A world of utility

When we hit the next halving, Bitcoin will be 15 years old.

While it will still be relatively new in terms of a technology, it has now more than enough years of trial by fire to have proven itself, and have shown to have laid a solid foundation.

Its utility and adoption has also extended beyond the original premise of an alternative decentralized currency. To the point where the utility side of both crypto and blockchain are used by many companies across the world, and now across many industries.

There's the core services and security of crypto, its decentralization, its verification system, its database system. Those services have opened the door far beyond just an alternative part of payment, and has shown its ability for the democratization of money, the removal of totalitarianism systems, offering rare unconditional ownership, offering a financial system with no discrimination on race/class/religion/social status etc, absolute transaction where everyone is guaranteed to be paid, the reduction of corruption, payment without borders, and a step even further in self-banking and banking the un-banked.

But crypto has gone far beyond those core values, and the core services it provides. There's many chains adding even more utility to crypto, from oracles, indexing, AI, supply chain, IOT, DeFi, etc...

On top of that, we now have smart contracts, which offers an entire world of utility. The sky is the limit with what you can do with a smart contract, which is why many companies around the world have started using them.

The problem is these aren't things most average Joe is aware of. This is why many average Joes still believe that crypto is a fad, and isn't here to stay.

Crypto has gone through its biggest trial by fire.

Recently, crypto has gone through a pandemic, threats of nuclear war, threats of regulation, a worldwide financial crisis, inflation and recession across the world, Fed QT, China banning Bitcoin mining, collapse of banks that were tied to crypto, one of the biggest stable coin collapse, one of the biggest crypto exchange collapse and causing a contagion.

If crypto was just a fad, and didn't have the legs to stand on, I really don't think it would have been able to get through all that. If even all those things aren't able to kill the crypto fad once and for all, then I don't think much else will. At this point, it might take a meteor to hit the earth to end crytpo. So I think it's probably best it doesn't end.

There's only so many times you can keep calling crypto a fad, and keep getting proven wrong.

When Mt Gox collapsed, and the whole crypto market imploded, it seemed like it would be the end of a fad. I can't imagine anything surviving something like that.

I honestly thought it was over.

When it crashed again in 2018, there were many skeptics who still thought that surely this time around the fad is over.

While crypto was already beginning to prove itself, and there was now a lot of utility proving itself, it was probably not obvious yet to average Joe. And maybe it was still early.

When it crashed again and we had another bear winter, at this point it became business as usual, and it was becoming obvious that this was just how Bitcoin was. While it's dominating the market, then so do its halving cycles.

But there were still some people who were saying "OK but this time it's definitely over for this fad. This is definitely the one".

It's not looking like it's over.

If crypto manages to go into a bull run once again, after all the bad macros, after all the wrenches thrown at it, then it will be the bull cycle that will wipe out any remaining doubts, and the bull cycle that will get most of average Joes to finally realize that crypto is here to stay and was never just a passing fad.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

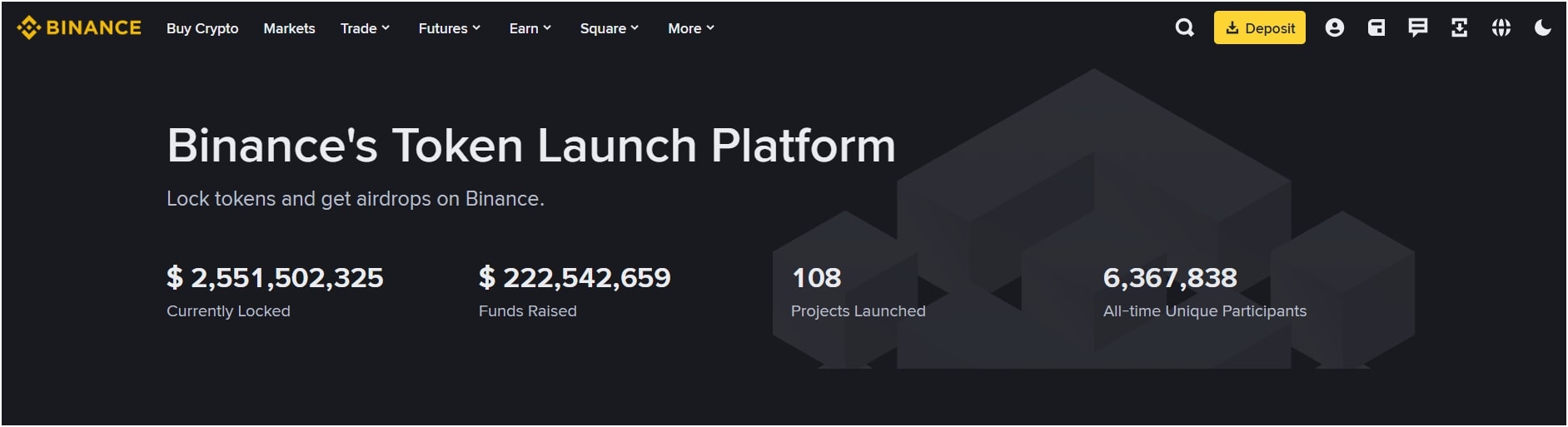

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments