Bitcoin ETFs continue limiting BTC’s recovery as institutional investors have pulled back, “reacting to macroeconomic uncertainties,” such as Trump’s trade tariffs.

Bitcoin’s recent rally above the key psychological threshold of $90,000 proved short-lived, with analysts pointing to ongoing macroeconomic uncertainties and a significant reduction in institutional investments in cryptocurrency markets.

Bitcoin (BTC) staged a near 10% recovery to above $95,000 on March 2 before forming a double-top chart pattern around $94,200 on the daily chart, a setup that indicates an imminent price decline.

Bitcoin bottomed at around $81,400 the following day and has since been struggling to remain above the $90,000 mark, TradingView data shows.

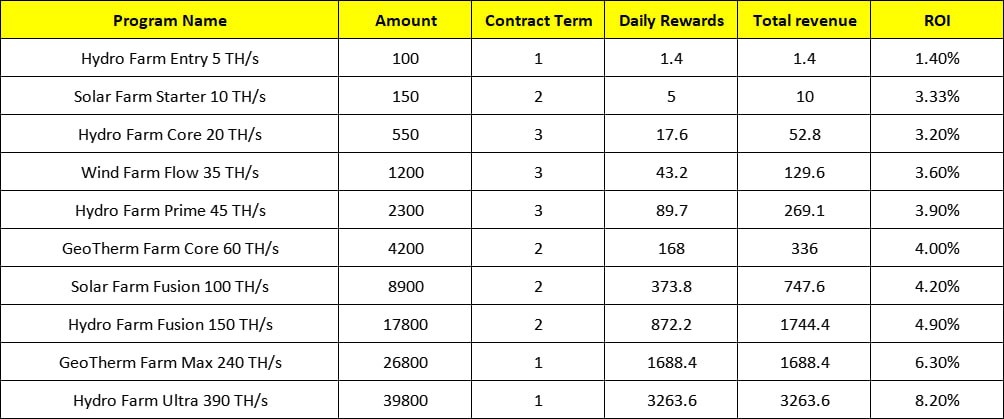

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments