Just as you might borrow against your home or any other property by way of remortgaging or taking out a secured loan you can borrow against your Bitcoin. This doesn't necessarily have to be done with smart contracts but their development will allow the decentralisation of the technology which will in turn make it more competitive and frictionless.

Property is a relatively stable store of value that appreciates against the dollar due to its restricted supply and predictable rate of growth. Aside from inflation, the value of property has an average positive growth against the dollar over time due to population growth outpacing the speed of house building. Fiat currencies which have no such restricted supply or predictable rate of growth or inflation of supply, move in the opposite direction as their value is debased through faster and faster money printing. This is why it is common practice to take out a 10-20% loan against your property. The value of a house should consistently outpace the value of the debt over a given time period meaning that you can borrow against your own property for relatively low rates and will almost always be able to pay off the loan in full at some point in the future through the appreciation of your assets alone.

Bitcoin has the same, if not better store of value properties as real estate. It is limited in supply but is at an advantage when it comes to maintenance costs. It doesn't need tenants or a boiler! Its short term price action is currently considerably more volatile than real estate but when viewed over a minimum 4 year period (the supply halving cycle of Bitcoin) the trend is the same, these assets go up in value compared to the dollar consistently over timeframes greater than 4 years. Any 10-15% loan taken out against collateralised bitcoin in the past 10 years would have been repaid in full within a maximum of 4 years based on its price appreciation alone.

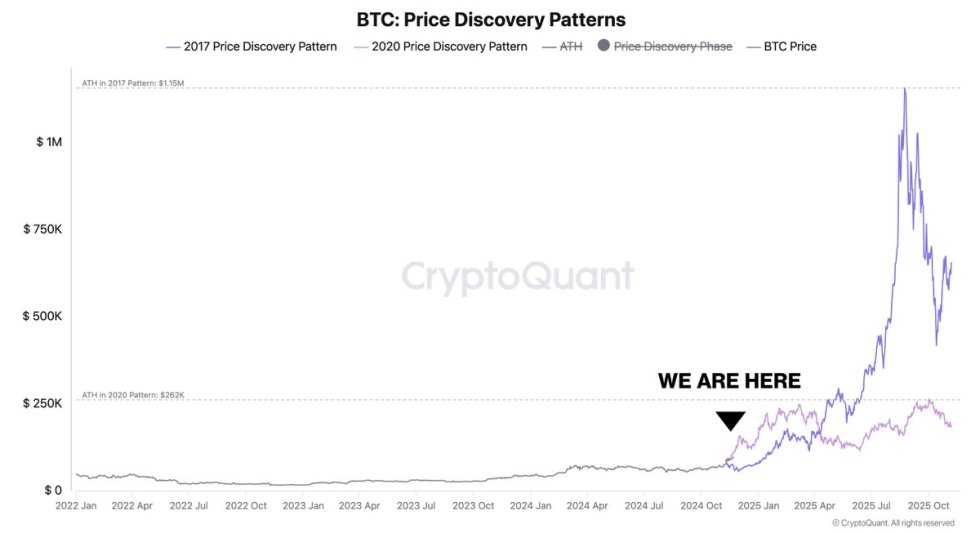

Drawdown needs to be factored in and is much more pronounced in crypto because of the volatility. Drawdowns of up to 80% means that historically collateralised loans amounts higher than 20% would have been at risk if they were made at the peak of any of the last few bull market cycles.

If you took out a loan of $50k against a house worth $100k and the housing market dropped by 50% you might lose your home as the bank would want to sell it before the price dropped any more so they could recover the $50k you borrowed. Luckily, the housing market does not tend to see such dramatic crashes in price very often and most people can borrow safely against their homes for a whole lifetime without being liquidated in this way.

Bitcoin saw an 80% drop after the previous bull market in 2017 so any loan above 20% would have been under threat of liquidation at this level of drawdown. That said, a 10% loan would have never been liquidated in any market since at least 2012. A plan to borrow 10-20% against your crypto assets with a 4 year repayment plan followed by another 10-20% loan against your collateral might be enough to secure financial freedom for yourself and your family within 1 or 2 decades. It’s pretty incredible.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments