USE AS A STORE OF VALUE:

Annual gold inflation: 1.5%

Physical gold storage costs: 0.5%

Paper gold storage costs: 0.15-0.5% + brokerage holding fees 0.25% (0.4%-0.75%)

Self custody costs: 0%(buying selling often has large spreads)

Estimated average annual cost of holding gold(inflation+storage) 2%

---------------

Bitcoin inflation: Trending towards 0%, less than 0.1% after next 5 halvings

Storage costs self custody: 0%

Storage costs third party: Likely 0.25% or less on average

Estimated future average annual costs of holding bitcoin: <0.25%

MINING COSTS:

Gold mining costs: $100 billion a year

---------------

Bitcoin mining costs: Depends on future market cap. With future halvings adjustments bitcoin could reach a price of $3 million per coin before bitcoin mining costs become bigger than gold mining costs.

ENVIRONMENT:

Mining is one of the dirtiest and most environmentally destructive industries. Gold mining generates 50% of mercury emissions worldwide. 1 in 4 mines is a gold mine. Poisons environment, water supply and workers.

---------------

Bitcoin consumes significant amounts of energy. Currently an estimated 0.1% of global CO2 emissions which is less than gold. Can consume excess energy that would otherwise be wasted. Can use carbon neutral energy sources.

Does produce e-waste. At $3 million per coin estimated 0.5% of global annual e-waste.

MEDIUM OF EXCHANGE:

Gold: Very inefficient since it is hard to divide. Hard to verify and can't be transported easily.

---------------

Bitcoin: Very efficient to send, divide and verify. Still more volatile compared to gold.

SOCIAL UTILIY:

Only 10% of gold is used in electronics. The other 90% are 50% financial uses and 50% jewelry(use as a status symbol). Most of the utility of gold is financial in terms of market cap.

If gold demand were reduced to it's industrial use the market cap would collapse more than 90% and be roughly the size of the silver market.

---------------

Over 50% of the human population either lives in authoritarian countries, countries with high inflation or countries with a dysfunctional financial system.

Bitcoin can help them protect their wealth and serve as an alternative form of money.

RISKS:

Gold can't be destroyed, has no physical competitors and has thousands of years of history. It has also demand from jewelry. Storing large quantities of gold with a third party has been risky historically even with the most trusted custodians.

Gold was confiscated in 1933 in the US. US ended gold conversion obligation in 1971. Nazis confiscated german gold. Paper gold also has counterparty risks and many other unknowns.

---------------

Bitcoin has significant risks in it's early stages due using to more complex technology and a lack of established history. The longer it keeps operating the smaller the risks will become.

TLDR:

- Using Bitcoin as a store of value would return 2% more annually compared to gold. In the past 30 years, gold has returned 5.55% annually, a rate of return similar to the return of bonds.

- Bitcoin is cheaper and easier to store in large quantities.

- Bitcoin is more cost-effective and environmentally cleaner than gold. If Bitcoin demonetizes gold, pollution from mining would go down significantly.

- Bitcoin can provide more social utility than gold.

- Bitcoin is much more useful as a medium of exchange.

- Bitcoin is still riskier than gold but that risk will gradually decline over time if it is successful.

Conclusion: Gold has been successful for a long time and Bitcoin does not look bad if not superior compared to gold. If someone thinks that Bitcoin is not socially or financially useful, inefficient, too costly and not sustainable they also would have to argue that gold is even much worse. Central banks do certainly hold a lot of gold for good reasons.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

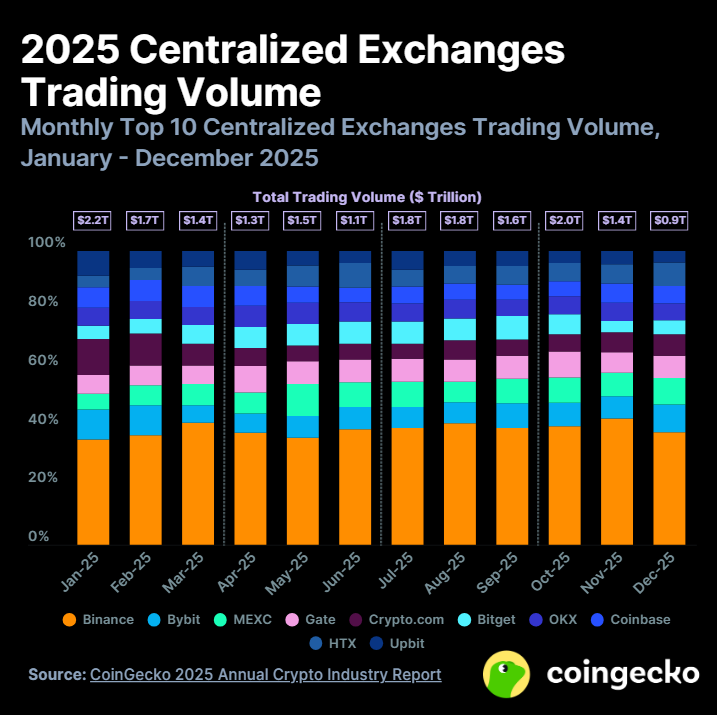

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments