Data shows Bitfinex traders have closed 12,000 Bitcoin longs in the past week. Here’s what happened the last time the whales showed this behavior.

Bitcoin Longs On Bitfinex Are Now Down To 80,000 BTC

In a new post on X, analyst James V. Straten has pointed out an interesting pattern in the derivative positions of the Bitcoin whales on cryptocurrency exchange Bitfinex.

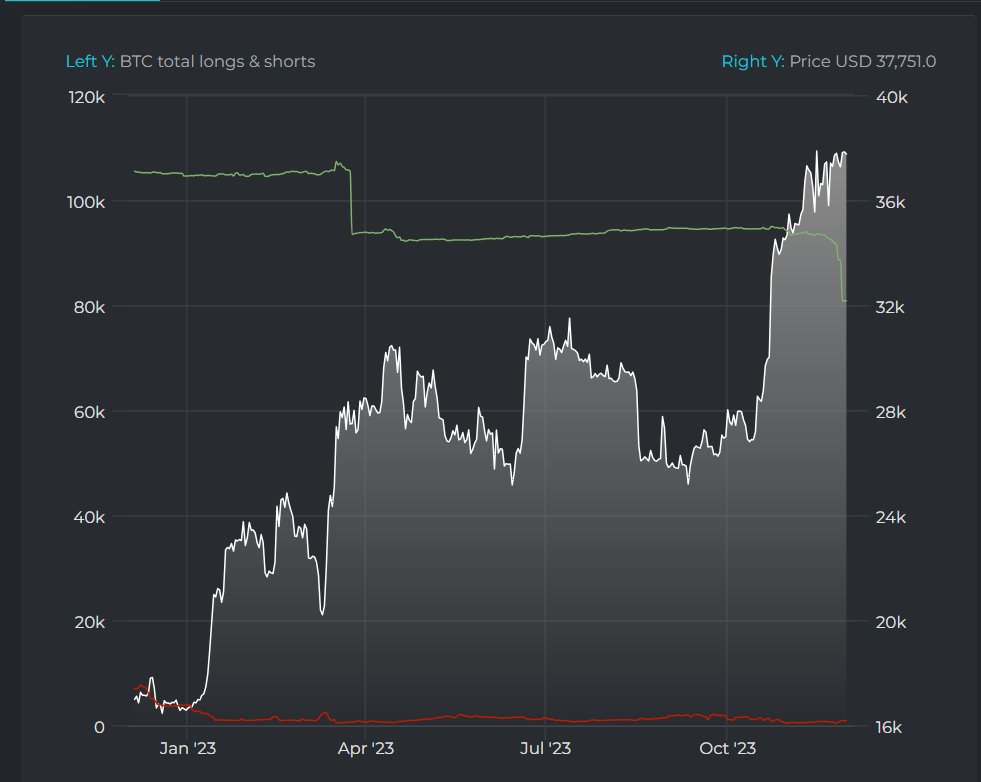

The below chart shows how the long and short positions (in BTC) on the platform have changed over the past year:

As displayed in the above graph, the Bitfinex exchange has had a relatively small number of short positions throughout the year. The long positions, on the other hand, have been quite sizeable.

At the start of the year, these Bitcoin long positions amounted to more than 100,000 BTC, but it would appear that the indicator has gone through two notable drawdowns since then.

The first of these plunges came right after the sharp rally that Bitcoin observed back in the middle of March, following its lows below the $20,000 level. Given the timing of this large-scale long closure, it would appear like a reasonable possibility that these whales made a move to lock in their profits.

Bitcoin would go on to see some more uptrend not too long after this decline in the indicator, but this surge was much smaller in scale than the previous rally, as BTC hit a top soon after.

Following this top, BTC registered some significant decline. Thus, the Bitfinex whales, although not completely precise, still exited the market at a highly profitable opportunity close to the top.

The second drawdown in the metric for the year has occurred within the past week, as is visible in the chart. During this plunge, the whales on the exchange have closed longs worth 12,000 BTC, taking the total long positions to about 80,000 BTC.

It’s possible that some of the whales think that the current Bitcoin surge has come far enough now, so they have decided to exit here while their profits are still high.

Since these traders have closed the long positions, though, the price of the cryptocurrency has actually registered some surge as it has broken back above the $38,000 level.

However, given that these humongous holders did miss the mark a bit when closing their long positions earlier in the year, it’s possible a similar pattern will repeat this time as well, with a top arriving for the cryptocurrency with some delay.

While the short-term view may be bearish for Bitcoin due to this, the fact that about 80,000 BTC in long positions is still up on Bitfinex should mean a lot of whales still continue to be bullish on the asset, so it might still be able to turn it around in the long-term.

BTC Price

Bitcoin had gone as high as above $38,800 during its surge in the past day, but the coin has since registered some pullback, as it’s now floating under $38,400.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments