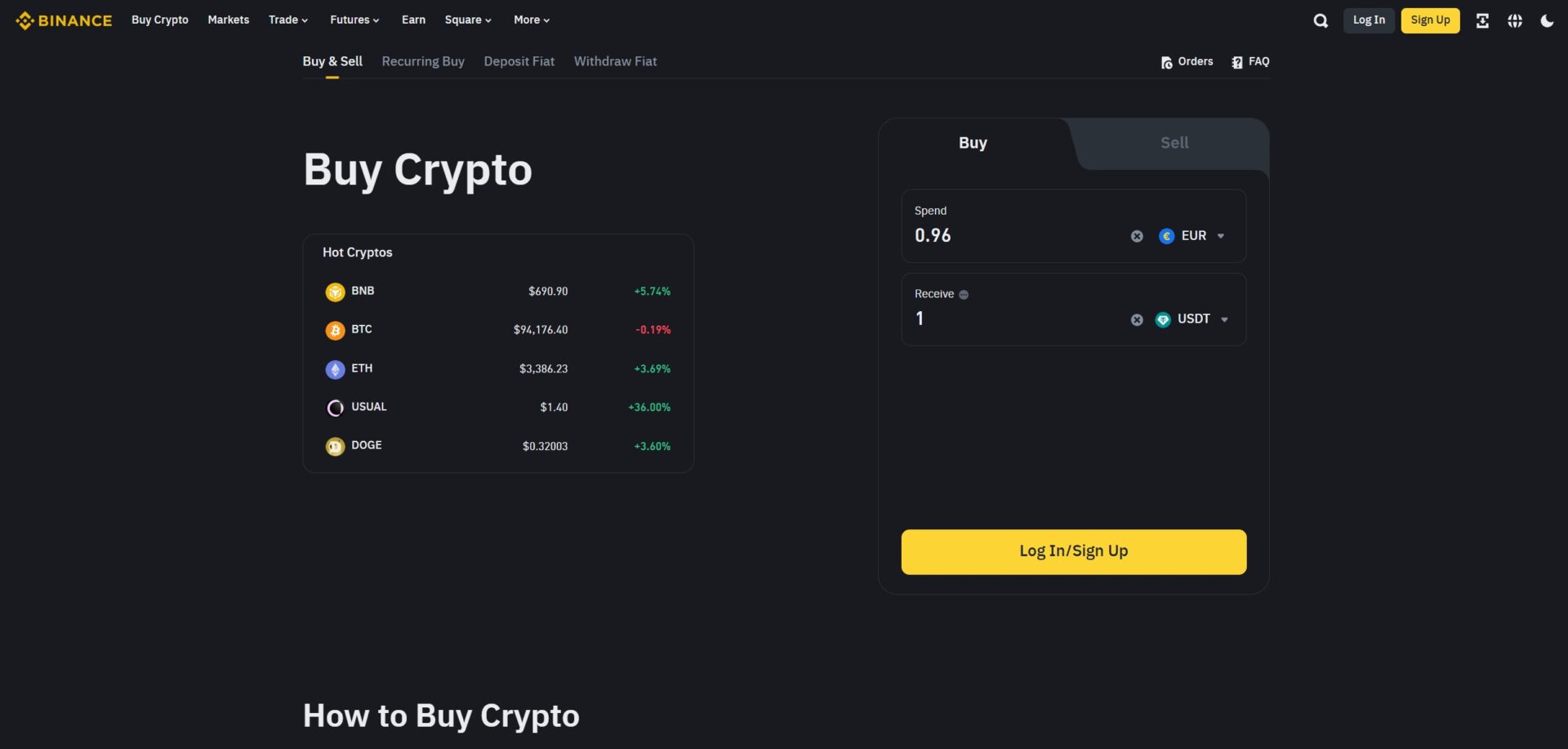

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments