Bitcoin is in recovery mode and bulls may push for $40k and above levels as the positive sentiment is fuelled by long term hodlers

The crypto market remains in the recovery mode after witnessing record price dips across the board last month, most prominently in the case of Bitcoin. Influencers are branding the ongoing phenomenon as the ‘Great Unwind’ that will filter out grains from the chaff. At the time of writing, Bitcoin was up by 2% in the last 24 hours, and was holding support at a little under $35,000. Technical analysis suggests a resistance in the vicinity of $40,000. Let’s carry out a brief analysis of Bitcoin’s recent price movements and understand where it may be headed in the month of June, 2021.

The flagbearer and gold standard of the cryptocurrency industry, Bitcoin is a peer-to-peer digital currency used primarily for online trading and digital payments. It was launched in 2009 by a mysterious and anonymous person going by the pseudonym, Satoshi Nakamoto.

What is the current price of BTC, and how did it reach this point?

Bitcoin was trading at $36,650 at the time of writing. The coin faced the maximum brunt of bearish developments over the past month, and saw the biggest drop in BTC’s history, crashing by over 50% from it’s all-time high of $64,000 in mid-April 2021.

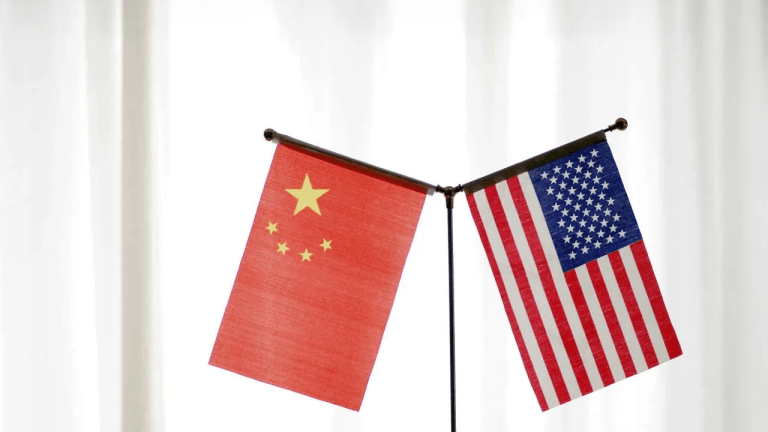

There were multiple external factors involved in bringing about its recent downfall, including Elon Musk’s announcement that Tesla won’t accept Bitcoin anymore; Hong Kong’s crypto trading ban, limiting the activity to only a group of professionals with high net worth; and most notably, the Chinese crackdown on cryptocurrency. May 2021 was in fact the worst calendar month in the 12-year long history of BTC. As we write, Musk is having another bad breakup with Bitcoin. Many fear it may make BTC breakout from the lower $29,800, a level that was tested earlier in late January this year. If that occurs, a reversal may be difficult any time soon.

Even though BTC didn’t lose a complete half of its value in May, Bullish spectators haven’t found any favours either, as the coin has failed to deliver a solid higher momentum. BTC prices saw brief reversals post 20 May, but they’ve only collapsed downwards, repeatedly. In that light if the resistance level continues to sustain longer between $38,000 and $42,000, bearish technical charts and a negative sentiment may lead to overall sell pressure, causing BTC to dip.

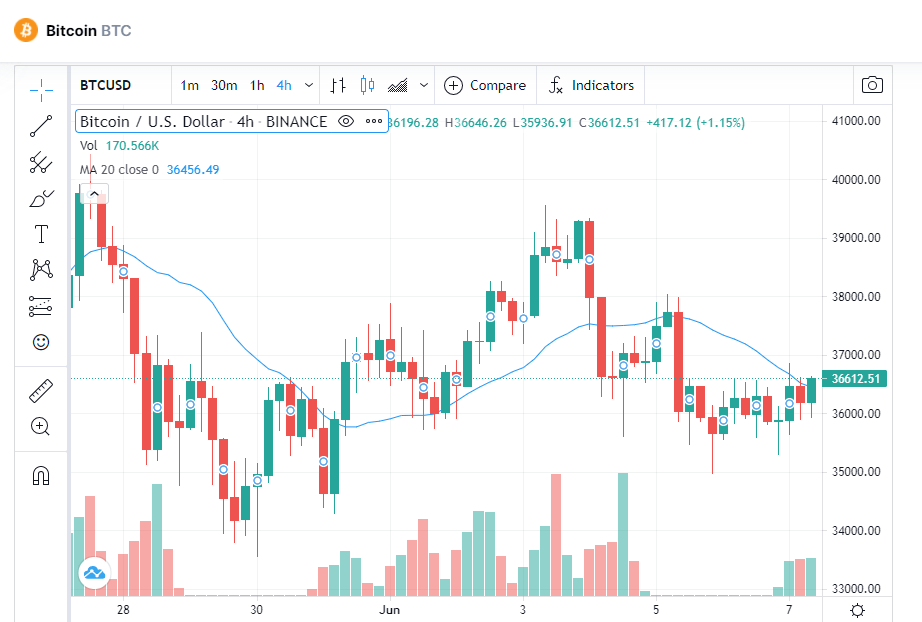

BTC began the month of June at a support level of around $33,500, continuing to witness ping-pong price movements, looking for its next big move. Bulls and bears have been engaged in a closely-fought battle, coiling the crypto into what appears to be a tightly wound spring, with BTC price action fluctuating between two converging trend lines.

Bitcoin Price Forecast for June 2021 and What May Impact it

The current BTC price can be deemed as a fairly good position, keeping in mind the sell pressure it witnessed last month.

There’s a good possibility that BTC volatility may accelerate once it breaks out from the pennant pattern that seems to have formed lately. Bulls would be hoping for a strong rebound, pushing the coin beyond the $40,000 mark, and further breaking into the $50,000 plus territory. In fact, spark reversals were witnessed earlier on 20 May and 24 May too, after BTC/USD had tested lower depths of $30,000 and $31,000 on previous days, bouncing back to the highs of $42,500 and $40,000 respectively.

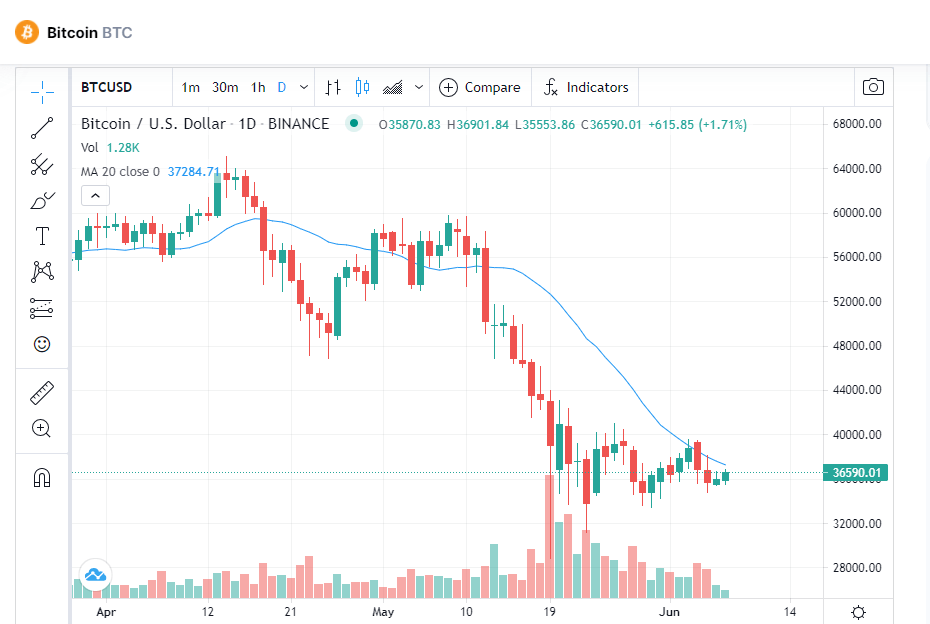

BTC/USD Daily Chart. Source: TradingView

BTC is apparently in a consolidation zone right now, and may soon breakout past the $40,000 mark. A reversal is very well on the cards and we may see it testing monthly or even quarterly highs in the June second half. The last level to buy the dip would be around $35,000, before the price starts reversing and pushing towards the $40,000 resistance level. However, if it doesn’t break out of the $40k level, and reverses instead, we might see it testing the previous support levels. Nevertheless, the good news is that overall sentiment around it is bullish.

Bears should watch out for the puncturing of the $30,000 mark. Once it crosses that mark, it may cause jitters among large traders who have been holding onto their coins so far. They may start closing some of their positions, causing a selling spree and testing of the early January 2021 lows.

On the other hand, bulls looking for an upward trend, should seek sustained trading above $42,000, and incremental higher moves from thereon. The resulting upturn could result in a potential test of the $50,000 level.

The good news is that the long-term Bitcoin hodlers haven’t pressed the panic button yet, and look determined to stay put for the time being.

BTC/USD 4-Hour Chart. Source: TradingView

Other events that might move BTC price in June 2021

There are many other external factors that may also impact the BTC price movement in June 2021. How the crypto regulatory restrictions unfold in China and Elon Musk’s love-hate relationship with BTC, will both have a say in determining the future market sentiment around the coin.

Furthermore, Troy Gayeski, the Senior Portfolio Manager and Co-Chief Investment Officer at SkyBridge Capital, a $7.5 Billion Hedge Fund manager recently stated that while Gold is good, they would like to stick to Bitcoin and crypto instead. Other billionaire investors like Ray Dalio and Carl Icahn have recently spoken about their commitment to BTC as well. All such bullish news stories will have a potentially positive impact on the BTC price in June 2021.

Please note, the above is a purely opinion-based piece, based on relevant data available for Bitcoin. It should not be deemed as direct investment advice.

The post Bitcoin Price Prediction for June 2021 appeared first on Coin Journal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments