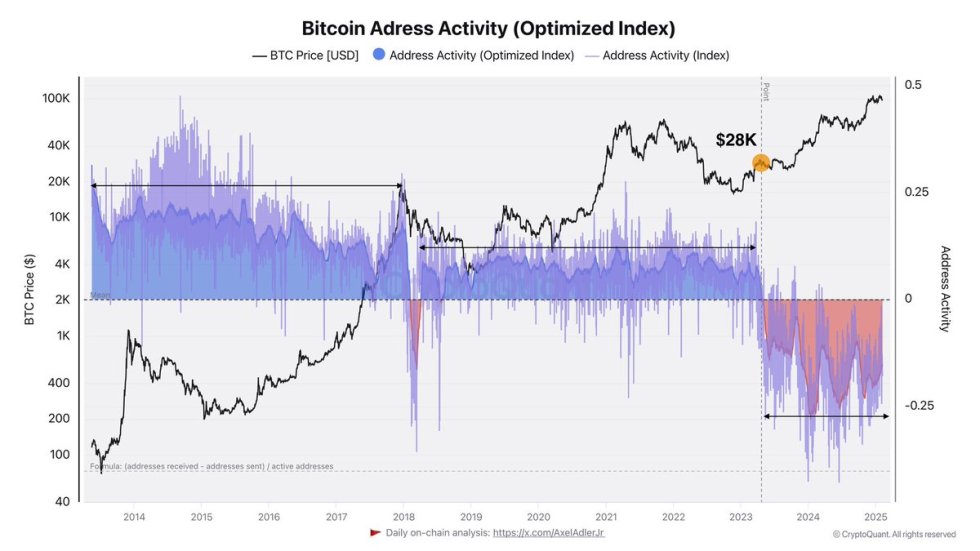

| Many crypto enthusiasts believe that the current growth is fake and illogical. Moreover, both from the point of view of technical analysis and from a fundamental position. I don't agree, from the position of technical analysis, most assets have been in the accumulation stage for many weeks, but another event acted as a driver and catalyst for growth. The same thing that for the majority, again, was a negative factor and an indicator of a falling market. Namely, the sale of Alameda and FTX assets, which was supposed to begin in Autumn, as part of the bankruptcy procedure. They are of greatest interest to companies operating in the market making segment. Again, not only for the purpose of selling immediately after purchase, but to use it directly for direct activities - supplying liquidity. But, of course, the interest in earning money not only from maintaining spreads and bonuses from the exchange isn't the only one; selling these assets will also be profitable. But, it is logical that it will be more profitable WHEN the asset GROWTH, and not when it falls, when trying to drain at catastrophically reduced volumes at key exchanges. Later, even market maker DFW Labs announced his plans for Alameda/FTX assets. Thus, my opinion is that the current growth, of course, is not “organic”; organic growth becomes closer to the end, when retails begins to enter there en masse with purchases. Whereas, most often it is professional market participants and/or large companies with personal interests who provide the impetus for growth. And there are quite a lot of them, from the same Bitmain, which recently presented a new model of Asic miner, and has a direct interest in the growth of BTC, to just those same contenders for the assets of FTX/Alameda. And, if you look at the current Gainers, they are all somehow connected either with DWF or are on the list of FTX/Alameda assets. According to my rough estimates, given that bankruptcy trustees are allowed by the court to sell assets worth around $100-200 million per week, the current holiday may last until approximately the halving. During gradual growth, assets will be sold carefully, in batches, the profit from the initial sale of which will go into a fund to compensate creditors. The current rush to get BTC spot ETF applications approved is a supportive factor, as it was in the fall of 2021. The gradually increasing capitalization of stablecoins also indirectly indicates that “new” money is still entering the market, no matter what its nature. If my assumptions are correct, then there is a certain irony in the situation, it was the collapse of FTX that served as the reason for stopping growth in the fall of 2022 (and an excellent repurchase option for interested parties), and it is they who now serve as the reason for this very “fake” growth, which is precisely in fact, it can become real, because there are professionals in the business, and it is beneficial to a fairly large circle of people. What do you think about this growth? [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments