A remarkable shift in sentiment and activity has been spotted among Bitcoin’s large investors also known as whales, especially wallet addresses holding more than 100 BTC in spite of recent price fluctuations, sparking discussions about the next trajectory of BTC’s price.

A Sharp Uptick In 100+ Bitcoin Addresses

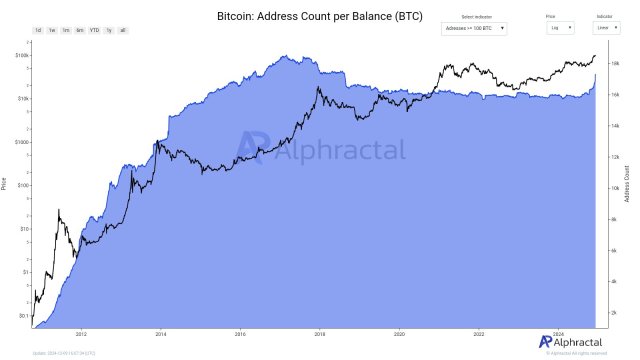

Recent reports from advanced investment and on-chain data platform Alphractal show that the number of Bitcoin wallet addresses holding over 100 BTC has risen significantly, reflecting a growing accumulation of the digital asset among large-scale investors.

Despite recent waning market performances, the rise in 100+ BTC addresses highlights increased confidence in Bitcoin’s long-term potential, which is often considered a bullish indicator. This is because the development might reduce the amount of Bitcoin in circulation, thereby prompting price increases in the long term.

Data from Alphractal reveals that while the number of addresses with more than 100 BTC has increased significantly in the last few days, the number of addresses holding over 10,000 BTC has been gradually declining. This shift cited within a period of accumulation is consistent with the general market optimism over the potential of the crypto asset.

It is important to note that institutional players, miners, sharks, and others are often considered owners of addresses with 100+ BTC. Meanwhile, crypto exchanges, funds, whales, and long-term investors or holders are the major owners of wallet addresses with over 10,000 BTC. “Other possibilities may exist, but generally, major exchanges hold the largest BTC addresses in terms of quantity,” Alphractal added.

In addition, the platform noted that sharks have been increasingly active as Bitcoin draws closer to the $100,000 price mark, and interest on the institutional level has been noticeable lately. As a result of the rising shark activity, many Bitcoins have moved from the biggest wallet addresses to smaller ones such as those holding 100 BTC or more.

Thus far, investors are closely watching the development as a substantial accumulation by addresses with more than 100 BTC mostly correlates with Bitcoin’s price action. When these holders constantly accumulate BTC, the asset often sees notable upside price movements.

New Investors Realized Cap Skyrockets

Although BTC’s price faltered in the past few days, the realized capitalization of new investors has increased sharply, demonstrating renewed interest and confidence in the crypto asset. This significant surge suggests that these investors are persistently accumulating Bitcoin in anticipation of a short-term rally.

Reports from Axel Adler Jr, an on-chain and macro researcher show that the realized cap for new investors who have held BTC for up to a month has surpassed a whopping $343 billion, marking an over 909% increase since the beginning of the cycle. Simply put, all the coins that long-term holders are selling are being purchased by new entrants.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments