The US Treasury is receiving opposing guidance on how to implement the GENIUS Act, which regulates stablecoin payments. Coinbase asked the department to limit a ban on stablecoin interest to issuers. Non-issuers, such as crypto platforms, should be allowed to offer interest, the company said, arguing this aligns with Congress’s intent.

Digital assets meet tradfi in London at the fmls25

The GENIUS Act was signed into law in July. It is expected to take effect either 18 months after enactment or 120 days after federal regulators issue final rules, likely in late 2026 or January 2027.

BPI Pushes Treasury to Extend Stablecoin Interest Prohibition

At the same time, banking organizations led by the Bank Policy Institute urged the Treasury to extend the prohibition to non-issuers. In a joint announcement, BPI and partner groups called for a blanket ban on stablecoin interest payments, covering exchanges and related entities.

The institute said the ban should apply whether payments come directly from an issuer or through affiliates or partners. BPI had previously warned that allowing stablecoin interest could lead to as much as $6.6 trillion in deposit outflows from traditional banks.

Just released - ABA and 52 state banking associations urge @USTreasury to uphold GENIUS Act's ban on stablecoin interest: https://t.co/2P2jelAuAg

— American Bankers Association (@ABABankers) November 4, 2025

Coinbase Suggests Treating Stablecoins as Cash Equivalents

Coinbase noted that lawmakers intentionally excluded non-issuer third parties from the ban, as a broader prohibition would have hindered stablecoin market development. It added that the Treasury does not have authority to override Congress.

Coinbase also recommended excluding non-financial software, blockchain validators, and open-source protocols from the law. The company suggested treating payment stablecoins as cash equivalents for tax and accounting purposes.

Trading Volume Drives Coinbase Quarterly Revenue Growth

Meanwhile, Coinbase reported third-quarter 2025 earnings of $1.50 per share, surpassing analyst estimates. The exchange generated $1.86 billion in revenue, a 25 per cent increase from the previous quarter, driven mainly by higher trading activity.

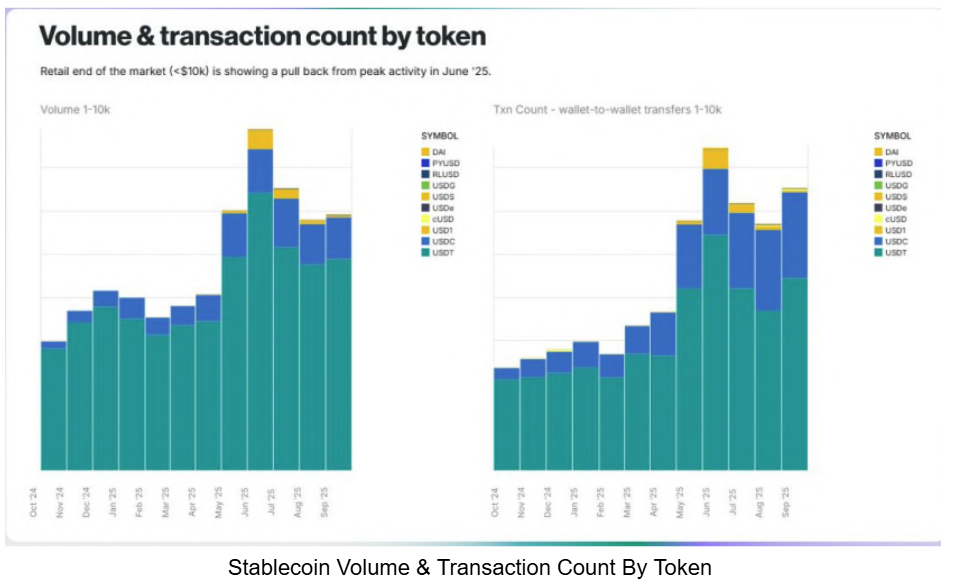

Transaction revenue contributed $1 billion, while subscription and services added $747 million. Stablecoin-related revenue was $355 million. Trading volume grew 38 per cent overall, with US spot volume rising 29 per cent. Net income reached $433 million, supported by strong operational performance.

This article was written by Tareq Sikder at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments