A breakout to avoid a fresh price dip would be a “miracle,” says Crypto Ed, as storm clouds gather for Bitcoin bulls.

Bitcoin (BTC) traded worryingly near $30,000 support on Tuesday amid fresh predictions of incoming lows.

BTC price hints at “sub $30,000” move

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as the pair lost 9% overnight on Monday.

No amount of good news was able to help bulls, with potential adoption breakthroughs in Latin America conspicuously doing nothing to boost lackluster price action.

United States Treasury Secretary Janet Yellen likewise failed to lift the mood when she voiced support for higher inflation.

Instead, Bitcoin dropped to $32,000 at the time of writing, coming off a rebound to $33,000.

For popular trader Crypto Ed, the outlook was uninspiring — and even included a trip below the $30,000 mark.

“It did the white ABC I posted before the weekend,” he told Twitter followers, referring to a forecast price rotation.

“Now in green box but I’d expect 1 more leg down today, followed by a bounce to ~35k From there down again, sub 30k, or ‘up only’ again, but the latter feels more like a miracle tbh.”

Moving averages cause alarm

As Cointelegraph reported, traders are already on edge over a potential “death cross” involving two key moving averages that could spell further downside.

This could extend beyond the short term, Cane Island Alternative Advisors investment manager Timothy Peterson noted, thanks to BTC/USD now lingering below its 200-day moving average for almost three weeks.

“This metric has *always* marked the end of a bull run and the start of a bear market,” he added in comments on Monday.

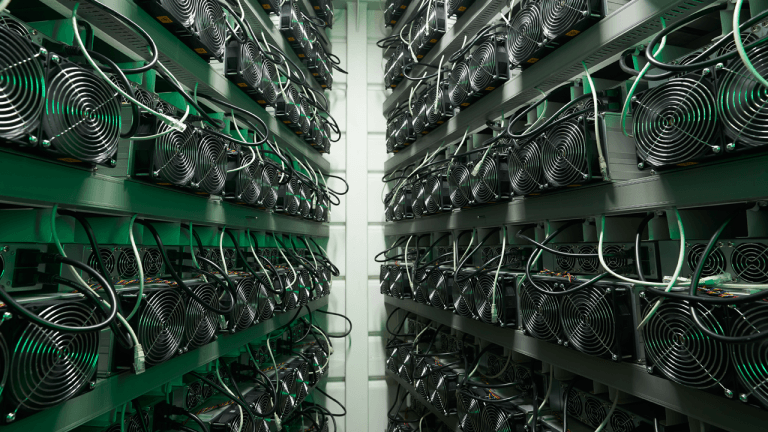

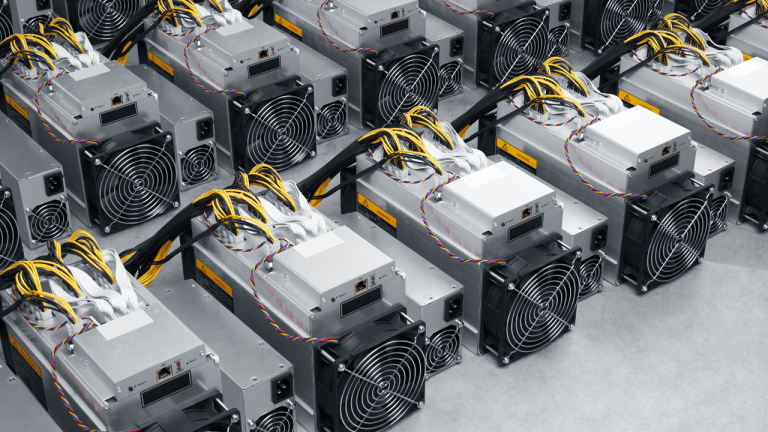

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments