While cryptocurrencies are widely known for running on blockchain technology, the Bank of England’s upcoming digital pound, colloquially known as ‘Britcoin’, could end up operating on non-blockchain software. The bank is considering all alternatives as it moves forward with researching the viability and implications of creating a digital pound.

Tom Mutton, who is spearheading the bank’s Central Bank Digital Currency (CBDC) project, highlighted the uncertainty around the choice of technology in a recent podcast interview with Bloomberg.

During a meeting that brought together numerous technologists to discuss potential designs for the digital pound, the consensus seemed elusive. “None of them agreed with each other at any point,” Mutton said, indicating the broad spectrum of opinions and perspectives on the issue.

A Technology Spectrum For Britcoin

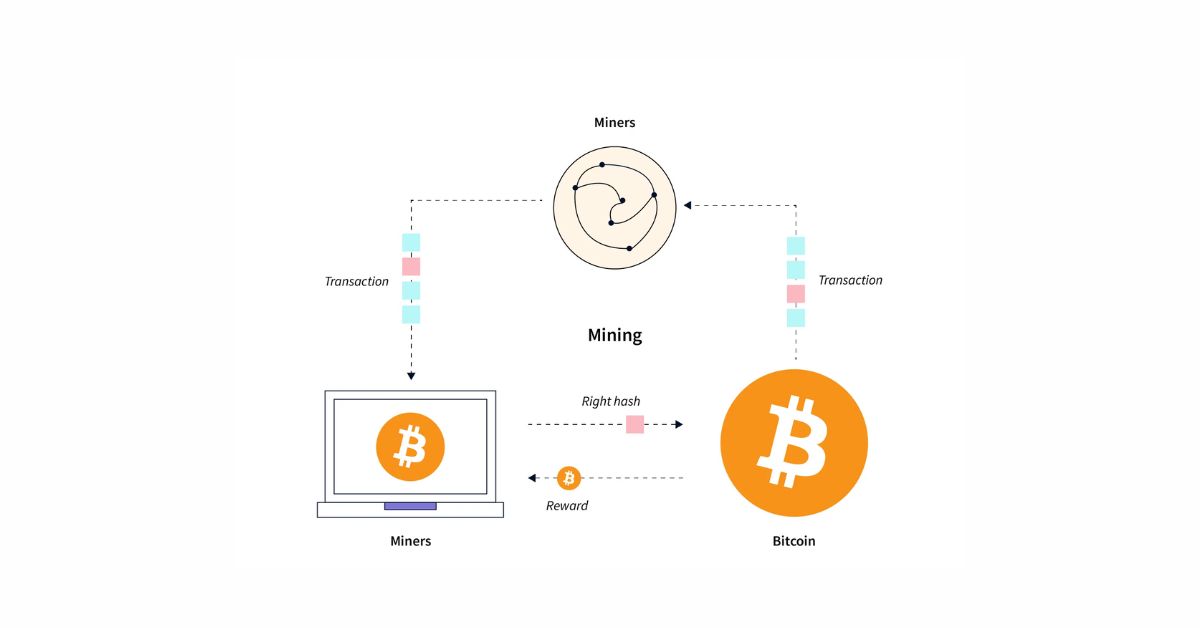

The Bank of England plans to test various ledger types, including public blockchains similar to those supporting cryptocurrencies such as Bitcoin. This wide-ranging approach aims to identify the best possible technological platform for a potential UK CBDC.

Related Reading: Bank Of England, UK Treasury Support ‘Digital Pound’ Project, Say UK Likely To Need CBDC

Currently, more than 100 central banks globally are examining the benefits of digital currencies and the efficiencies they could bring to existing payment systems.

Mutton noted:

We definitely want to be compatible with distributed-ledger business models in the private sector, but we were not convinced that distributed ledgers offered more efficiency over conventional ledgers.

According to Mutton, thus, the bank is keeping its options wide open. Notably, the UK Treasury and the Bank created a joint task force in April 2021 to study a UK CBDC.

Bloomberg revealed a proposal earlier this year that suggested a cap on the number of digital pounds each consumer could hold, aimed at preventing the financial system from bypassing private sector banks.

The Bank is currently seeking responses to its consultation on building a CBDC, with the submission deadline set for June 30. Following the consultation, the Bank expects to spend two to three years evaluating technological and policy requirements before reaching a final decision.

If the CBDC gets the green light, a digital pound could possibly be launched as early as the second half of this decade, according to Bloomberg.

The Future Of The Digital Pound

It is worth noting that the digital pound if launched, would be the Bank of England’s first significant consumer-facing service in a long time. However, it’s unlikely to carry the Bank of England’s branding.

Mutton suggested that digital pounds would primarily be accessible through wallets developed by private sector companies.

Mutton stated:

I‘m not sure that we want people to see this as a Bank of England product. It might be best to see it as something which is a way of paying, which is offered by your private-sector wallet, and you just know it’s very, very safe.

Thus, while blockchain technology has revolutionized the financial world, the Bank of England is demonstrating that it is open to exploring other options.

The final outcome for Britcoin is still uncertain, with the future hinging on technological advancements, expert consensus, and the outcomes of the ongoing consultation.

Regardless of the Bank of England’s implementation of blockchain, the technology has continued to thrive in adoption as cryptocurrencies grow despite regulatory crackdowns.

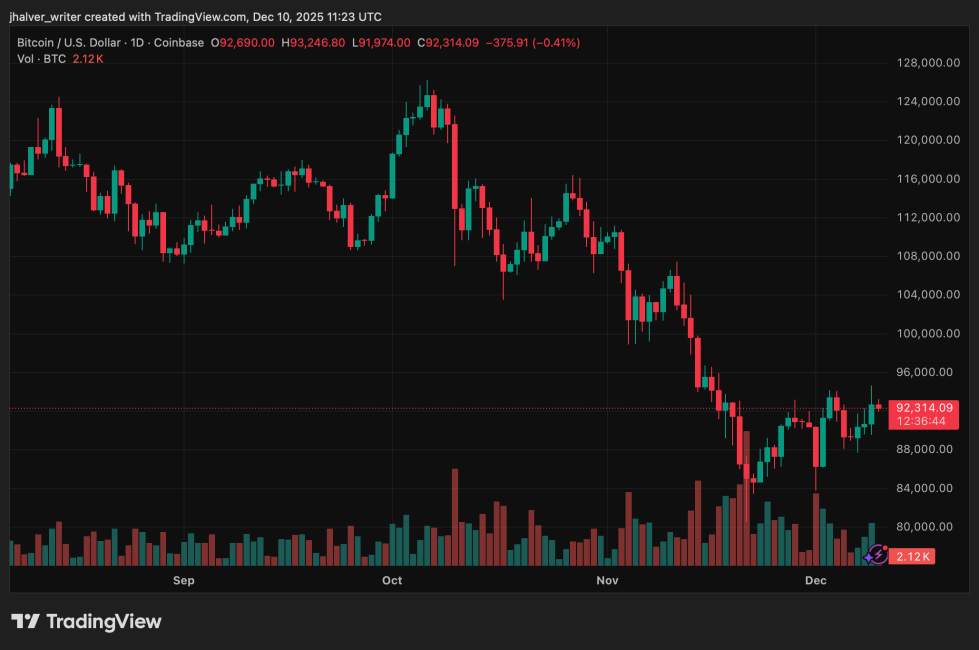

Over the past week, more than $50 billion has been added to the global crypto market with its value currently above $1.2 trillion up by 0.6% in the past 24 hours.

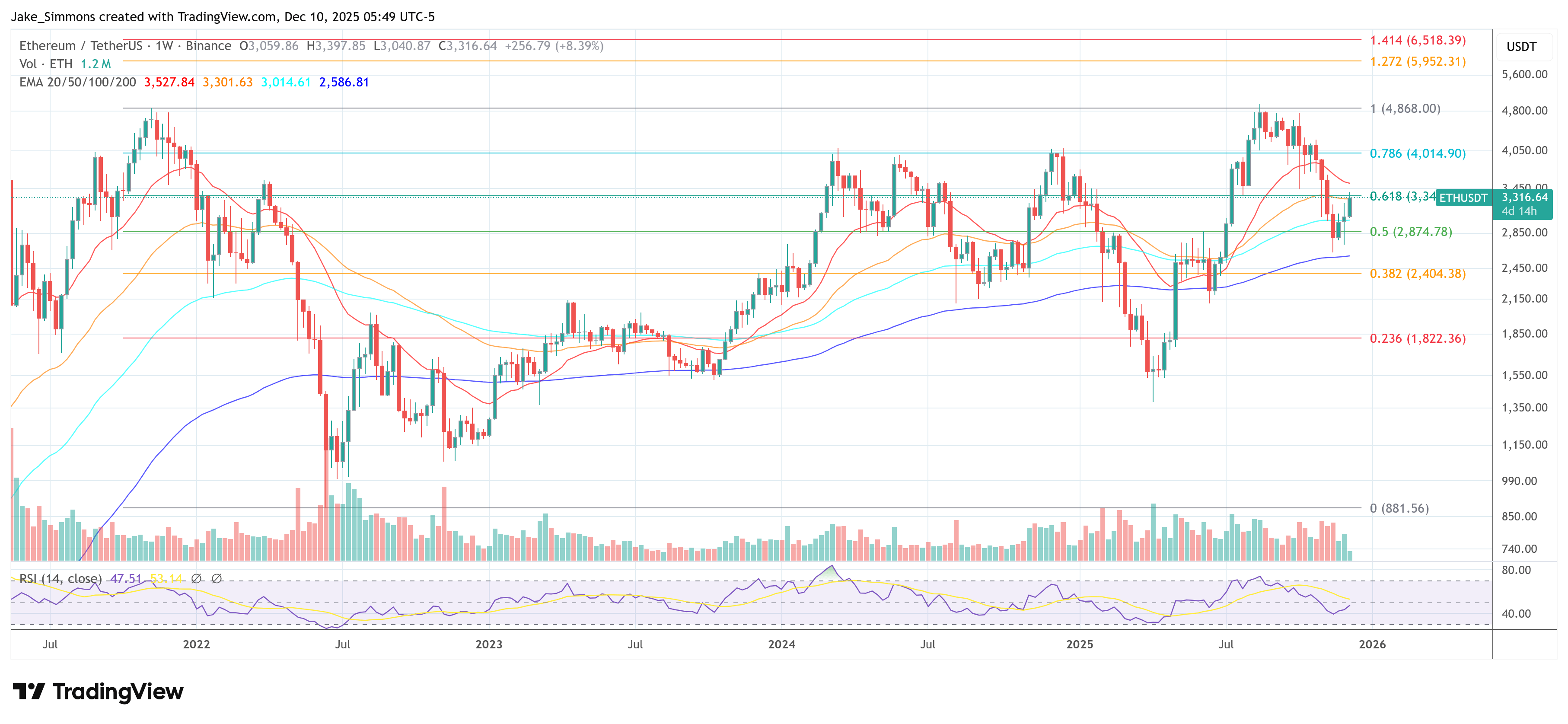

Featured image from Unsplash, Chart from TradingView

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments