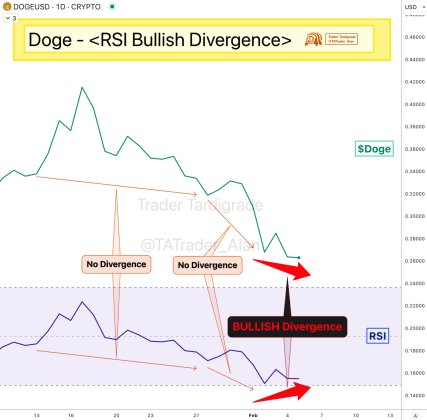

The daily transaction volume on NFT auction site Rarible has dropped significantly since peaking in April 2021 and has not recovered since.

Nonfungible token (NFT) sales tapering off is nothing new, and since their May peak, they have gone down by about 90%. However, as some marketplaces shore up their numbers, NFT auction site Rarible appears to have users flocking away from its platform.

Rarible is one of the most popular sites for buying and selling digital collectibles, and in April, it reached $2.5 million in daily transactions, according to DappRadar. But as the overall cryptocurrency market entered a bearish spell, Rarible’s numbers took a nosedive and have not recovered yet. Data reveals how volumes declined to levels not seen since June 2020.

Rarible appears to have been left in the dust if to compare its performance with its main competitor, OpenSea. There has been a noticeable divergence in Rarible’s and OpenSea’s volumes in the last 12 months. As OpenSea’s daily transaction volume continues to press higher in July, breaching the $10-million mark several times, Rarible’s has been moving in the opposite direction.

Wash trading?

In July of last year, NFT data aggregator Nonfungible.com discontinued listing the market history of Rarible, claiming that the NFT marketplace’s move to enable users to earn RARI tokens, Rarible’s governance tokens, for buying assets fosters wash trading.

According to Nonfungible.com, allowing liquidity mining creates an artificial demand for the platform’s assets. As such, when users are incentivized to make purchases because they can get paid more than what they spend, it creates an illusion of demand for the assets. This is another form of wash trading, says the statement by the data aggregation platform.

Rarible’s “market liquidity mining” was introduced on July 15, 2020, while RARI issuance started on July 19, 2020, and it is during this same period when transactions on Rarible began to pick up. The effects of these were palpable early on, as the price of RARI skyrocketed to $8.42 in September from trading just under a dollar in early July.

Nonfungible.com also claims that most of the assets that were sold for over $1,000 were merely a result of washed trades.

Instances of wash trading may partially explain why transaction volumes have declined for Rarible, especially since more users have become conscious of the underlying incentive structure that favors liquidity mining more than the actual assets and platform. It could be argued that investors and actual collectors find a platform with unreliable statistics to be a huge turnoff.

Download the 27th issue of Cointelegraph Consulting Bi-weekly Newsletter in full, complete with charts, market signals, as well as news and overviews of fundraising events.

Rarible’s countermeasure of blocking addresses of suspected wash traders also does no good to its numbers. Nonfungible.com argued that promoting market liquidity while purging bad actors results in a case of “one step forward, two steps back.”

The best platform for NFT enthusiasts?

As the NFT sector regains ground, headlined by megadeals and rising token prices, an active marketplace with steady and dependable transactions will be invaluable to artists and NFT investors alike.

In this setting, OpenSea’s and Rarible’s volumes once again clash. Erratic changes appear more common with Rarible as it went under -400% several times in one year. Against OpenSea’s steadier numbers, the transactions on Rarible’s platform are somewhat turbulent and may perhaps be less ideal for genuine NFT enthusiasts.

With sales on a slump and users clearing out, Rarible seems less likely to take advantage of the next NFT boom, especially as the competition is tight and new marketplaces bursting into the scene.

Cointelegraph’s Market Insights Newsletter shares our knowledge on the fundamentals that move the digital asset market. The newsletter dives into the latest data on social media sentiment, on-chain metrics and derivatives.

We also review the industry’s most important news, including mergers and acquisitions, changes in the regulatory landscape, and enterprise blockchain integrations. Sign up now to be the first to receive these insights. All past editions of Market Insights are also available on Cointelegraph.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments