Summary:

- Alameda Research also had unlimited access to customer accounts among other special privileges at the FTX crypto exchange.

- The CFTC’s complaint against Sam Bankman-Fried cited insider information, chat logs, and internal conversations as evidence for its lawsuit.

- Charges were also filed by the U.S. Department of Justice and the SEC.

The U.S. Commodity Futures Trading Commission (CFTC) said that Alameda Research, Sam Bankman-Fried’s trading behemoth, was insolvent as of May/June 2022 despite allegedly using customer funds to finance debts and loans.

On Tuesday following SBF’s arrest, the CFTC filed a formal complaint against Bankman-Fried for committing fraud among other crimes. The Department of Justice and Securities and Exchange Commission also filed charges against SBF on December 13.&

According to the CFTC, Bankman-Fried and other FTX executives gave special access to Alameda. SBF’s trading firm was exempt from liquidation rules thanks to specific code written into FTX’s trading engine, per the complaint. The regulator added that Alameda could also open positions and order transactions without insufficient asset balances.&

Alameda could borrow without limit on FTX, said the CFTC. The filing noted that Alameda’s borrow limit, or lack of it, included customer deposits and user assets.&

On at least one occasion during the Relevant Period, Alameda had reached a previously-set borrowing limit for its FTX account. In response, Bankman-Fried directed FTX personnel to raise the borrowing limit to a level that would be unlikely to ever be exceeded. On information and belief, FTX personnel ultimately raised Alameda’s borrowing limit to be many tens of billions of dollars. Alameda’s borrowed funds could also be withdrawn from FTX. These features, in combination, allowed Alameda unlimited ability to borrow and withdraw digital assets directly from FTX Trading to put towards its off-platform activities.

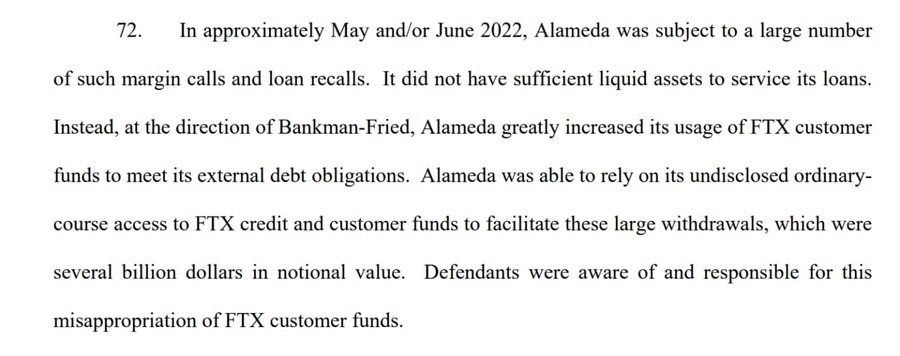

Despite using customer funds to backstop billions in Alameda’s losses, the CFTC alleges that SBF’s trading giant was unable to repay loans and meet margin calls by May/June 2022. Notably, Terra’s $40 billion implosion happened around the same time.

The filing spurred discourse around claims that Bankman-Fried and FTX played a role in crashing Luna and Three Arrows Capital after Su Zhu and his 3AC co-founder Kyle Davies published a barrage of Twitter threads blaming SBF for their fortunes.

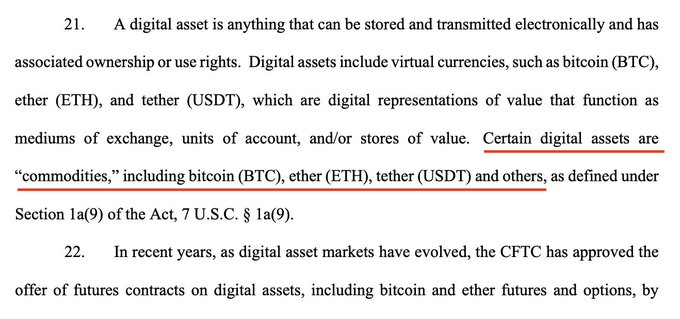

Bitcoin, Ether, and Tether Are Commodities: CFTC

Part of the CFTC’s complaint gave insight into the regulators’ approach toward classifying some cryptocurrencies. “Certain digital assets are commodities including Bitcoin (BTC), Ether (ETH), Tether (USDT) and others are commodities”, said the CFTC.

The SEC reportedly backs classifying Bitcoin as a commodity. However, the SEC under Gensler suggested that Ethereum, and by extension ETH, should fall under U.S. Securities laws&

Clear crypto regulations in the U.S. remain elusive despite the CFTC’s argument and the SEC’s rhetoric. Crypto participants have long blamed a lack of regulatory guidance for crypto as the underlying factor behind some failures in the digital asset industry.&

During the FTX Congressional hearings, bipartisan lawmakers suggested a myriad of regulatory paths total bans on crypto, inclusive regulatory policies, and completely isolating blockchain technology from America’s traditional financial ecosystem.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments