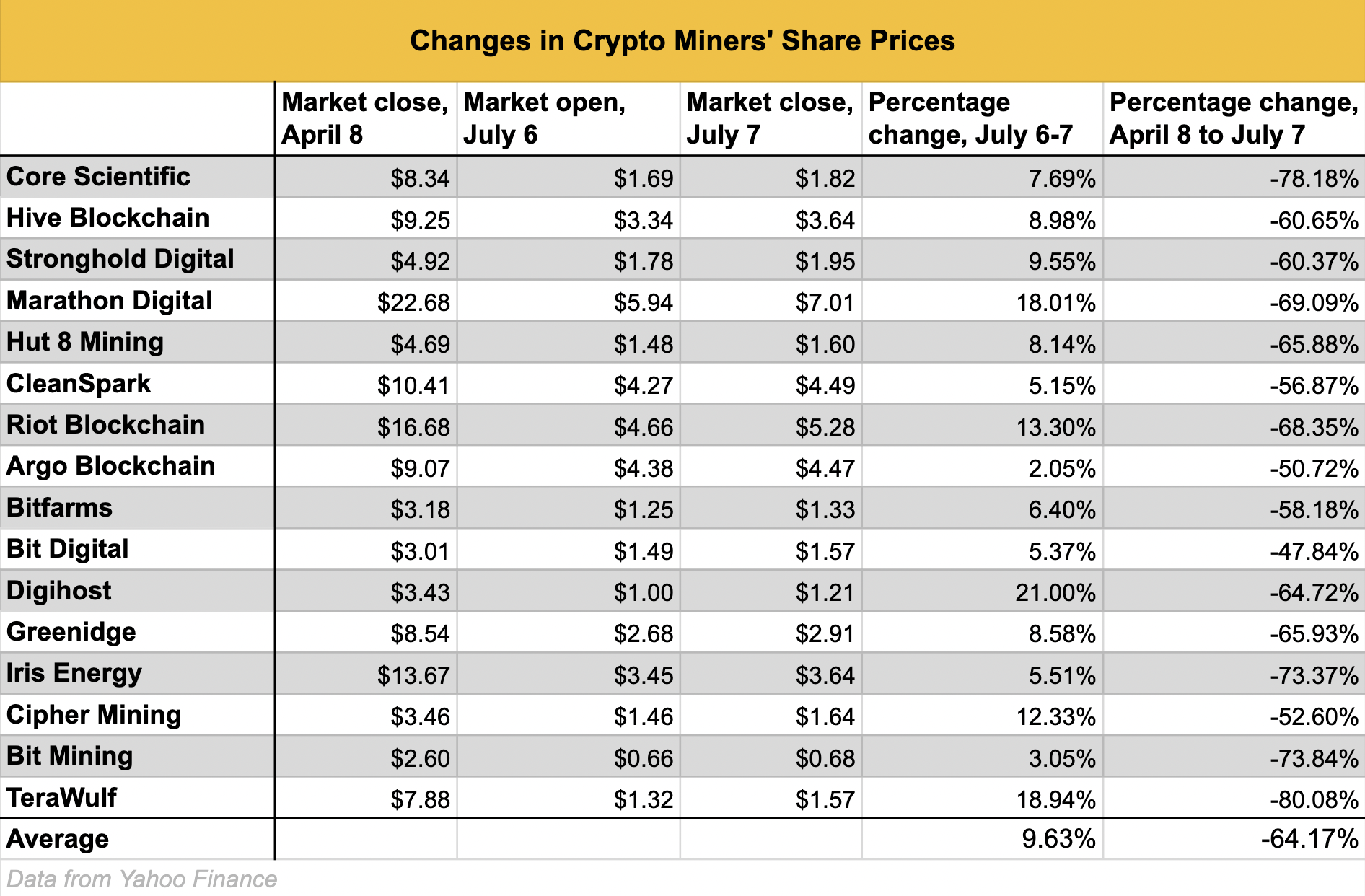

Crypto miners' share prices were up 9.6% between Wednesday and Thursday as bitcoin showed signs of a steady recovery, breaking over the $21,000 mark.

Investors were likely uncertain about how listed miners would react to the bear market, but feel more confident seeing the price of the world's largest cryptocurrency by market cap stabilize, Jaran Mellerud, a researcher at Oslo, Norway-based Arcane Research, said.

Digihost Technology, TeraWulf and Marathon Digital led the pack with 26.6%, 18.94% and 17.62% increases respectively from Wednesday's open to Thursday's close. TeraWulf's run came as the company announced on Tuesday that it had added $50 million to a $123.5 million loan signed with Wilmington Trust to continue its growth.

Miners saw gains of 9.6% between market open on Wednesday and market close on Thursday, but they have a long way to go to recoup the 64.2% in losses they have suffered in the last two months. (Eliza Gkritsi/CoinDesk)

"It's possible some people are making the bet" that if bitcoin isn't declining to $18,000, "then this may be an attractive time to start accumulating some of the miners," which are still profitable, said Joseph Vafi, managing director of equities research at investment bank Canaccord Genuity, which covers Argo Blockchain, Iris Energy and Hut 8 Mining.

At the same time, many miners "are still growing their exahash (a measurement of computing power on the Bitcoin network) pretty nicely this year," Vafi said.

Investment bank D.A. Davidson last week slashed its expectation for computing power growth for the rest of the year to include only "current, funded orders," according to a note from senior research analyst Christopher Brendler. However, that still represents a 37% hashrate increase for last three quarters of 2022 for the five miners that Brendler analyzed, including Argo Blockchain, Hut 8 Mining, Core Scientific and Riot Blockchain.

At the same time, the difficulty of mining bitcoin has decreased by about 6.7% since May 22 as miners unplugged unprofitable machines, according to data from information platform Blockchain.com. This makes it easier for the miners left standing to mine bitcoin and bring in revenue.

"Many of these stocks are very undervalued compared to their assets and cash flows," Mellerud said. D.A. Davidson said in last week's note that the risk-to-reward ratio of miners' stocks is better than markets have priced in.

The 15 publicly listed miners CoinDesk analyzed have lost on average of 64% of their stock value in the past two months.

"The stocks are just moving a little bit with bitcoin coming off of a bottom, honestly," Canaccord Genuity's Vafi said, adding that the stock market has also firmed up over the last few days.

Many miners are facing margin calls on debt as the price of their collateral, mostly bitcoin and mining rigs, has decreased, and so they are selling their bitcoin holdings to continue paying their bills.

Vafi said he is "not particularly concerned that leverage becomes a large issue" because miners are still profitable, and so they can keep servicing their loan installments. They can also continue selling bitcoin, he said. One possible negative aspect is that their growth will be constrained if they have trouble raising more capital, he said.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments