Cryptocoins News / Blockchain - 1 month ago

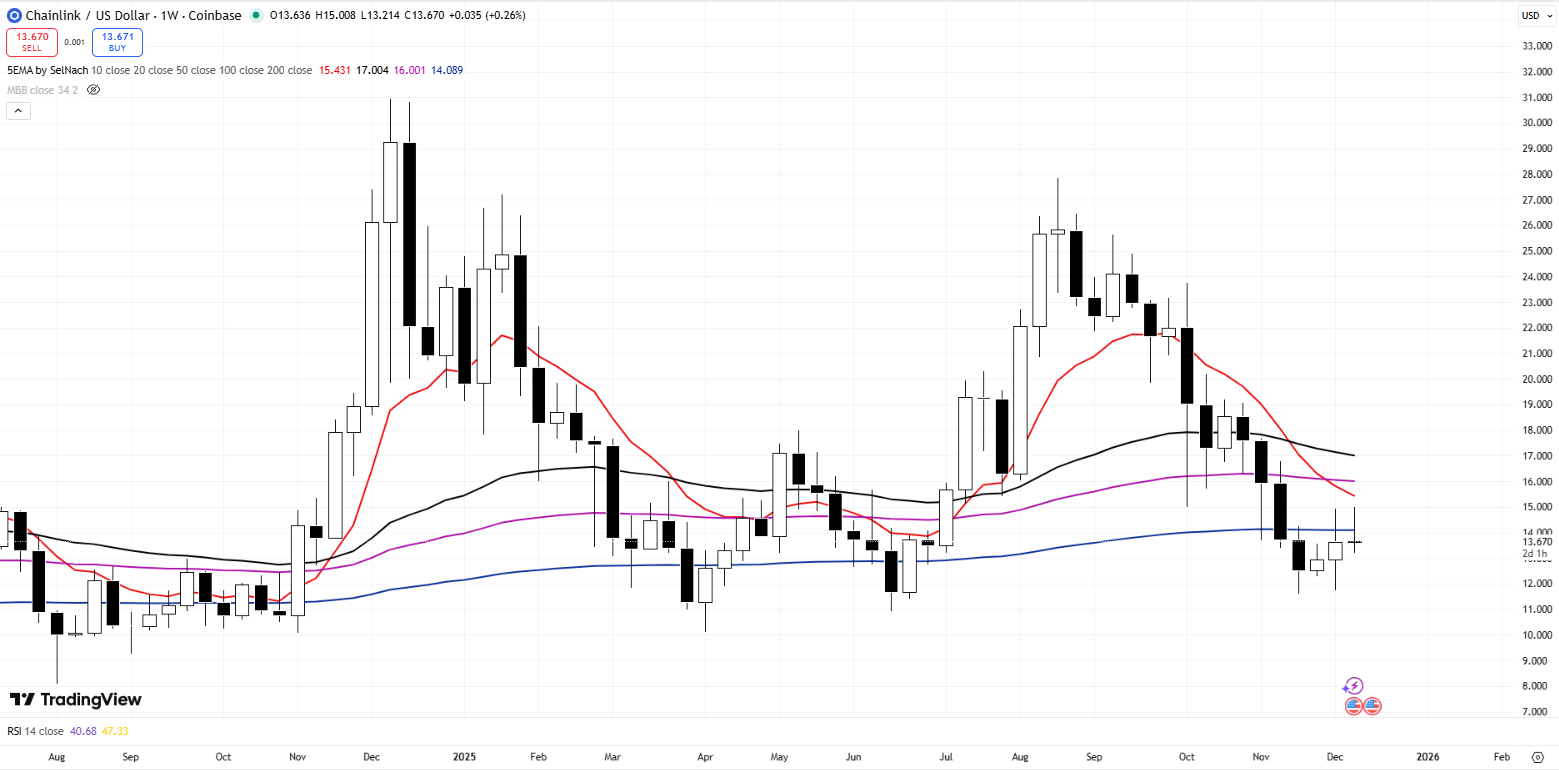

LINK price prediction points to potential 34% upside to $16.50 if bulls break critical $14.93 resistance, though bearish momentum suggests caution near $12.19 support. (Read More)

Cryptocoins News / Blockchain - 1 month ago

LINK price prediction targets $16.50 short-term as analysts forecast bullish breakout above $14.93 resistance, with critical support holding at $11.74. (Read More)

Cryptocoins News / Blockchain - 1 month ago

LINK price prediction shows potential 21% upside to $16.50 within 2-3 weeks if Chainlink breaks critical $14.93 resistance, with technical momentum turning bullish. (Read More)

Cryptocoins News / CryptoNinjas - 1 month ago

Bear markets have a way of clarifying what matters. Narrative-driven and over-owned majors bleed first, while anything tied to real adoption, fees, and solving genuine problems starts to stand out.

Now investors are debating Chainlink vs. Digitap ($T...

Cryptocoins News / Blockchain - 1 month ago

LINK price prediction shows bullish potential with analysts targeting $15.50-$20.50 by month-end as MACD momentum strengthens and key resistance at $14.50 comes into focus. (Read More)

Bitcoin News / Bitcoinist - 1 month ago

Swapper Finance has launched Direct Deposits in collaboration with Chainlink and Mastercard, aiming to bring global payments directly into the on-chain economy to more than 3.5 billion users worldwide.

Swapper Finance Launches Direct Deposits With C...

Cryptocoins News / Blockchain - 1 month ago

LINK price prediction shows potential upside to $15.50 in the coming weeks, with Chainlink forecast supported by improving MACD histogram and key resistance test at $14.93. (Read More)

Cryptocoins News / CryptoNinjas - 1 month ago

Key Takeaways:

The Base–Solana Bridge is now live on mainnet, secured jointly by Chainlink CCIP and Coinbase.

Users and developers can transfer SOL and SPL tokens to Base apps, enabling unified liquidity across both ecosystems.

The launch marks one...

Cryptocoins News / CoinJournal - 1 month ago

Chainlink price hovered near $14, down 2% in the past 24 hours.

LINK remained under pressure despite two key integrations on Solana.

Coinbase and Chainlink have launched a Base-Solana bridge.

Chainlink continues to play a key role in the blockchain...

Cryptocoins News / The Cointelegraph - 1 month ago

Analysts called the Chainlink ETF’s debut a “solid” launch, but the development has yet to attract enough liquidity to reverse the LINK token’s 39...

Bitcoin News / Bitcoin.com - 1 month ago

Grayscale’s Chainlink ETF debut on NYSE Arca signals accelerating investor demand for Oracle-driven blockchain infrastructure while opening a streamlined path to Chainlink exposure without direct crypto ownership. Grayscale Chainlink ETF Begins Tradi...

Cryptocoins News / Blockchain - 1 month ago

LINK price prediction shows bullish momentum with $18.26 short-term target. Technical analysis reveals key breakout setup after 19.43% daily surge. (Read More)

Cryptocoins News / Blockchain - 1 month ago

LINK price prediction targets $16.25 in the next 2-3 weeks as MACD histogram turns positive despite recent 6.84% decline. Chainlink forecast shows mixed signals with support at $11.61. (Read More)

Cryptocoins News / The Cointelegraph - 1 month ago

Grayscale’s Chainlink ETF is expected to launch on Tuesday this week, marking the first spot LINK ETF to enter the US market. ...

Cryptocoins News / Blockchain - 1 month ago

LINK price retreats 1.2% to $13.12 amid broader crypto weakness, testing technical support while momentum indicators hint at potential reversal formation. (Read More)

Cryptocoins News / Blockchain - 1 month ago

LINK price prediction points to $14.98 medium-term target as MACD shows bullish divergence, though short-term consolidation near $13.36 expected before breakout. (Read More)

Cryptocoins News / Blockchain - 1 month ago

LINK price prediction shows potential 11.5% upside to $14.98 within 30 days, though short-term consolidation near $13.19 expected as technical indicators flash mixed signals. (Read More)

Cryptocoins News / Blockchain - 1 month ago

Chainlink price holds $13.34 amid neutral momentum signals, with LINK testing critical support levels as broader crypto market awaits direction following recent volatility. (Read More)

Bitcoin News / Bitcoinist - 1 month ago

Chainlink co-founder Sergey Nazarov says DeFi, or decentralized finance, is closer to the mainstream than many realize, but real hurdles remain before it can scale to match traditional finance.

According to Nazarov, DeFi is about 30% of the way to b...

Cryptocoins News / Blockchain - 1 month ago

LINK price prediction shows potential 112% surge to $27.79 by month-end, but medium-term Chainlink forecast suggests decline to $11.72 by early December amid conflicting signals. (Read More)

Cryptocoins News / The Cointelegraph - 1 month ago

Chainlink’s Sergey Nazarov has shared a potential roadmap for how DeFi could reach 100% adoption in four years, noting that a big part of this hin...

by COINS NEWS - 1 month ago

Grayscale says Chainlink will anchor the next phase of blockchain adoption, positioning LINK as the core infrastructure powering tokenization....