In this week’s crypto highlights, we explore the price movements of BTC, FIL, NEO, and KSM. Additionally, this recap includes other notable industry news items that occurred over the last seven days. Without further ado, let’s dive into the latest market developments.

Noteworthy market events

Hong Kong’s regulator proposed rules for crypto platforms

Hong Kong’s Securities and Futures Commission (SFC) published its proposed rules for virtual asset service providers (VASP). According to the proposal, from June 1, 2023 and onward, all centralized crypto platforms operating in Hong Kong, or interacting with local investors, must obtain an SFC license.

The regulator is also seeking input on whether to allow licensed platforms to serve retail investors, and under what investor protection measures these services should be offered.

According to Bloomberg, the Chinese government is providing tacit support to the Hong Kong authorities in their commitment to turn the region into a crypto hub.

Questionable optimism

Once this news dropped, some crypto enthusiasts claimed that “Hong Kong will officially make crypto purchases fully legal for all of its citizens.” This sparked bullish enthusiasm in crypto markets, and is considered a top catalyst behind the recent short-term rally. However, some of the excitement could be due to a misread of the legislation.

While the situation may evolve, for the time being, the VASP framework for licensing exchanges allows them to provide access only to accredited professional investors. Retail investors are currently excluded. In addition, the regulator proposed some demanding regulations for crypto platform compliance, including comprehensive due diligence for listed tokens, and insurance to cover any potential risk.

The SEC suggested changes to qualifying crypto custodians

A five-member panel of the United States Securities Exchange Commission (SEC) has voted 4-1 in favor of a proposal that would, in effect, make it harder for crypto firms to serve as “qualified custodians.” The proposal recommends amendments to the “2009 Custody Rule” that may apply to custodians of “all assets,” including cryptocurrencies.

In order to become a “qualified custodian” under the proposed rules, U.S.-based and offshore firms would need to ensure that all assets — including cryptocurrencies — are properly segregated. Furthermore, these custodians will be required to jump through additional hoops such as annual audits from public accountants, among other transparency measures.

Terraforms Labs was sued by the U.S. regulator

The SEC has filed a lawsuit against Singapore-based Terraform Labs, and its co-founder Do Kwon, for allegedly orchestrating a multibillion-dollar securities fraud using an algorithmic stablecoin. Terraform Labs is the company behind Terra, LUNA, and UST stablecoin development.

The SEC also mentioned mAssets, which are crypto derivatives that mirror the prices of stocks for publicly listed companies. It claims that the company used these as a vehicle to lure investors into the ecosystem.

Delphi Digital’s General Counsel Gabriel Shapiro called the vector chosen by the SEC a “roadmap” for pursuing stablecoins. In turn, Bankless podcast host Ryan Sean Adams expressed a similar sentiment. He noted that the SEC’s victory in this case “can establish a broad precedent for more control over crypto.”

BNB Chain developers published the 2023 roadmap

According to the 2023 roadmap, the team behind BNB Chain development plans to double the blockchain throughput from 2,200, to 5,000 transactions per second. In turn, developers suggested increasing the number of active validators from 29 to 100.

Previously announced solutions based on zero-knowledge (ZK) rollups, parallel EVM, BNB Greenfield, and higher performance nodes are also planned to launch this year. Anticipated ZK rollups include zkBNB, which come in the form of SNARKs. This can help prove the validity of every single transaction in the rollup block.

Parallel EVM is an extension to the EVM that allows it to execute multiple instructions in tandem, which may improve the network performance. BNB Greenfield is dedicated to trading data assets created by users.

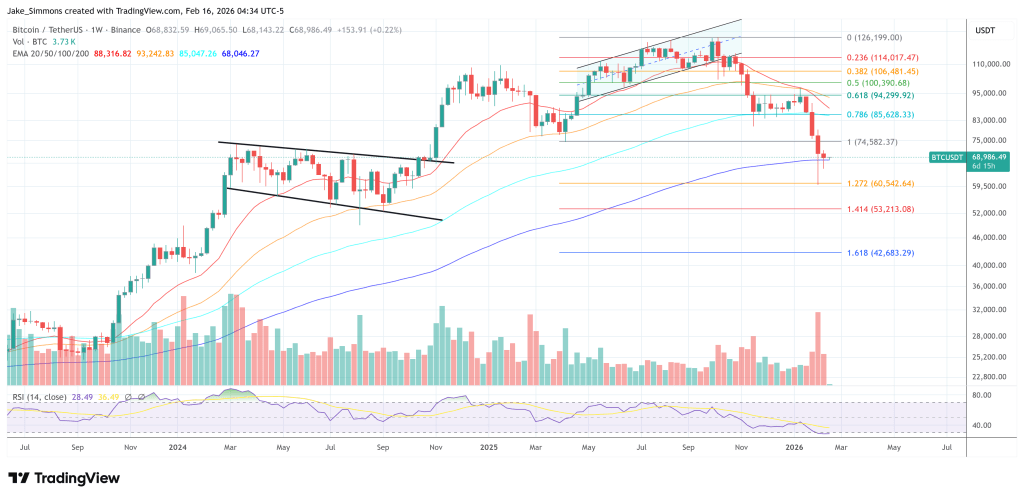

BTC formed a death cross on a weekly chart

While various altcoins enjoyed double-digit gains over the last seven days, Bitcoin struggled to sustain above the $25,000 resistance level. The crypto market cap also consolidated near the $1.1 trillion level, despite the recent altcoin rally. This could be related to the increased Bitcoin dominance in the crypto market, which has the potential to continue its upward momentum. Typically, such market behavior is associated with increased bearish pressure.

The wider stock market also hints that cryptocurrencies may soon experience downward movement. For instance, Morgan Stanley analysts anticipate that the S&P 500 could drop to 3,000, or 25% below the current level, in the first half of 2023.

Correlations between crypto and stock markets are a matter of active discussion among analysts. However, this past Tuesday was one of the worst days for the S&P 500 in 2023. Coincidentally, the BTC price moved from $25,000 to $24,000 on the same day.

Bitcoin’s winter rally didn’t help the asset sustain above 200 WMA (orange line), which acted as a major support level in previous cycles. Furthermore, Bitcoin formed a death cross (blue circle) on a weekly chart, which is typically considered a bearish sign. This suggests that the asset may still have downward potential in the longer term.

Bitcoin’s winter rally didn’t help the asset sustain above 200 WMA (orange line), which acted as a major support level in previous cycles. Furthermore, Bitcoin formed a death cross (blue circle) on a weekly chart, which is typically considered a bearish sign. This suggests that the asset may still have downward potential in the longer term.

As we mentioned in previous weekly highlights, Bitcoin could be in the fifth motive wave with a potential target near the $25,000-$25,800 range. According to the Elliot wave theory, completion of the fifth wave assumes that a deeper correction should follow (ABC figure).

In addition, the asset formed a bearish divergence (white lines) on a daily chart. This also indicates that price correction is coming soon.

However, if the asset manages to break the $25,000-$25,800 range, and move to $30,000 in a short term, this can potentially invalidate the bearish view.

Smart contracts drove FIL to the top gainers club

Filecoin’s native token, FIL, has become one of the top gainers over the last seven days, showing a 50% price increase. A potential catalyst of this rally could be the imminent release of the Filecoin Virtual Machine (FVM).

With this feature, smart contracts will be introduced within the Filecoin network, enabling developers to design decentralized applications. FVM is scheduled to be implemented in March 2023. Anticipating the smart contract appearance, the project held a hackathon, which it labeled the “most successful” in its history.

Such a rapid price movement pushed the asset to the overbought zone on a daily timeframe. This indicates that bullish momentum may temporarily fade away, or could lead to a price correction. The Fibonacci grid hints that the closest support level could be near $7.7 and $6.7.

However, if the asset breaks $9.5, the next potential target for the bulls could be a previous local high near $11.3. The golden cross formation on the daily chart could support bullish momentum.

NEO enjoyed the Chinese coins rally

Rumors that Hong Kong is going to legalize crypto trading for retail investors pushed up digital assets with strong links to China. One of these projects is Neo, which is widely called “Chinese Ethereum.” The price of its native token, NEO, surged by more than 50% in a week.

In addition, the People’s Bank of China (PBOC) recently injected approximately $92 billion into its financial markets. According to Bloomberg, it is the largest single-day liquidity injection. Aside from Chinese coins, local stock indices also experienced positive performance after this event.

Daily RSI indicates that NEO is in the overbought zone, hinting a price correction could occur soon. Previous swing highs, $13.3 and $11.9, may act as potential support levels.

However, daily MACD experienced a bullish crossover and lines widening. This may indicate that bullish momentum may maintain for a short period. The closest resistance level could be near $16.3.

KSM price performance could be related to developers’ activity

According to the market intelligence platform Santiment, Polkadot and its canary network Kusama became the industry’s most active in terms of developer commits on GitHub.

Additionally, on February 21, the Web3 Foundation (W3F) posted an update on the latest Ink! 4.0 release. Ink! is a programming language for smart contracts that is compatible with substrate-built blockchains such as Kusama. Increased interest in Polkadot and Kusama could be a potential catalyst behind a 40% price increase in the latter.

The KSM price moved above the 200-day SMA (cyan line), and tried to test the $44 resistance area. However, a long wick on a daily candlestick means that the asset saw increased bearish pressure above this level.

In turn, Kusama formed a bearish divergence on a daily chart. This could push the asset down to retest the 200-day SMA. If successful, the KSM price can make another attempt to sustain above $44. If failed, the next potential target for the bears could be near $31.3.

Tune in next week, and every week, for the latest CEX.IO crypto highlights. For more information, head over to the Exchange to check current prices, or stop by CEX.IO University to continue expanding your crypto knowledge.

&

Disclaimer: For information purposes only. Not investment or financial advice. Seek professional advice. Digital assets involve risk. Do your own research.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments