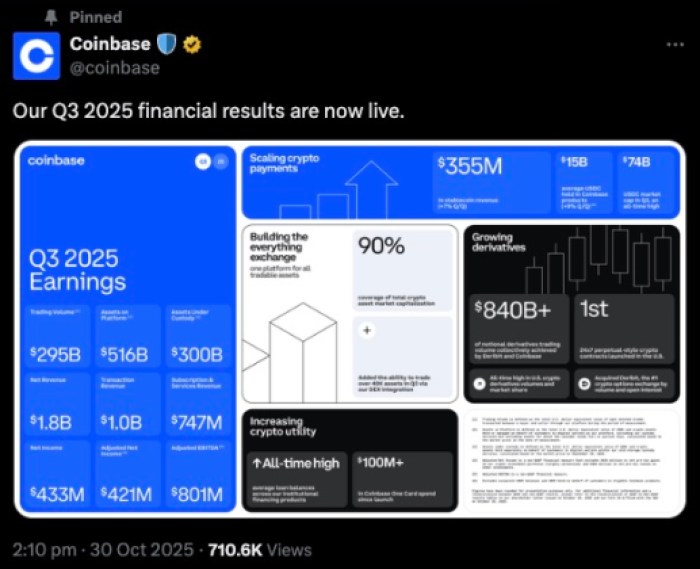

As the legal battle unfolds between the United States Securities and Exchange Commission (SEC) and US-based crypto exchange Coinbase, the presiding Judge Katherine Polk Failla has shown skepticism towards the SEC’s position and motives in pursuing the case.

This development has tilted the scales in favor of Coinbase, as the judge demonstrated a keen interest and indicated a potential inclination towards the exchange’s arguments.

Coinbase’s Defense Gains Momentum

The SEC filed a lawsuit against Coinbase in June, alleging that the exchange facilitated trading of crypto tokens that should have been registered as securities.

Specifically, the SEC accused Coinbase of operating as an unregistered national securities exchange, broker, and clearing agency.

The regulatory body took particular aim at the exchange’s “staking” program, which enables users to pool assets and earn rewards by verifying activity on blockchain networks. However, Judge Failla’s evident skepticism has cast doubt on the strength of the SEC’s case.

Notably, Bloomberg’s senior litigation analyst, Elliot Z. Stein, has expressed confidence that Coinbase has a 70% chance of winning this legal dispute.

Stein’s analysis points to the judge’s interest in establishing a clear definition of “investment contract” that would not encompass collectibles, with Coinbase’s proposed definition being more compelling.

The analyst suggests that Coinbase’s definition requires investment in a business instead of merely an ecosystem and an enforceable obligation. Stein also notes that recent rulings, such as the one involving Ripple in July, indicate that sales of digital assets on public exchanges do not neatly fit into the Howey test used to determine investment contracts.

Additionally, the exchange has made a strong case against the SEC’s allegations, arguing that they have not sufficiently demonstrated the exchange’s performance of broker functions.

Outcome In Coinbase Case Anticipated By Q2?

After the first courtroom clash, Bloomberg’s senior litigation analyst highlighted a fundamental question. According to Stein, the ruling on this case is expected to be delivered by the end of the second quarter of 2024, with Judge Failla’s known efficiency potentially resulting in an earlier decision.

More importantly, a favorable outcome for Coinbase could significantly impact SEC Chairman Gary Gensler’s efforts to regulate the crypto industry through enforcement actions.

Gensler has initiated over fifty crypto enforcement actions since assuming the chairmanship. An SEC victory over Coinbase would uphold Gensler’s agenda. At the same time, a ruling in favor of the exchange would challenge the SEC’s regulatory reach and potentially lead to a narrowing of the Howey test by the Supreme Court.

This legal showdown between the exchange and the SEC highlights the ongoing struggle to define regulatory boundaries and establish clear guidelines for the rapidly evolving crypto industry.

The outcome of this case has the potential to shape the future of crypto regulation and set important precedents, impacting not only Coinbase but the broader ecosystem as well.

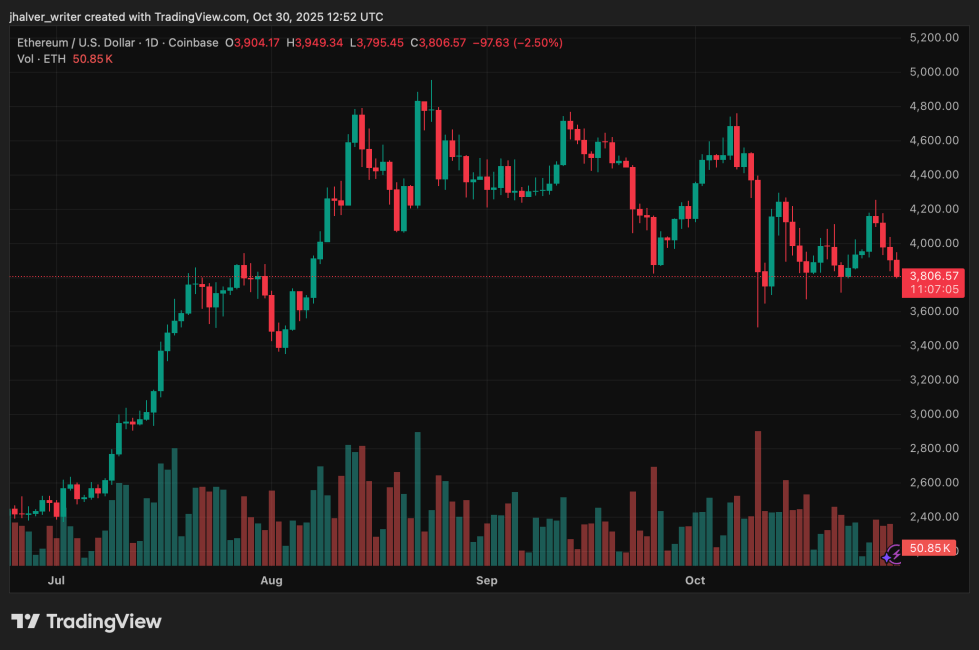

Featured image from Shutterstock, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments