Can someone with more knowledge convince me that we’re not barreling towards the biggest financial crisis in the history of fiat? The more I learn about crypto the more I’m beginning to see it as a 3+ trillion dollar house of cards that could be rugged at any second. My main concerns are the following:

•Tether’s claimed ‘assets’ that back their coin 1:1 even though they refuse to be audited, are being delisted by countries and exchanges for not following regulations, Yet they’re minting billions of dollars worth at their treasury every week. Where are their assets?

•IFinex owning tether and bitfinex. So you mean to tell me they take my dollars, mint new tether which I go buy bitcoin with, then with the dollars I gave them they also buy bitcoin. Am I missing something here? Or are they somehow able to buy two dollars worth of bitcoin with one dollar. Isn’t this propping up the price of bitcoin?

•Liquidity issues. Especially with recent widespread complaints of Coinbase users not being able to withdraw funds in USD. If there was a run on the exchanges would people be able to cash out?

•Whale dominance. It’s no secret that whales control a majority of crypto wallets. If and when they want to cash out they are going to dump on the heads of new retail investors/etf investors and whoever else weren’t able to sell fast enough once the rug gets pulled.

•U.S. political landscape. It’s no secret the incoming trump administration wants to pump their bags. Claiming to make the U.S. the crypto capital of the world. At the same time Trumps Pick for Commerce Secretary Howard Lutnick just so happens to be the Cantor Fitzgerald CEO. The ones currently being fined by the SEC for violations. The same Cantor Fitzgerald who is partnering up with Tether to issue them U.S. backed loans. Conflict of interest much?

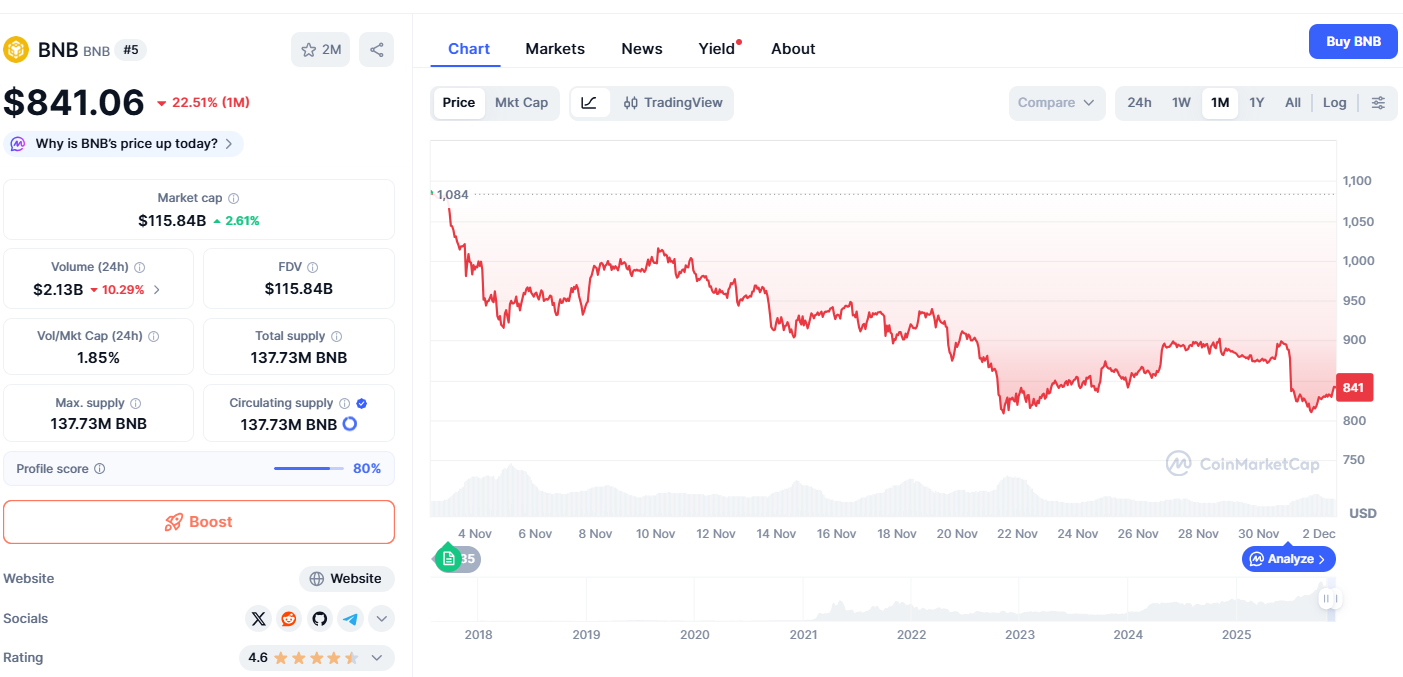

•MicroStrategy and other mining companies bitcoin treasury strategy. With MSTR now being added to the QQQ this raises the concerns of what would happen in the event of another 80%+ drawdown in crypto. Their infinite money glitch is reminiscent of mortgage lenders genius ideas of CDO’s back in 08. I understand the differences but MSTR is relying on their bitcoin continually increasing in price. This method works great until it doesn’t.

Don’t get me wrong I love bitcoin, the concept, the future goals, the technology and security of it. The freedom it gives you from tradfi and central banks. However I can’t seem to shake the fact that we might be speeding towards one of the greatest financial bubbles/collapses in history of it all fails. Led by an administration of deregulation oligarchs who wants to pump their bags until the national debt reaches 100 trillion plus. I’m not trying to spread FUD in here and I’m heavily invested myself but can someone drop their knowledge and ease my mind about these concerns?

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments