Key Takeaways

- Crypto prices are rising sharply, with Bitcoin up 20% in the last three weeks

- The filing of a number of high-profile Bitcoin ETFs has pushed optimism in the market

- Under the hood, liquidity remains low and some worrisome trends emerge, however

- The regulatory woes are still present, with Coinbase and Binance facing a murky future

- The macro picture also remains uncertain, with the prospect of a lagged impact via tightening monetary policy looming large

It wouldn’t be like crypto markets to get overly excited. In the past couple of weeks, positivity has returned to the space, led by the seminal filings for a Bitcoin spot ETF by two of the world’s biggest asset managers, Blackrock and Fidelity.&

Additionally, Fidelity were among a cohort of large trad-fi operators, including Schwab and Citadel Securities, to back the new exchange EDX, which offers trading for Bitcoin, Ether, Litecoin and Bitcoin Cash.&

Bitcoin is up 20% in the last three weeks, breaching past the $30,000 mark, while Ether is up 16% in the same timeframe, approaching the $2,000 mark once more. A glance at the Fear and Greed index, an interesting metric which gauges overall sentiment in the space, shows it is markedly in the “greed” sector with a score of 61 (0 represents extreme fear, 100 represents extreme greed).&

And yet, a look under the hood betrays some concern. Firstly, if the filing of the ETFs is the reason for the recent ramp, as it appears to be, is a 20% jump justified? The SEC has declared the recent filings as “inadequate”, according to the WSJ, informing the Nasdaq and CBOE (who filed the paperwork on behalf of the asset managers) that there is not enough detail with respect to “surveillance-sharing agreements”. The SEC had previously said that sponsors of a Bitcoin trust are required to enter into a surveillance-sharing agreement with a regulated market of significant size.

And yet, a look under the hood betrays some concern. Firstly, if the filing of the ETFs is the reason for the recent ramp, as it appears to be, is a 20% jump justified? The SEC has declared the recent filings as “inadequate”, according to the WSJ, informing the Nasdaq and CBOE (who filed the paperwork on behalf of the asset managers) that there is not enough detail with respect to “surveillance-sharing agreements”. The SEC had previously said that sponsors of a Bitcoin trust are required to enter into a surveillance-sharing agreement with a regulated market of significant size.

While the applications can be updated and refiled (and the CBOE did indeed refile theirs since, with Nasdaq likely soon to follow) the development hints at how difficult it has been to get the much-coveted spot ETF over the line. There is no guarantee that these are approved, despite the big names involved &- the SEC even rejected an application from Fidelity in the past, turning it away in January 2022.&

In truth, it feels inevitable that Bitcoin spot ETFs will one day be traded freely, but a 20% jump on a mere filing in the last couple of weeks is a massive ramp when considering what else has happened in the space, and the state of markets, which we will delve into now.&

Liquidity

Liquidity continues to lag, a factor which cannot be overstated &- and indeed one which the eventual approval of spot ETFs should help.

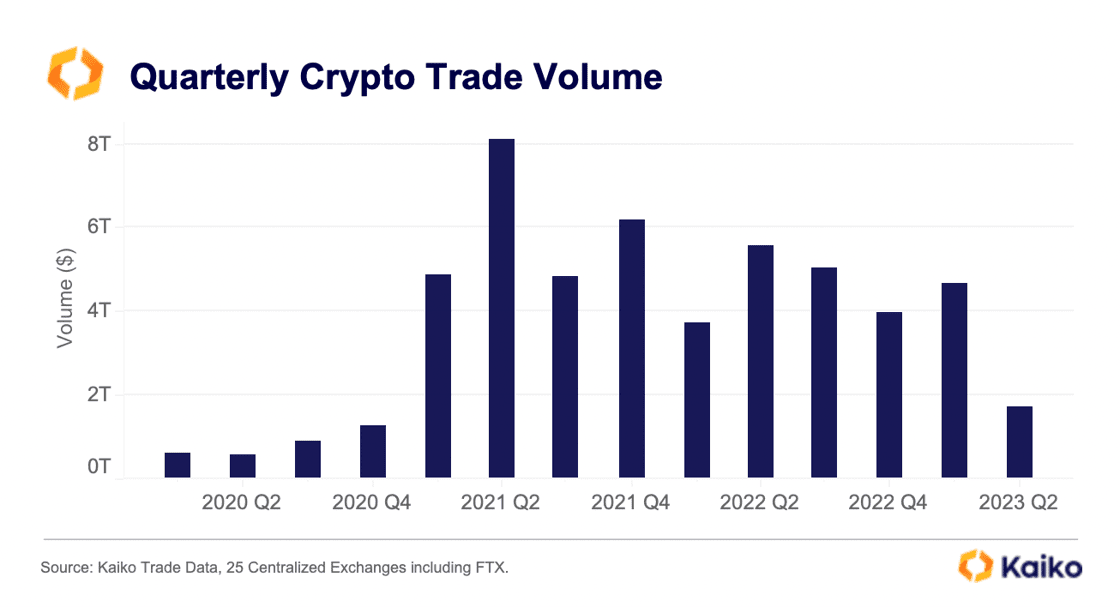

Looking at centralised exchanges per data from Kaiko as we close out the second quarter of 2023, volume over the past three months was lower again, coming in at the lowest number since 2020, before Bitcoin and crypto embarked on their inexorable price rises and took the financial world by storm.&

But with lower liquidity, moves to both the upside and downside are exacerbated. This has perhaps contributed to Bitcoin’s steep rise in the past few weeks, and also year-to-date, with it currently up 83%.&

But liquidity and volumes being so low should be alarming for market participants. Much of the inroads made during the pandemic, with regard to Bitcoin taking its place next to bona-fide asset classes from a trading perspective, have slowed if not reversed &- at least from a liquidity perspective.&

As further evidence of this, in the below chart, I’ve presented the total balance of stablecoins across exchanges, which has fallen a staggering 60% in the past six months &- an outflow of $26 billion.&

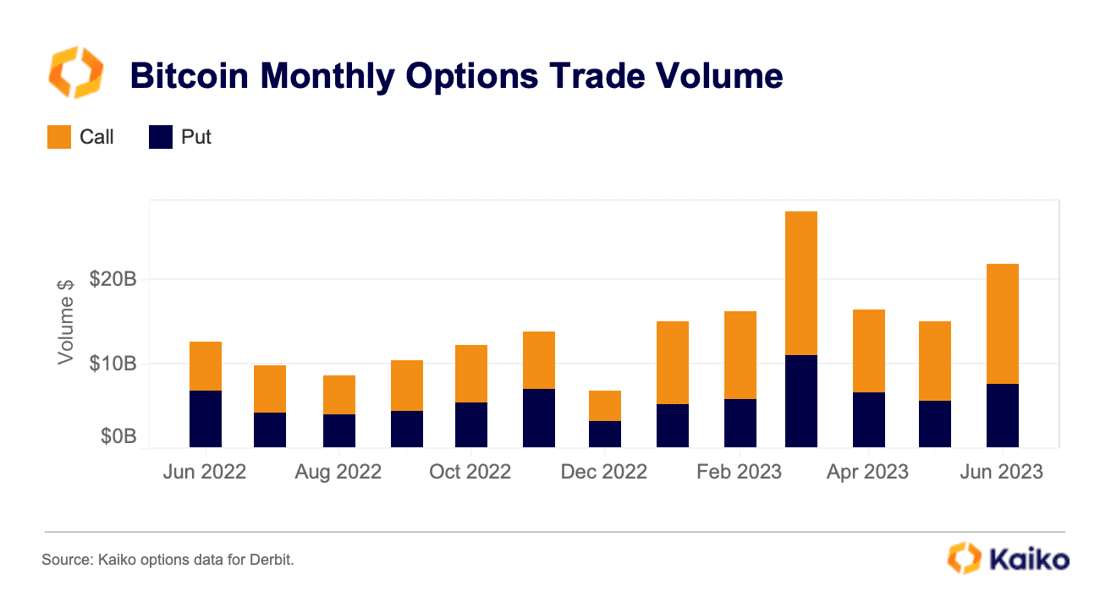

Having said that, there are pockets of optimism which hint at a brighter future if/when these spot ETFs do get approved. Looking at volume in derivatives markets, it has been rather consistent. In fact, it is markedly up on the second half of 2022. Perhaps this means the spot market has been greater affected by the regulatory crackdown. Either way, it’s a less gruesome picture than what we are seeing in spot markets.&

Regulation

Right now, with regard to crypto-specific risk, it really all comes back to regulation. We have discussed the ETF filings, but June also brought two seminal moments: formal charges brought against Coinbase and Binance.&

The two cases are extremely different, mind you. Binance’s lawsuit could not be less surprising, with the exchange constantly skirting guidelines and laws. The charges amount to a laundry list of different offences, including trading against customers, manipulating trade volume, encouraging users to circumvent geographical restrictions and securities violations.&

It is the latter charge which is the centre of the suit against Coinbase, however, and the most pivotal of the lot. It is also why the Coinbase suit is far more intriguing. Do not forget that the allegations are coming from the SEC, the same body which presided over Coinbase’s IPO in April 2021. Why did the SEC let an unregistered securities exchange float on a US stock exchange? You tell me.&

But let’s get back to the point: what this all means for crypto markets. While Bitcoin appears to be carving its own place out in the eyes of the law, a slew of other tokens were named as securities by the SEC. Despite this, they have risen sharply since off the Bitcoin ETF news. Does this make sense?&

Conclusion

At the end of the day, crypto is going to crypto. Prices move, and trying to pinpoint reasons is often a fool’s errand. The last month, however, feels like we have seen an extremely aggressive price rise despite some bad news on the regulatory front.&

Additionally, the macro picture has not changed much, even with the pause at the last Fed meeting. Fed chair Jerome Powell’s comments made it clear that this was a pause rather than an about-turn in policy.&

“Looking ahead, nearly all committee participants view it as likely that some further rate increases will be appropriate this year,” Powell said when announcing the pause.&

The market believes him. I backed out probabilities from Fed futures in the next chart, which show that there is currently an 86% chance of a 25 bps hike at the next Fed meeting in three weeks time, with only a 14% chance of rates being left unchanged again. I have presented this next to the same probabilities conveyed by the market exactly a month ago (Bitcoin is up 20% in the time since), showing softer forecasts do not explain the sharp price (the chance of no hike has actually come down).&

As I said, crypto going to crypto. But with assets as notoriously volatile as what we see in this sector, it would be wise to stop and think about whether the sudden wave of positivity is justified. When considering the liquidity picture and the regulatory trouble, there are plenty of reasons to hesitate.&

Then when one layers in the macro picture, the picture becomes murkier again. Let us not forget that we are in the midst of one of the swiftest rate hiking cycles in modern history, with rates rising all the way from zero to above 5%, and the prospect of them rising even further later this month.&

Monetary policy operates with a lag, and the scale of that tightening is enormous. Sentiment may feel like it has flipped dramatically, but there is a long road ahead yet.&

The post Crypto prices rising and sentiment flipping but liquidity & macro picture are ominous appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments