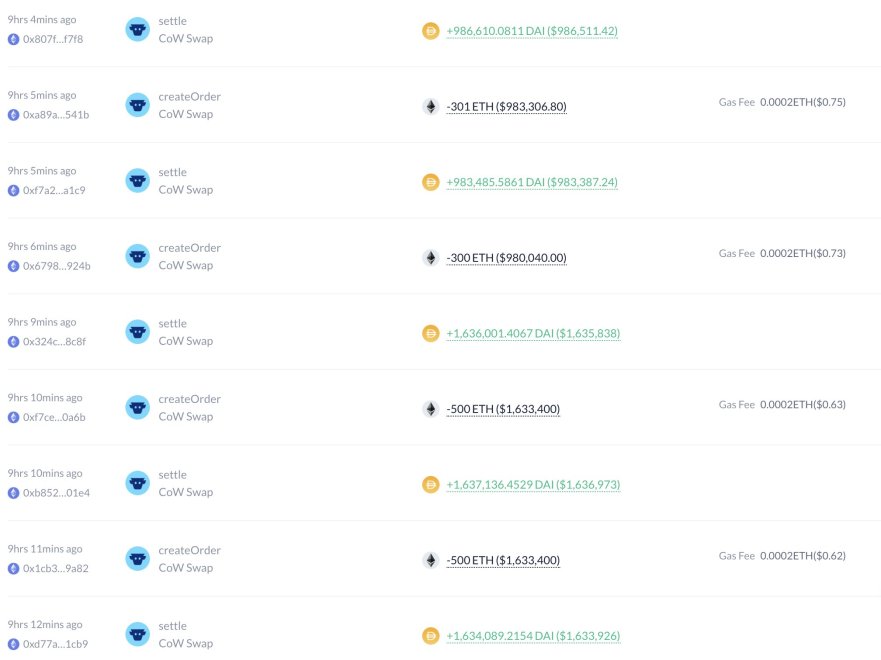

| One of the largest defi money markets Aave just paused ETH borrows to prepare for the Merge. This has caused the Instadapp stETH leverage pools to get crushed badly. There is almost $100m worth leveraged ETH in these pools. Why is there negative yield? Well because these strategies borrow ETH to leverage more stETH recursively. And the borrow rate of ETH has shot up over the last week or so. This means these yield strategies which were borrowing at 0.5% APY have suddenly seen their borrow rates shoot up to 8-10%. So the strategies are massively unprofitable right now. All these pools are earning negative yield, so users in them will look to exit. However there is just 155k worth ETH in the Curve ETH/stETH pools, which has 530k stETH. So majority of that stETH cannot be exited given these circumstances. And there is 97k stETH that could be liquidated at $1311. If these targets are hunted, we could see a lot of capitulation, similar to May and June. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments