The role mining can play in enabling energy grids to provide greater utility at lower cost is completely misunderstood.

The mainstream media mistakenly portray bitcoin mining as wasteful. Nothing could be further from the truth. Bitcoin mining provides an economic bid for otherwise unusable, excess energy. Bitcoin will propel humanity to abundance.

To discuss bitcoin mining, one must first understand how it works: Proof-of-Work and the difficulty adjustment.

How Bitcoin Mining Works

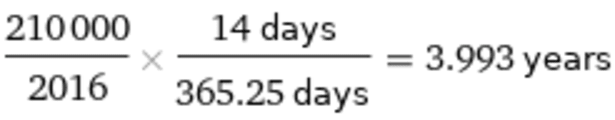

Bitcoin is a new type of money that uses a Proof-of-Work consensus mechanism to secure the network (SHA-256). The “work” is the computation that must be performed to solve the puzzle. Miners use computers specifically designed for bitcoin mining (ASICs) to compete against each other in a race to guess an extremely large number. Every 10 minutes on average, according to a Poisson distribution, the miner who first guesses a successful number gets to add a new block to the Bitcoin blockchain, earning the block reward. The block reward is made up of the deflationary block subsidy, which halves every four years or so, and transaction fees paid by users to incentivize their transactions to be added to the next block.

Proof of work is based on asymmetry. It’s exorbitantly expensive and difficult to generate the proof while remaining extremely cheap and easy to verify that proof. Miners must expend a great deal of energy to have any chance at solving the puzzle before an even faster competitor does. As of June 10, 2022, this cost comes to about $22,000 per BTC for miners in North America. At the same time, it’s practically free to verify that a block is valid, enabling all other network participants (full nodes) to quickly accept or reject a block proposed by a miner.

By itself, proof of work would not be sufficient to secure the Bitcoin network. Miners would quickly adapt by specializing in solving this one kind of puzzle, improving the efficiency of their miners (CPUs → GPUs → ASICs), increasing the number of miners and thus growing the overall hash rate by leaps and bounds. This competitive rush would result in ever briefer intervals between successive blocks, with bitcoin being issued at a rate far greater than was called for by the original supply schedule.

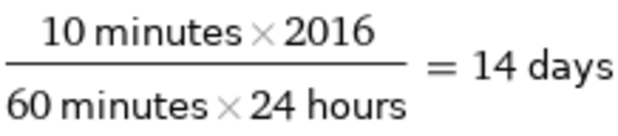

Satoshi Nakamoto solved this problem by implementing the difficulty adjustment, a remarkable example of algorithmic homeostasis. Over the long run, the difficulty adjustment ensures that new blocks are found, on average, every 10 minutes, readjusting itself each time that 2,016 additional blocks (two weeks) have passed. This clever Easter egg is a nod toward reversing the effect of Executive Order 6102.

When blocks are being mined too quickly (less than 10 minutes between blocks on average), as can often be the case due to increasing hash rate coming online, the puzzle becomes harder at the two-week checkpoint so as to slow the rate of mining. On the other hand, when blocks are being mined too slowly (more than 10 minutes between blocks on average), the puzzle becomes easier so as to accelerate mining back to the targeted equilibrium rate of 2,016 blocks per fortnight. At this pace, the designated halvings every 210,000 blocks take place at approximately four-year intervals.

Over the long run, this homeostatic feedback loop determining mining difficulty generally balances out any deviations from the planned rate of 2,016 new blocks per fortnight. However, when rapid increases in the total hash rate are more common than declines in the mining difficulty, this cumulative slight imbalance caused by Bitcoin’s exponential increase in mining power has led to block reward halvings that occur a few months sooner than expected. In practice, when the hash rate rapidly increases, the upward difficulty adjustment every two weeks isn’t nearly enough to fully counteract this trend of blocks arriving sooner than planned. This is ultimately why the first several Bitcoin halvings (November 28, 2012; July 9, 2016; and May 12, 2020) have been about three years and three seasons apart.

This elegant, self-correcting system ensures that the bitcoin supply schedule set by Satoshi Nakamoto at the beginning is followed, ultimately enforcing the 21 million cap with roughly quadrennial halvings of the block reward.

Bitcoin’s Energy Usage

Bitcoin provides a uniquely valuable product to humanity. It is the best money in existence. Bitcoin offers a deflationary store of value, light-speed medium of exchange and precise unit of account for the global economy. Bitcoin, when used with best security practices, protects an individual's purchasing power and property rights from seizure, debasement, inflation, counterfeiting or other political abuses.

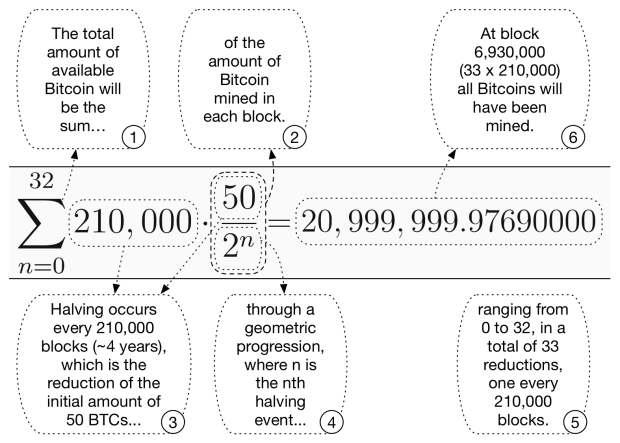

Historically, gold provided similar benefits to humanity. For generations, people have debated the merits and costs of the gold standard.

Bitcoin miners are able to convert watts of electrical power anywhere on the planet into money (BTC). This is mind-blowing and will radically change energy markets.

Bitcoin is an energy buyer of last resort. It is the only use case that will buy energy anywhere in the world, at any time, for any interval. Due to the competitive market of bitcoin mining, miners only prosper by using cheap power that has no other buyer ready and willing to bid a higher price for it. Using overly expensive power that’s also highly sought after by others or mining at a loss is self-defeating. This market system creates new opportunities, such as using wasted flared gas for Bitcoin mining to reduce CO2 emissions.

Bitcoin miners use energy that would otherwise be wasted or unprofitable to use. Large sources of energy, such as Hydro-Québec in Canada, often have an excess generative capacity that couldn’t be applied before Bitcoin. Now, thanks to bitcoin mining, these clean power resources have a direct way to monetize their excess power capacity. This lowers the cost of production for all power consumers as companies are able to earn the same or higher profit by serving more watts to consumers for the same or lower cost.

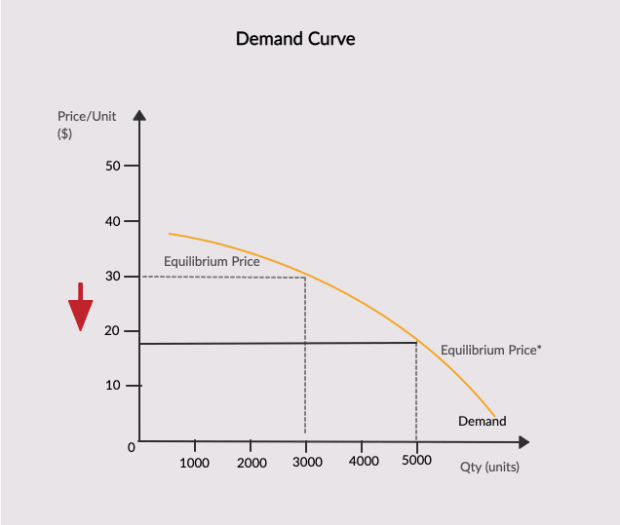

Wasting any power at all increases costs for everyone by lowering the demand curve below the available supply. In order to get the same rate of return, producers must increase prices to compensate for the resources wasted in developing sources of excess power capacity that aren’t always able to find a buyer.

For example, let’s imagine there is a rural hydro plant that has a fixed 5,000 megawatts available. The operators of the facility want to achieve a profitable return on the operation, as it costs a lot of money to build and maintain the plant. The consumers in the rural town are price inelastic, as they have no alternative sources of electric power and must resort to manual labor whenever electricity does not suffice. Currently, the town only uses 3,000 MW out of the 5,000 MW available. A bitcoin miner comes in and purchases the remaining 2,000 MW. The rural residents are no longer on the hook and are thus freed from having to subsidize excess power that they don’t even use. Now, the rural hydro plant is able to lower consumer prices for electrical power while earning the same rate of profit. A win-win for everyone.

Mining bitcoin today is profitable with low-cost energy on many national electricity grids. In the future, bitcoin mining will only be profitable at the margins where the net energy cost is close to zero or even negative: for example, using the waste heat for a boiler or food production.

Bitcoin miners stabilize the grid. Bitcoin miners are highly cost-sensitive. If they want to stay operating in profit, they must not compete with consumers and businesses for high-cost electrical power in areas where it is most scarce and highly valued by existing market participants. They will shut down during high-stress events instead of continuing to mine. As flexible buyers of power only when it is economical to do so, bitcoin miners are able to shut down quickly in response to upward fluctuations in electricity grid demand. This is unlike other large power users such as aluminum smelting, which takes 4–5 hours of uninterrupted power to shut down.

Recently, Texas’s power grid operator, ERCOT, asked Texans to conserve power due to ongoing heatwaves. Texas bitcoin miners responded by shutting off over 1,000 megawatts worth of bitcoin mining load, allowing for over 1% of total grid capacity to be pushed back to the grid.

Bitcoin miners encourage further investment in low-cost, stable baseload power. Energy usage is directly correlated with human flourishing and empowerment. Bitcoin miners are rapidly growing energy users seeking low-cost electric power globally. Bitcoin miners are directly responsible for bringing online new solar, wind and hydro plants around the world.

Conclusion

Bitcoin mining is good for the planet. It lowers energy costs for everyone, increases energy market efficiency, stabilizes grids and incentivizes humanity to rapidly scale energy production to abundance.

**The author generated this image with OpenAI's DALL-E. Upon generation, the author reviewed and published the image and takes ultimate responsibility for the content of this image.

This is a guest post by Interstellar Bitcoin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments