Blackrock is moving forward with the process of bringing its spot bitcoin exchange-traded fund (ETF) to market. The world’s largest asset manager has secured a ticker symbol and a CUSIP number for its forthcoming spot bitcoin ETF, which is now listed on the Depository Trust and Clearing Corporation (DTCC), the entity responsible for clearing Nasdaq trades. Additionally, Blackrock’s spot bitcoin ETF filing signals the firm’s intention to buy bitcoin to seed its upcoming ETF this month.

Blackrock’s Spot Bitcoin ETF Now Listed on DTCC With Ticker IBTC

Several developments have sparked optimism among crypto investors regarding the launch of Blackrock’s spot bitcoin exchange-traded fund (ETF), the Ishares Bitcoin Trust. This speculation has fueled a significant surge in bitcoin’s price on Monday.

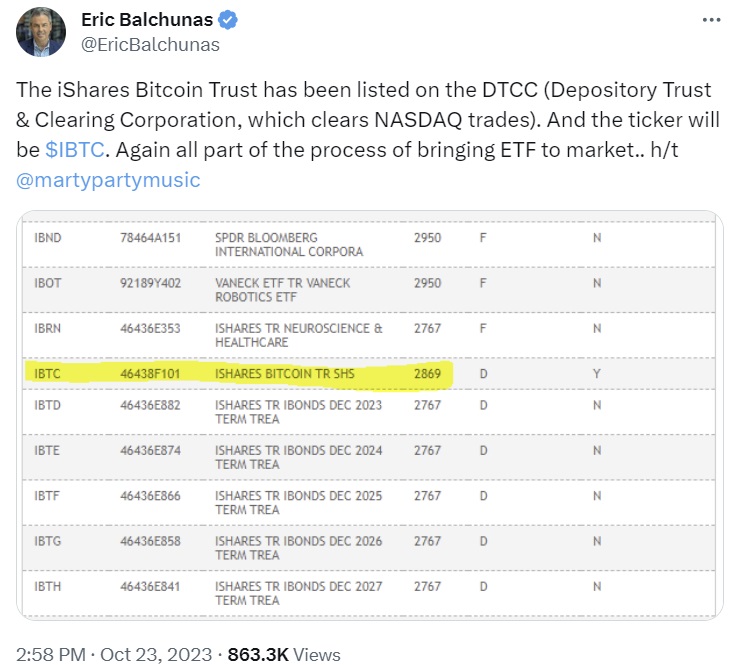

These developments include the allocation of a ticker symbol (IBTC) and the assignment of a CUSIP number (46438F101) to the Ishares Bitcoin Trust. Furthermore, the trust is now listed on the Depository Trust and Clearing Corporation (DTCC), which is responsible for clearing Nasdaq trades.

Eric Balchunas, a senior ETF analyst for Bloomberg, explained on social media platform X on Monday that the steps that the world’s largest asset manager has taken are part of the process of bringing an ETF to market.

Blackrock Expected to Buy Bitcoin to Seed Its Spot Bitcoin ETF This Month

Many people on social media have also pointed out that the amendment to the Registration Statement for Ishares Bitcoin Trust, filed with the U.S. Securities and Exchange Commission (SEC) on Oct. 18, indicates that Blackrock may be buying bitcoin this month to seed its upcoming spot bitcoin ETF.

Balchunas explained:

Blackrock stating in their recent spot bitcoin ETF amendment that they are seeding the ETF in October. Don’t want to read that much into it but it is new info not in original filing so noteworthy.

However, he clarified: “Seeding is typically not a lot of money just enough to get ETF going. So I wouldn’t read this as ‘omg Blackrock is buying a ton of bitcoin’ at all but more the fact they doing it and disclosing it shows another step in the process of launching.”

The sponsor of the Ishares Bitcoin Trust is Ishares Delaware Trust Sponsor LLC, a Delaware limited liability company and an indirect subsidiary of Blackrock, the filing details, adding that “Ishares” is a registered trademark of Blackrock Inc. or its affiliates.

Crypto enthusiast Martin Folb, aka “Martyparty,” detailed on X: “Once approved for registration, the ETF can then obtain its initial capital from a broker/dealer licensed ‘bank,’ in this case Coinbase, and must buy the genesis shares, or ‘creation units’ with this capital, in this case, its raw native BTC. This initial coin capital is exchanged for IBTC ETF shares, which become available for open-market trading on the first day, thus setting the ‘opening price’ of the IBTC.”

Timing of When SEC Could Approve Blackrock’s Spot Bitcoin ETF Application

Regarding when the SEC could approve Blackrock’s spot bitcoin ETF, litigator Joe Carlasare shared on X: “Lots of misinformation out there about the next key dates for the Ishares/Blackrock bitcoin spot ETF application.”

He explained: “Here’s a summary: On 9-28-23, the SEC invited the public to provide feedback on the application. Anyone wishing to submit a comment has until October 25th to do so. Following that, if someone wants to reply to another person’s comments, they have up to November 8th.” Carlasare noted:

The SEC does not typically approve rule changes or similar proposals until the comment request period is complete. This comment period is an essential part of their regulatory process.

“Usually, after the comment period ends, there’s an additional 30-60 days reserved for comment review. Therefore, if a spot ETF gets the green light in 2023, it probably won’t be from Blackrock,” he opined.

The price of bitcoin soared on Monday, hitting $35,000 before retreating slightly. At the time of writing, BTC is trading at $34,423, up 13% over the past 24 hours.

What do you think about Blackrock preparing to launch a spot bitcoin ETF? Do you think the SEC will greenlight spot bitcoin ETFs this year? Let us know in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments