The global economic downturn should not have a long-term negative effect on cryptocurrency prices, even if it is influencing crypto in the short term.

It’s been a tough year for risk assets across the board, and it’s fair to blame the macroeconomic situation. A combination of factors has ignited a surge of inflation in developed economies and forced central bankers to react.

As a consequence, several events — including inflation, payrolls, interest rate announcements, and speeches from monetary authorities (especially in the United States) — have had a relevant impact on the risk asset prices globally. As bad news prevailed, the turmoil spread across different asset classes and regions. By mid-September, all the main stock indexes from developed countries recorded double-digit negative returns (year to date, currency adjusted).

In these turbulent waters, crypto assets were severely harmed. The Nasdaq Crypto Index (NCI), which represents the performance of the most relevant crypto assets, had dropped 52.3% (year to date) by Sept. 12. During this crisis, crypto also exhibited an unprecedented high correlation with traditionally risky assets, notably stock in tech companies, which comprised one of the most heavily damaged sectors. Under these circumstances, it is worth questioning whether or not the crypto winter is a result of a macro scenario. Let’s see what the data can tell us.

Related: The market isn’t surging anytime soon — So get used to dark times

We fitted a simple regression model to understand how macro shocks impact the NCI returns. We used the Nasdaq 100 (NDX) returns, which are highly correlated to crypto, as a proxy variable for changes in the macro landscape. Our data-driven approach also indicated two outlier dates that demanded special treatment, but we will explore this later on. Using daily returns from March 1 to Sept. 12, the estimation indicates that, for a 1% variation in the NDX, one should expect 1.27% variation in the NCI. Considering that the NDX had dropped 21.9% by Sept. 12, we can infer that 27.0% of the NCI’s negative return was directly caused by the macroeconomic situation. This is definitely a substantial amount, but there is still a 34.6% drop to be explained. Can we declare macro “not guilty” for this residual drawback? The model gives us some clues.

The two outlier dates were identified purely by data-driven criteria. But, taking a closer look, there is some meaningful storytelling around these dates. The first date is May 9, which coincides with the collapse of Terra (an algorithmic stablecoin ecosystem), and the second is June 13, the very same day when Celsius, the then-leading centralized crypto lending platform, halted withdrawals. According to the model, these two days are responsible for a 22.4% drop, and the latter accounts for two-thirds of the drop.

Both Terra and Celsius are examples of classic economic disasters: a currency crisis and the bankruptcy of overleveraged agents, respectively. These situations usually occur when risk aversion rises (exactly what happens during major and widespread crises). A famous quote attributed to Warren Buffett fits pretty well in describing this idea: “You don’t find out who’s been swimming naked until the tide goes out.” Although it is not fair to put all the blame on the macro environment for these events, it is hard to believe that it didn’t play a key role in accelerating the deadly spirals and amplifying the spillover effect across the rest of the crypto ecosystem. It would be fair to classify these two cases as macro-boosted crypto-specific events (what a fancy name).

After removing the effect of the two outlier dates, we land on a negative return of 15.5%, which can be labeled as pure crypto performance. Well, if you call it a winter, you probably live quite near the Equator line. The chart below shows the alternative trajectories implied by the model:

All of these statistical gymnastics are great, but what does it mean for investors who have witnessed half of the market meltdown? First, in spite of the high correlation, the links between the current macro situation and the future possibilities of crypto and blockchain technologies are extremely weak. There is no reason to believe that this crisis will have an impact on the long-term outcome of crypto investments.

Second, the macro-boosted crypto-specific events that have had a substantial impact on prices were purely technical and had no effect on the foundations of the investment thesis. It is reasonable to expect that their impact will be reversed in the medium term.

Related: What will the cryptocurrency market look like in 2027? Here are 5 predictions

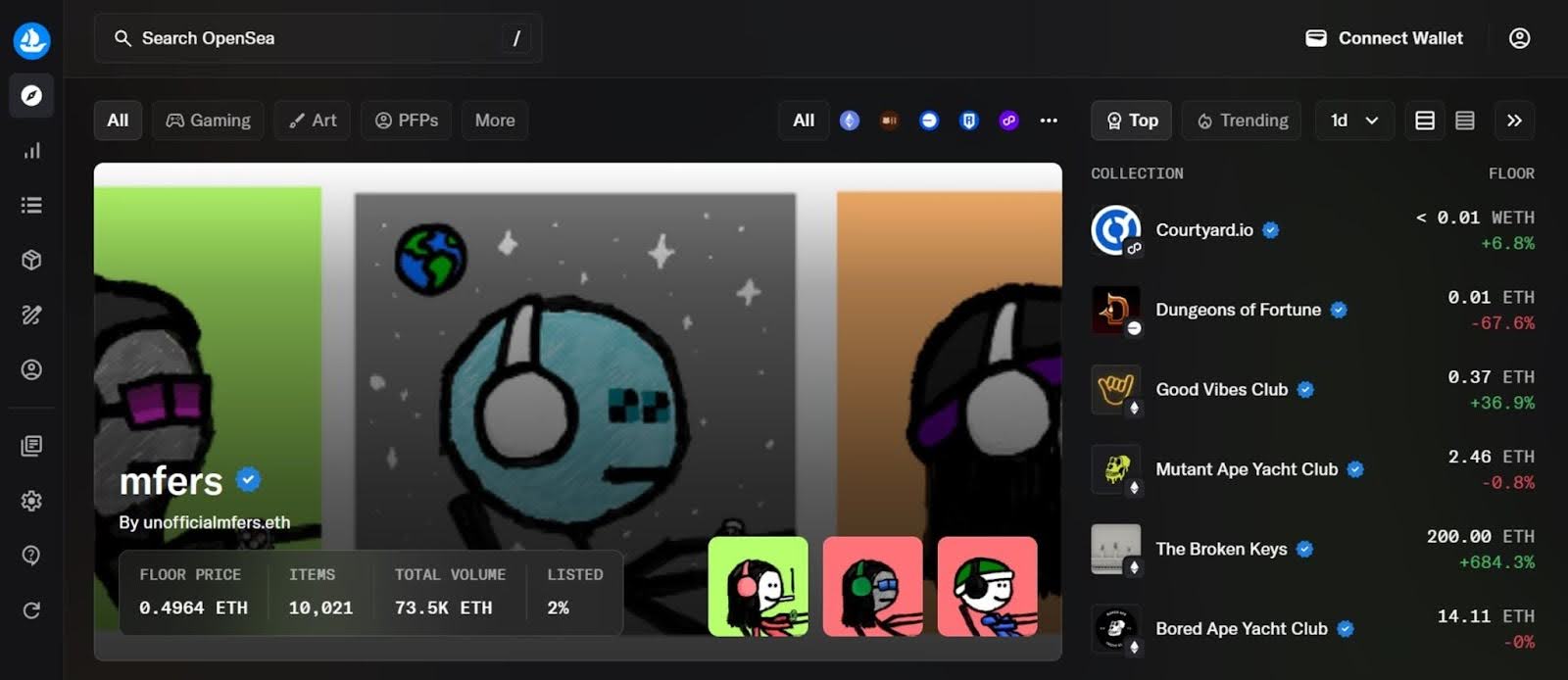

Third, the crypto ecosystem is all right. The crisis washed away some bad actors and ill-designed projects, but all the pillars are standing intact. Decentralized finance (DeFi) protocols worked as expected. Ethereum just finished the most relevant update in crypto history. Second-layer solutions are evolving. There is growing adoption of nonfungible tokens (NFTs) and other forms of digital culture, and so on.

Crypto’s downturn is not all about macro. But, it is likely that we would be in a comfortable autumn if it wasn’t for the crisis. And, why should we be skeptical about the possibility of a crypto summer after the macro turmoil recedes? It’s been said: “To appreciate the beauty of a snowflake, it is necessary to stand out in the cold.” To get tanned in the crypto summer, you must be exposed.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments