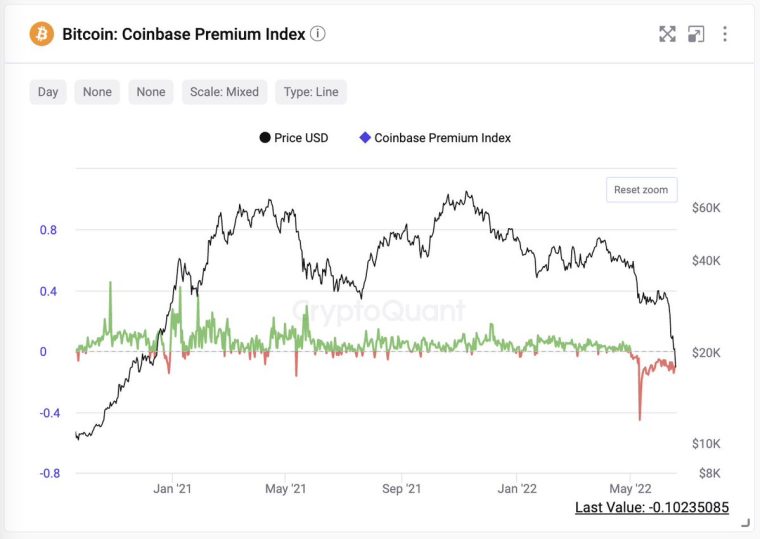

The CEO of cryptocurrency analytics firm CryptoQuant Ki-Young Ju has confirmed through a tweet that Coinbase’s Bitcoin (BTC) price premium has risen to near the 0.075 mark, marking its second move into positive territory after briefly spiking to 0.217 on June 30, before slipping back into the negative territory. The index is now recovering.

Coinbase $BTC price premium seems to be recovering.https://t.co/Xkoohe4Ozc https://t.co/ZEorApSlTT pic.twitter.com/SDEIn1IkPz

— Ki Young Ju (@ki_young_ju) July 8, 2022

The Coinbase Premium index has turned constructive for the second time since April of this year amid a cryptocurrency market recovery that has seen the area’s market capitalization briefly surpass the $1 trillion mark, exhibiting growing BTC buying pressure.

During the crypto strike, the benchmark showed one of the strongest dips in history. It showed that the Coinbase market makers were struggling to find enough liquidity in the market which caused a huge discount.

In accordance with Crypto Quant metrics, the Coinbase premium index is a measure showing the price gap between Coinbase’s BTC/USD trading pair and Binance’s BTC/USDT pair. When the premium is positive, it shows buying pressure on the exchange is heating up.

The CEO also added that this buying pressure on Coinbase likely comes from institutional and retail investors from the United States and brokerage firms that are using Coinbase. In mid-June, the CEO also added that the Bitcoin Price at Coinbase is lower than other exchanges which means that, which means that these U.S. investors are selling now.

Most US institutional investors, market makers, and brokerage firms are using Coinbase. Bitcoin price at Coinbase is lower than other exchanges, which means these US institutional investors are selling now.

Institutional investor sentiment is no good for now.

— Ki Young Ju (@ki_young_ju) June 17, 2022

The premium index has recovered at a time when the flagship cryptocurrency has been recovering and briefly traded above $22,000, up from an $18,500 low seen last month. Within the second quarter of the year, Bitcoin posted its worst quarterly performance in more than a decade as it misplaced up to 58% of its worth thereby going from $45,524 to only slide beneath $19,000 at the end of the three-month period.

The crypto’s space ongoing bear market came amid a risk-off sentiment within the markets pushed by inflation fears, rate of interest hikes, and the effects of the Ukraine war.

The Bitcoin (BTC) market Crash Casualties

The cryptocurrency market slump has forced some companies to slash off part of their staff, including Voyager Digital, Coinbase and Vauld.

Cryptocurrency market crash also revealed several corporations in the cryptocurrency space were extremely leveraged. In May, TerraUSD ($UST), an algorithmic stable coin in the Terra network, collapsed along with the LUNA token depegging, wiping billions from the market.

In June, troubled crypto lending firm Celsius Network froze withdrawals for customers over “extreme market conditions,” with rival lender Babel Finance and crypto exchange Vauld freezing withdrawals shortly after.

The crypto hedge fund Three Arrows Capital (3AC) has entered liquidation following a court order issued in the British Virgin Islands in New York after creditors sued the fund for its inability to repay debts. Several lenders suffered losses on loans provided to the hedge fund.

According to Crypto compare, The 21Shares Short Bitcoin (BTC) ETP (SBTC), which “seeks to provide a -1x return on the performance of Bitcoin for a single day,” saw a 30-day return of 30.8%, making it the third consecutive month where the product’s assets under management have risen, recording a new $16.5 million all-time high this month.

Related News:

DeFi Coin (DEFC) - Undervalued Project

- Listed on Bitmart, Pancakeswap

- Native Token of New DEX - defiswap.io

- Up to 75% APY Staking

- Whitepaper and DeFi Tutorials - deficoins.io

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments