As bitcoin is coasting along under the $20K region, the network’s hashrate is still riding high at 250.04 exahash per second (EH/s) following the all-time high (ATH) the hashrate tapped on October 5. At the time of writing, the current speed at which blocks are processed is faster than the typical ten-minute average block intervals between the current block height (757,531) and the last difficulty adjustment. Statistics show that because block times have been much faster, the network could see the largest difficulty increase this year, as estimates show a possible jump between 9% to 13.2% higher.

Block Times and Hashrate Suggest a Notable Bitcoin Mining Difficulty Increase in the Cards

Bitcoin mining is looking to become a whole lot more difficult on the next retarget date which will occur on October 10, 2022. Two days ago, on October 5, the network’s total hashrate reached an ATH at 321 EH/s at block height 757,214. While the price of BTC is lower and the difficulty is near the last ATH, miners are relentlessly dedicating computational power to the BTC chain. At the moment, the hashrate is coasting along at 250 EH/s after the ATH was reached on Wednesday.

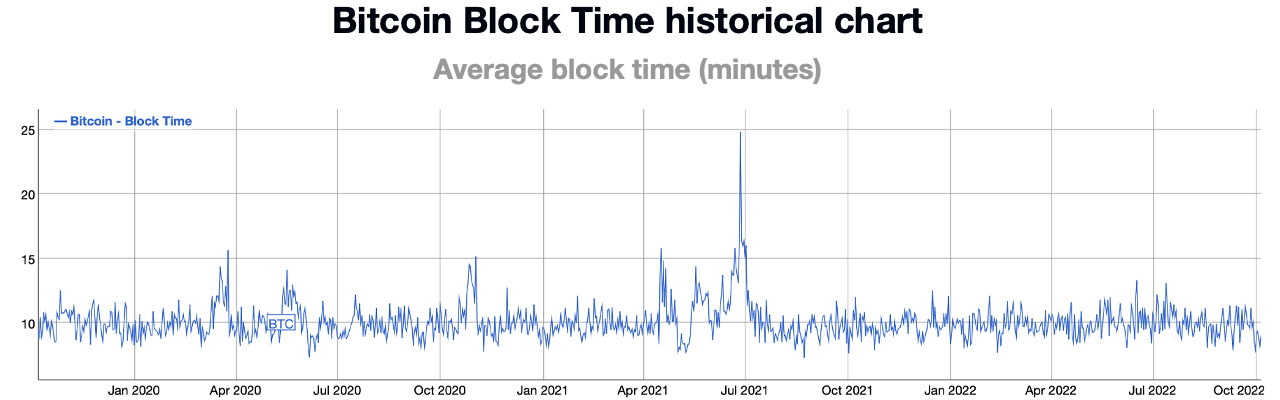

Currently, block times (the interval between each block mined) are faster than the ten-minute average, bitinfocharts.com data shows. Presently, at 9:00 a.m. (ET), metrics show block times are around 9:05 minutes but other dashboards show a much faster rate at 8:49 minutes. With the average bitcoin block interval between the current height (757,471) and the last difficulty epoch (756,000) at 8:49 minutes, it means BTC’s network difficulty is due for a notable rise. There’s a chance that the difficulty jump on October 10 could be the network’s highest difficulty rise this year.

Data from btc.com shows an increase of around 9.34%, which would surpass the network’s second-largest increase in 2022. If btc.com’s estimate is correct, BTC’s network difficulty will rise from 31.36 trillion to 34.29 trillion. Metrics from Clark Moody’s Bitcoin dashboard show the difficulty change could be a lot higher and at the time of writing, Moody’s dashboard indicates it could be around 13.2% higher than it is today. The Bitcoin network has roughly 400+ blocks to go until the next retarget.

It’s quite possible the hashrate will slow and block times increase back to the ten-minute range. If so the difficulty’s percentage increase could be a lot lower than even Btc.com’s 9% increase estimate. Every two weeks or when 2,016 blocks are discovered, the network’s difficulty adjusts to make it either harder or easier to find a BTC block depending on how fast the 2,016 blocks were discovered.

If the 2,016 blocks were found too fast, the network’s algorithm adjusts the difficulty higher and if the blocks are found at a much slower pace, the difficulty rating can decline. The last significantly large difficulty reduction took place on July 3, 2021, when the difficulty dropped by 27.94% at block height 689,472. That means it was 27% easier to find a BTC block subsidy than it was prior to block 689,472.

What do you think about the possibility that Bitcoin’s mining difficulty may see the largest jump this year? Let us know what you think about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments