The Crypto-friendly Custodia bank, founded by Caitlin Long, a well-known figure in the crypto industry, has been denied its application to come under the supervision of the U.S. Federal Reserve (Fed), according to an official announcement.

The Board had previously announced the denial of the application. Still, the announcement confirmed that the order outlining the decision was not immediately available due to the need to review it for confidential information.

Fed’s Decision Based On Custodia’s Ties With Crypto?

The order of the Federal Reserve Board notes “concerns” about Custodia Bank’s proposed business plans, which focus entirely on the crypto sector. The Board believes that banks with business plans focused on a narrow sector of the economy may pose heightened risks, as they may be more “susceptible” to economic or regulatory challenges.

Furthermore, the recently released denial by the Fed notes that the Board’s concerns are further elevated concerning Custodia Bank. The financial institution believes that the crypto-friendly bank is an “uninsured depository institution,” not backed by the Federal Deposit Insurance Corporation (FDIC), and may pose greater risks to depositors and the overall financial system.

In addition, according to the released Fed’s denial of the crypto-friendly bank, the Custodia Bank proposed the issuance of Avits, which are dollar-denominated tokens designed to function as a programmable “electronic negotiable instrument” and as deposits for purposes of federal banking law.

According to the press release by the Fed, they note that Custodia Bank does not refer to Avits as “stablecoins” but that they would likely function similarly to stablecoins like Tether USDT and USDC.

This proposed issuance of Avits by Custodia Bank may have been seen as a potential risk by the Fed, given the concerns around stablecoins and their potential use for “illicit purposes.”

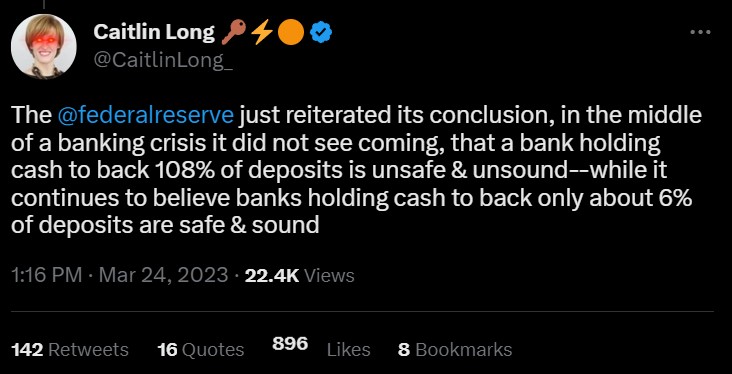

Custodia Bank’s Response To The FedAfter the reiterated conclusion by the Fed, Custodia Bank emitted its response. The financial institution and its founder Caitlin Long made several claims about the need for fully solvent banks and the Federal Reserve’s handling of bank-run risks and the crypto industry.

Custodia Bank proposed a model that would hold $1.08 in cash to back every dollar customers deposit, which may be seen as a more conservative and risk-averse approach to banking.

Custodia Bank’s statement also highlights that there is a dire need for fully solvent banks that are equipped to serve “fast-changing” industries in an era of rapidly improving technology, referring to the need for banks that can adapt to the demand and changes of customers in industries like fintech and the crypto-asset.

The statement by Custodia Bank also suggests that Custodia has not been intimidated by what it perceives as coordinated “attacks” and press leaks of confidential information by the Fed.

The notice also suggests that the recently released order denying Custodia Bank’s application for membership in the Federal Reserve System resulted from numerous procedural “abnormalities, factual inaccuracies, and a general bias against the crypto industry.”

Additionally, the claims by the Custodia Bank suggest that the bank may need to turn to the courts to vindicate its rights and compel the Fed to “comply with the law” in response to the denial of its application for membership in the Federal Reserve System.

Featured image from Unsplash, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments