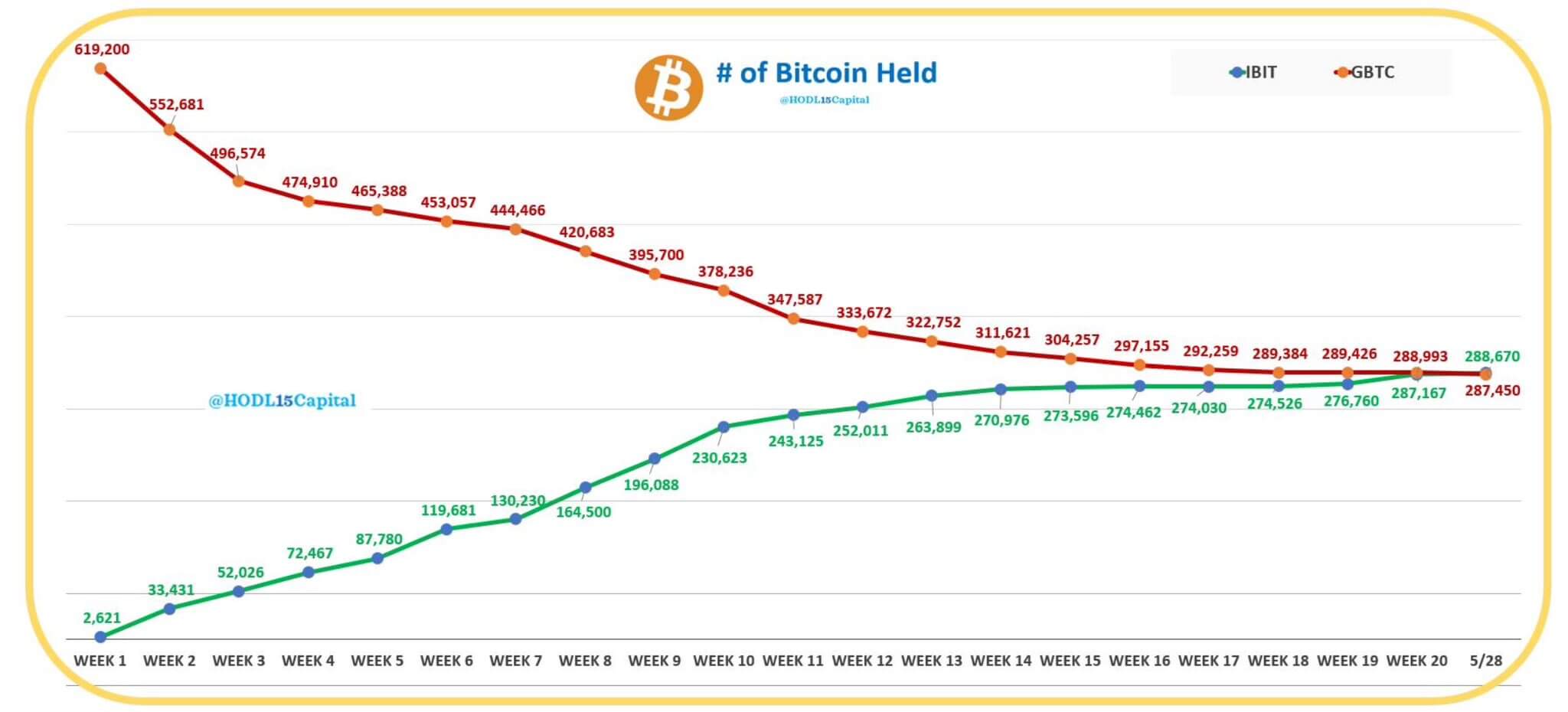

- BlackRock’s IBIT has flipped Grayscale’s GBTC in Bitcoin ETF holdings.

- IBIT holdings have surged to 288,670 BTC compared to 287,450 for GBTC.

One of the top Bitcoin news headlines today is that BlackRock’s iShares Bitcoin Trust (IBIT) has become the largest Bitcoin exchange-traded fund (ETF) in the world, surpassing Grayscale’s Bitcoin Trust (GBTC).

On May 28, inflows into IBIT reached $103 million while GBTC saw outflows of $105 million. Overall, the spot Bitcoin ETF market recorded net inflows for the 11th straight trading day on May 28 with a total of over $45 million.

IBIT surpasses GBTC as largest Bitcoin ETF

As Grayscale’s spot BTC ETF recorded outflows of $105 million or 1,540 BTC, BlackRock’s IBIT saw inflows of nearly $103 million, or plus 1,501 BTC.

BlackRock now holds 288,670 BTC for its IBIT ETF, while Grayscale’s GBTC holdings have shrunk further to 287,450 BTC.

Notably, when spot Bitcoin ETFs debuted in January, Grayscale’s ETF held 620,000 Bitcoin. However, as data HODL15Capital shared on X shows, these have quickly shrunk as BlackRock, Fidelity and others swelled in the last four months.

According to HODL15Capital, Grayscale’s outflows have come amid the fee issue (1.5% for GBTC vs. 0.2% for peers).

“Grayscale held 620,000 BTC at the time of the conversion (1/10/2024), which was more than 3% of circulating supply, but refused to lower the fee (1.5% vs 0.2% for peers), even after investors pulled 330,000+ BTC.& So much for the “differentiated” strategy,” HODL15Capital noted.

A Bloomberg report published on Wednesday notes that BlackRock’s BTC holdings reached $19.68 billion as of the end of trading Tuesday, compared to $19.65 billion in BTC for Grayscale. Fidelity’s FTBC, which registered inflows of $34.3 million on May 28, currently holds $11.1 billion.

IBIT’s flippening of GBTC comes as BlackRock revealed in a regulatory filing that its funds have purchased IBIT shares.

Specifically, the BlackRock Strategic Income Opportunities Fund (BSIIX) bought IBIT shares worth $3.56 million in the first quarter. Meanwhile, the Strategic Global Bond Fund (MAWIX) holds the ETF’s shares worth $485,000.

The post BlackRock’s IBIT flips Grayscale’s GBTC to become world’s largest Bitcoin ETF appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments