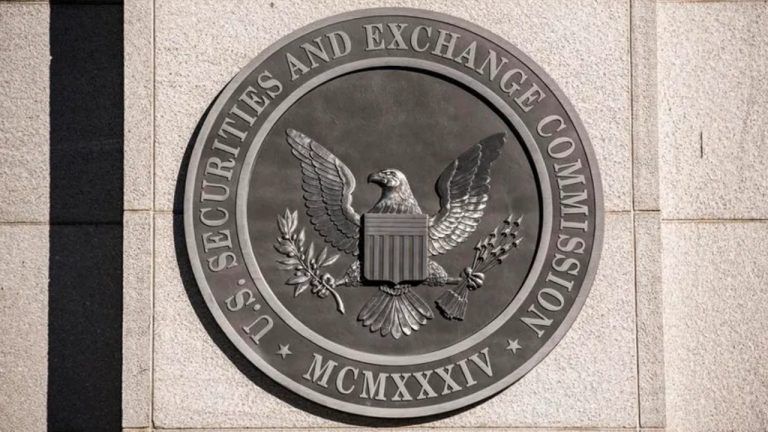

According to Reuters, significant progress has been made in discussions between the US Securities and Exchange Commission (SEC) and asset managers over the potential approval of Bitcoin exchange-traded funds (ETFs).

“Discussions between the US securities regulator and asset managers hoping to list Bitcoin exchange-traded funds (ETFs) have advanced to key technical details, in a sign the agency may soon approve the products,” Reuters reports.

US bitcoin ETF issuer talks with SEC have advanced to key details -sources

Discussions between the U.S. securities regulator and asset managers hoping to list bitcoin exchange-traded funds (ETFs) have advanced to key technical details, in a sign the agency may soon…

— *Walter Bloomberg (@DeItaone) December 7, 2023

Bitcoin ETF Approval Soon?

Currently, thirteen firms, including Grayscale Investments, BlackRock, Invesco, and ARK Investments, are awaiting decisions from the SEC on their applications for spot ETFs. The SEC has historically been resistant, citing investor protection concerns.

However, a significant change in the SEC’s stance occurred following the August court ruling against the SEC’s decision to reject Grayscale’s spot ETF application. “But after a court in August ruled the SEC was wrong to reject Grayscale’s application to convert its bitcoin trust into an ETF, the SEC has been engaging with issuers on substantive details, some of which are usually discussed near the end of an ETF application process,” according to industry executives and SEC public memos.

These discussions have covered various aspects, including “custody arrangements; creation and redemption mechanisms; and investor risk disclosures,” a person told Reuters who requested anonymity due to the private nature of the talks. Notably, according to the report, a spot Bitcoin ETF could trigger demand of up to $3 billion in the first few days.

“The SEC has long worried that Bitcoin is vulnerable to manipulation. Previously, discussions focused on that concern and were mostly educational,” the anonymous source said. However, this has fundamentally changed. “The advanced nature of the discussions signals the SEC may approve ARK’s application and likely some of the other 12 applications, in the New Year,” the insider remarked.

Reuters also highlighted that ARK CEO Cathie Wood expressed optimism in a Yahoo Finance interview last month: “My guess is that we’ll have several ETFs approved at once, which will give investors the best opportunity to compare them,” echoing the sentiment of Bryan Armour, ETF analyst at Morningstar.

The Pace Of Application Amendments Increases

SEC public memos reveal that executives from BlackRock, Grayscale, Invesco, and 21 Shares (collaborating with ARK) have met with SEC staff since September. In general, the pace of SEC information requests has also increased.

“While past meetings have mostly been with staff from the SEC’s trading and markets and corporate finance divisions, some recent meetings have been with staff in Chair Gary Gensler’s office, according to the memos and sources. The pace of SEC information requests has also accelerated from every few months to every week or so,” Reuters reports.

Despite this progress, the SEC, under the leadership of Chair Gary Gensler, a noted crypto skeptic, has not publicly indicated its stance on these filings. The primary sticking points remain, particularly the nature of the settlement mechanism, either cash or “in-kind.”

But after all, many issuers believe they have addressed the SEC’s market manipulation concerns through surveillance arrangements with listing exchanges and Coinbase, the largest US cryptocurrency exchange, according to the report.

At press time, BTC traded at $43,442.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments