4-hour price chart for Ethereum/U.S. Dollar

A. Product Developments

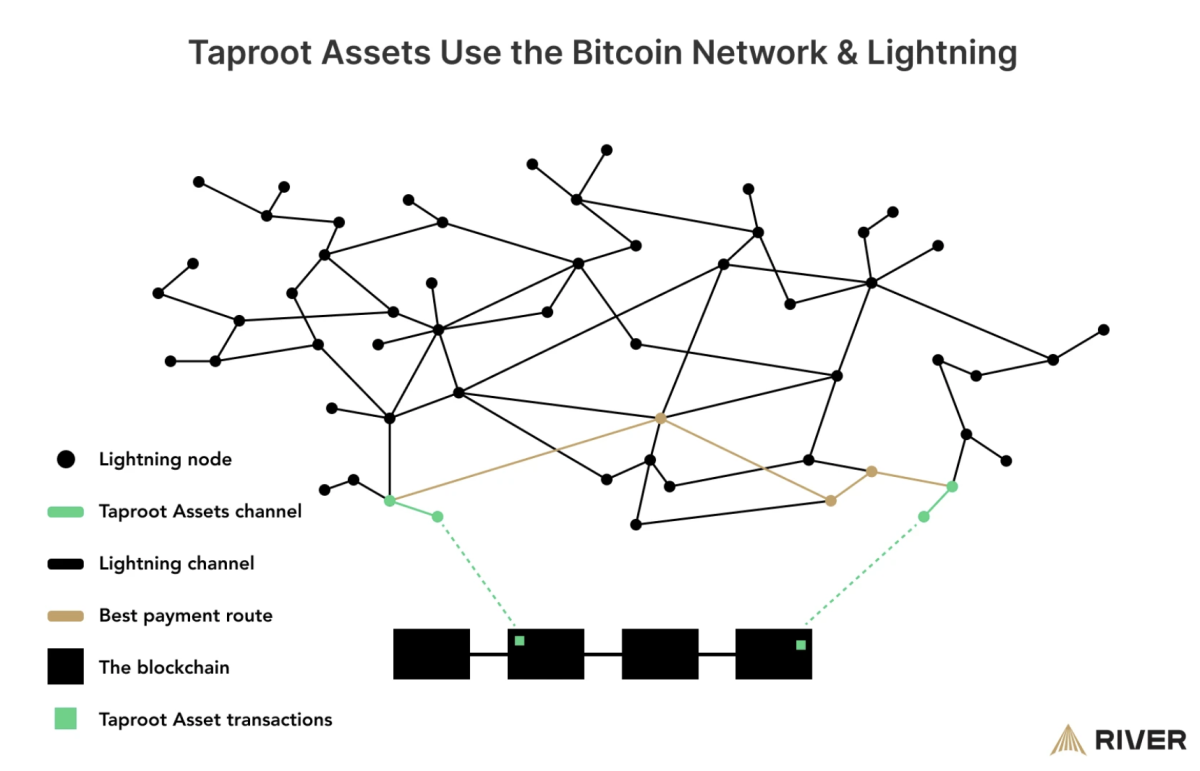

Block Integrates Lightning Payments

Block (formerly known as Square) integrated Lightning payments for Cash App. This move allows Block customers to benefit from the fast and free payments of the Lightning network by directly using their BTC wallet in the app. The integration was made possible by Spiral’s Lightning Development Kit (LDK). LDK is a universal tool that integrates Lightning into BTC wallets which eliminates the need to have separate wallets for Bitcoin and Lightning payments. Jack Dorsey, the CEO of Block and a Lightning Labs investor, had expressed interest in bringing Lightning to Cash App as early as 2019.

B. Regulatory Developments

SEC Rejects Fidelity’s Wise Origin Bitcoin ETF

The US Securities and Exchange Commission (SEC) rejected another spot bitcoin ETF — this time from Fidelity — on January 27. Citing fraud, manipulation, and investor protection in its filing, the SEC continues to use the same precedent to reject another spot ETF. This rejection, and the rationale behind the decision, make it clear that the SEC prefers futures-based ETFs instead of spot ETFs. Some other rejected spot ETFs are Kryptoin’s, VanEck’s, and WisdomTree’s proposals. The SEC also delayed its decision for ETF products from ARK21 Shares and Teucrium just a few days before it rejected Fidelity’s proposal.

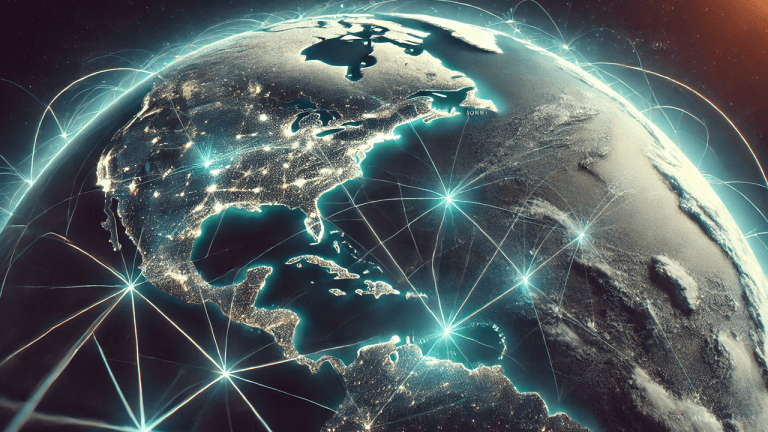

U.S. Politicians Compete Over BTC Adoption

Congressman, senators, and governors, in addition to state legislators, started to roll out their cryptocurrency agendas in the wake of the midterm election season in the USA. Senators across Arizona and Mississippi, competing governors in Texas, and the governor of Colorado have all included Bitcoin in their future legislation plans. Bitcoin and crypto are fast becoming a major topic on which politicians are building their campaigns. This trend should grow as blockchain technology becomes increasingly integral to the lives of all Americans.

Arizona Senator, Wendy Rogers, introduced a bill outlining a path to making Bitcoin legal tender in the south-western state. The bill aims to add Bitcoin to the list of valid tenders in the state, which would enable citizens to use the digital currency to pay debts, public charges, taxes, and other fees.

Mississippi State Senator, and chairman of the Mississippi Senate Finance Committee, Josh Harkins proposed a series of bills that would bring Bitcoin into state code as a viable means of transacting. There are a total of 3 bills proposed by Senator Harkins – SB 2631, SB 2632, and SB 2633.

- SB 2631 – This bill would exempt virtual currencies from the Mississippi Money Transmitter Act, and for related purposes. Under Mississippi law, “a money transmitter license is required for engaging in the sale or issuance of checks or receiving money or monetary value for transmission to a location outside the U.S. or within it by any means, including wire, facsimile or electronic transfer”. Bitcoin, and those who handle it, would be exempt from this language.

- SB 2632 – This bill would create a Digital Assets Act that defines digital assets as property within the Uniform Commercial Code (UCC). SB 2632 would permit security interests in digital assets and initiate an opt-in framework for banks to provide custodial services for digital asset property.

- SB 2633 – This bill would exempt open blockchain tokens from securities laws. Developers or sellers of open blockchain tokens wouldn’t be considered issuers of security and would not be subject to the Mississippi Securities Act of 2010.

On the other hand, competition for the governor elections in Texas is centered around Bitcoin adoption and mining. Texas has the cheapest energy prices in the country, which makes it a haven for Bitcoin mining, and subsequently digital asset ownership. Both the current governor, Greg Abbott, and 2022 candidate, Allen West, look forward to capitalizing on this.

Colorado Governor, Jared Polis, also noted that the state’s plans to move forward with Bitcoin and other cryptocurrencies have not changed. Governor Polis stated, “our plans to allow people to pay taxes in Bitcoin and crypto haven’t changed.” This statement comes despite a near 50% sell-off in the cryptocurrency market.

A. NFT/Metaverse

Microsoft Enters the Metaverse with a Record-breaking Deal

Microsoft has announced that it purchased Activision Blizzard, a game publishing enterprise, for a total of $69 billion. This is by far the highest acquisition in the metaverse world and shows the tech giant’s interest and commitment to this new ecosystem. This acquisition comes only a few months after Microsoft acquired Bethesda for $7.5 billion, which is another major video publisher.

Microsoft’s purchasing Activision Blizzard for $69 billion is not only the largest acquisition in metaverse history but it is also the largest transaction in the entire gaming history. Capturing lucrative gaming IPs will serve Microsoft’s goal to tackle the metaverse as it will now own a rich roster of gaming characters that it can introduce to the metaverse world.

Call of Duty, Candy Crush, World of Warcraft, and Tony Hawk’s Pro-Skater are just a few of the legendary gaming series owned by Activision Blizzard.

Animoca Brands Raised $359 Million of Funding

Animoca Brands, a leading investor in NFT games and the publisher of the Sandbox, has raised nearly $359 million, which values the company at over $5 billion.

The funding round was led by Liberty City Ventures. Many other prominent private equity firms also participated in the funding, which includes Winklevoss Capital, billionaire investor George Soros’ Soros Fund Management, Gemini Frontier Fund, and 10T Holdings.

Animoca Brands succeeded in raising a record level of funds throughout 2021 considering the nascent size of the metaverse industry. First, the company raised nearly $140 million in two tranches announced in May and July. Coinbase Ventures, Samsung Venture Investment Corporation, and zVentures were the main investors in these two tranches.

The firm then raised another $65 million at a valuation of $2.2 billion in October. This smaller round brought several strategic investors onboard such as gaming giant Ubisoft. With this partnership, Animoca Brands seeks to co-develop new NFT games with Ubisoft.

Using the proceeds from the received funds, Animoca Brands has invested in more than 100 NFT startups. Among its investments are Opensea, the largest NFT marketplace (valued at $13.3 billion), Dapper Labs, the developer of NBA Top Shots (valued at $7.6 billion), and Sky Mavis, the publisher of Axie Infinity (valued near $3 billion).

B. DeFi

The Graph Now Supports Moonbeam

Similar to how Google indexes the internet for information related to every search, there are protocols that index blockchains. This improves blockchain data accessibility and makes it easier to obtain data on different blockchains.

The Graph is a decentralized indexing protocol for querying blockchain networks, like Ethereum, and the protocols built on top of them. It offers different methods of storing and tracking information generated from smart contracts to allow other networks or dapps to monitor them.

Moonbeam offers modules that trace the Ethereum blockchain, which enabled integration between The Graph and Moonbeam to index its blockchain data. Now, Graph developers seek to expand to the Polkadot (DOT) ecosystem to build, publish, and use subgraphs in a Polkadot-based environment. This will enhance the transparency of Moonbeam by allowing developers to display network data in their front-end applications for users.

Wonderland and Abracadabra Propose a Merger

A merger between the decentralized asset protocol Wonderland and the lending protocol Abracadabra was proposed on January 26. Each of the protocols exists under the Frog Nation umbrella, which also includes Popsicle Finance and Sushi Swap.

Strong ties between the two protocols have raised the need for a merger. Most notably, Abracadabra’s cauldrons and building strategies, which are used by Abracadabra’s Degenbox, are consistently leveraged by Wonderland. Other synergies between the protocols include liquidity provision, incentive voting on Curve, and degenbox strategies in yield farming via Abracadabra Collateralized Debt Positions (CDPs).

Both Abracadabra and Wonderland are rapidly growing ecosystems. Abracadabra’s total value locked (TVL) had eclipsed $6 billion in January, and Wonderland has grown by nearly 100x since its inception in September 2021. The merger can help further propel each of the protocols and bring a robust product to DeFi users. Abracadabra’s cross-chain capabilities and isolated lending markets, in conjunction with Wonderland’s unique approach to asset treasuries, would unify two facets of DeFi for outsized protocol performance efficiency.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments