The cryptocurrency market has started 2023 on a positive note, rebounding to pre-FTX crash levels and witnessing a surge in Bitcoin prices, almost reaching June 2022 levels. With a resurgence of investment activity in Web3 and a surge in token sales, the market seems to have overcome the challenges of the past year.&

Q1 2023 faced some challenges primarily from the traditional financial sector rather than within the crypto market. In fact, the banking crisis has further bolstered the adoption of Bitcoin among investors, highlighting its ability to weather financial uncertainty.&

As the world grapples with global financial market uncertainty, it remains yet to be seen how the crypto market will perform. However, it's increasingly clear that cryptocurrencies like Bitcoin offer a viable alternative to traditional finance systems.

This report will delve into the Q1 performance of DeFi in 2023 and provide insights into its future potential.&

So, let's dive in and explore the crypto ecosystem's exciting developments!

Key Takeaways

- DeFi's TVL growth continues, reaching an impressive $83.3 billion. Lido Finance is now the largest DeFi protocol, indicating a growing demand for LPPs.

- Cardano's DeFi TVL experienced a remarkable 172% surge, while its native coin, ADA, recorded a significant price gain of 54%.

- The ARB airdrop's launch on March 23 led to a significant surge in daily transactions on the Arbitrum blockchain. The peak daily transaction volume reached 2,728,907, surpassing both Ethereum and Optimism.

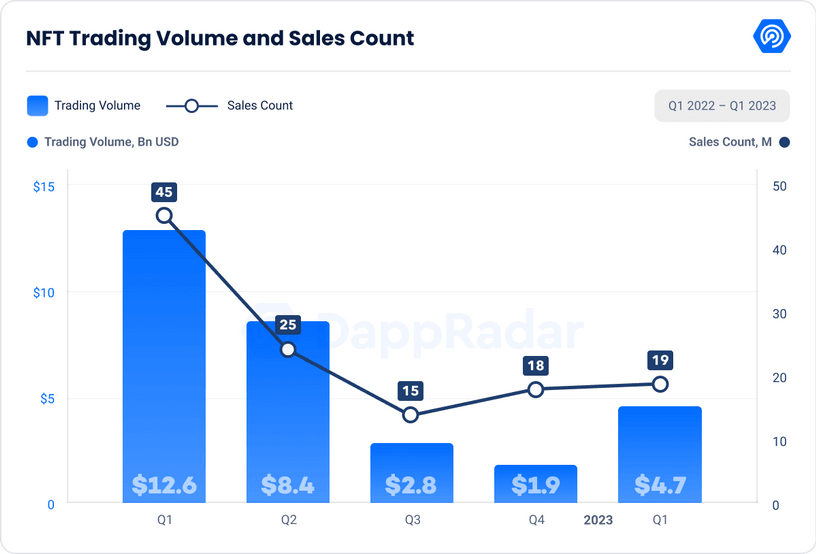

- The NFT market continues thriving, registering $4.7 billion in trading volume and 19.4 million in sales count. Polygon saw a 124% increase in trading volume and a 157.39% increase in sales count, driven by the popularity of its NFT collections.

- In January 2023, OpenSea emerged as the top performer in the NFT market, with a 66.58% surge in trading volume, amounting to $495 million. This impressive figure accounted for 58% of the NFT market's total trading volume, establishing OpenSea's market dominance.

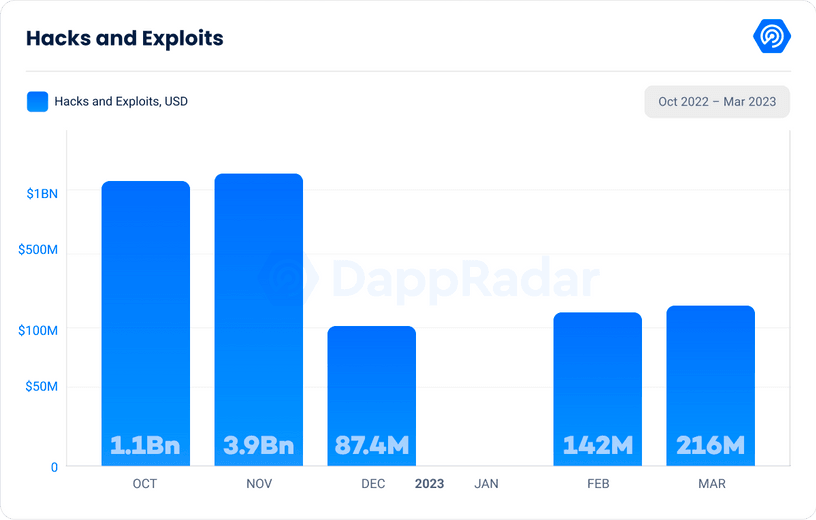

- In Q1 2023, the crypto industry experienced a significant decrease in the loss of funds resulting from hacks and exploits. Compared to the previous quarter's staggering $5 billion, the amount lost was a mere $373 million, representing a remarkable 92.60% reduction.

Bull Market on the Horizon

The start of 2023 marked a pivotal point for Bitcoin, as its value surged following weeks of low volatility. Despite negative events such as the Genesis drama, January proved to be a successful month for the cryptocurrency market as a whole. While February saw an average performance, March witnessed an upsurge in various metrics, signaling new heights for the industry.

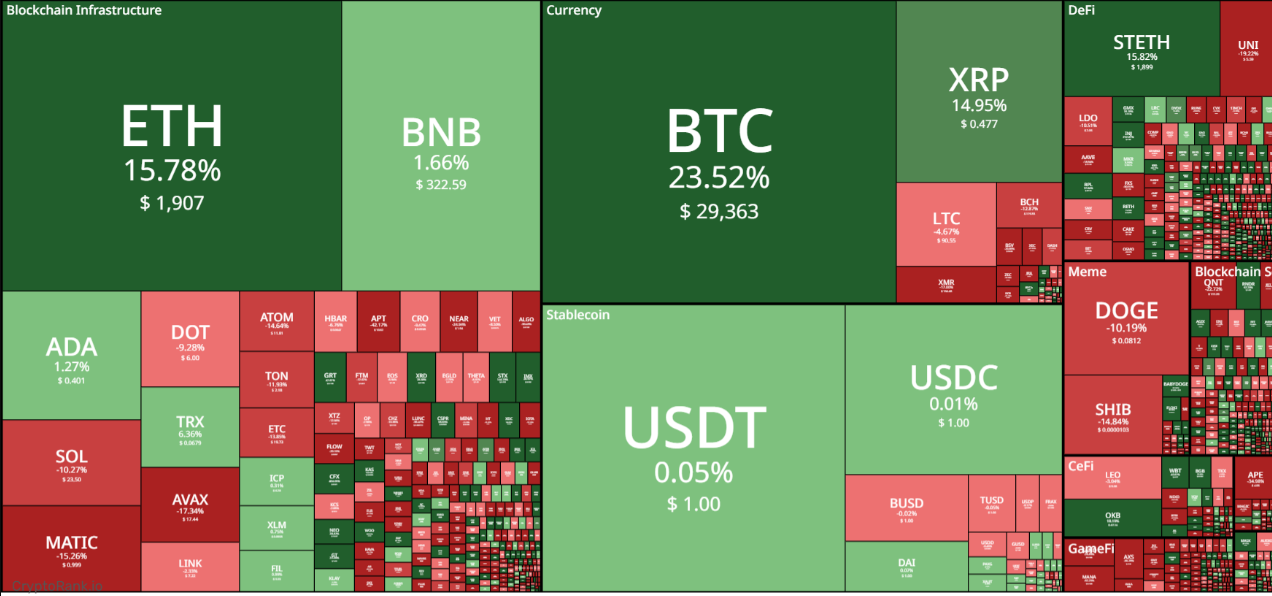

Bitcoin emerged as the clear outperformer among the top 10 projects of Q1, with several notable top-100 projects also making significant gains. Solana, which had a rough Q3 due to its& association with FTX, experienced a 109% increase in Q. Lido also performed impressively, with a 134% increase. Lastly, Aptos showed outstanding growth, with a remarkable 230% increase in this quarter.&

The DeFi Comeback: Exploring the Resurgence of Decentralized Finance

As the market rebounds, DeFi is also showing signs of recovery. However, DeFi's Total Value Locked (TVL) growth has been slower compared to the overall market due to altcoins lagging behind Bitcoin in their growth. Nevertheless, the emergence of new trends is a positive sign for DeFi.

Liquid staking has emerged as a new trend in DeFi as a key element of Proof-of-Stake networks and a significant income source for validators and delegators. The upcoming Ethereum upgrade, Shapella, will enable staked ETH withdrawals, further increasing liquid staking's popularity. Decentralized liquid staking providers like Lido and Rocket Pool have gained popularity among DeFi users due to offering derivative coins pegged to the amount of staked coins.

The latest DeFi market data reveals that liquid staking protocols have now surpassed lending and borrowing protocols in terms of combined TVL, making them the second-largest after DEXs. While there are 759 decentralized exchange (DEX) protocols with a total value locked (TVL) of $19 billion, there are only 78 other protocols with a combined TVL of over $16 billion.

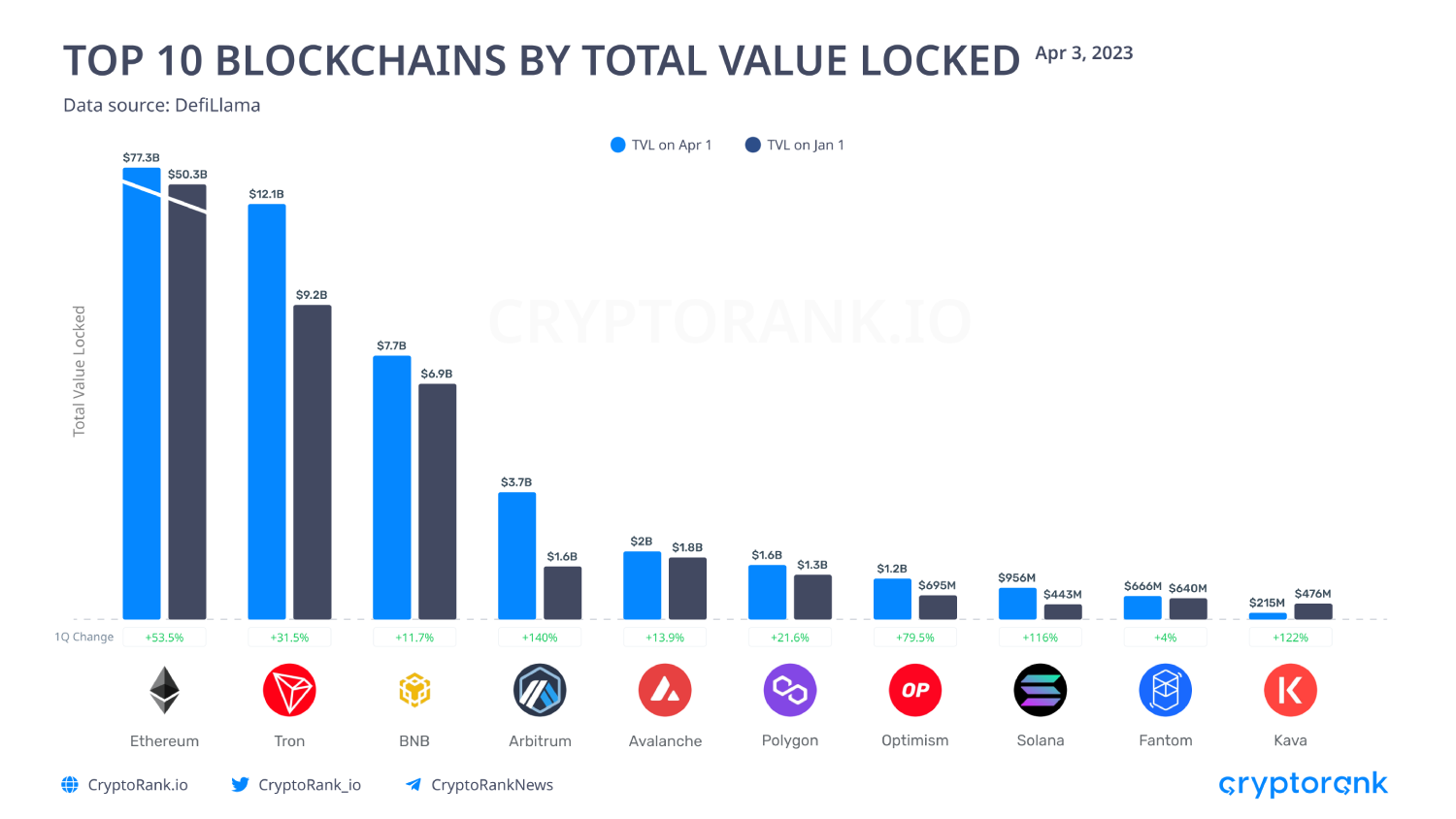

Regarding quantitative indicators of DeFi's recovery, the TVL has increased by almost 40% since the beginning of the year. While Ethereum continues to be the top-performing blockchain, Arbitrum, Solana, and Optimism experienced a significant increase in TVL during Q1 2023.

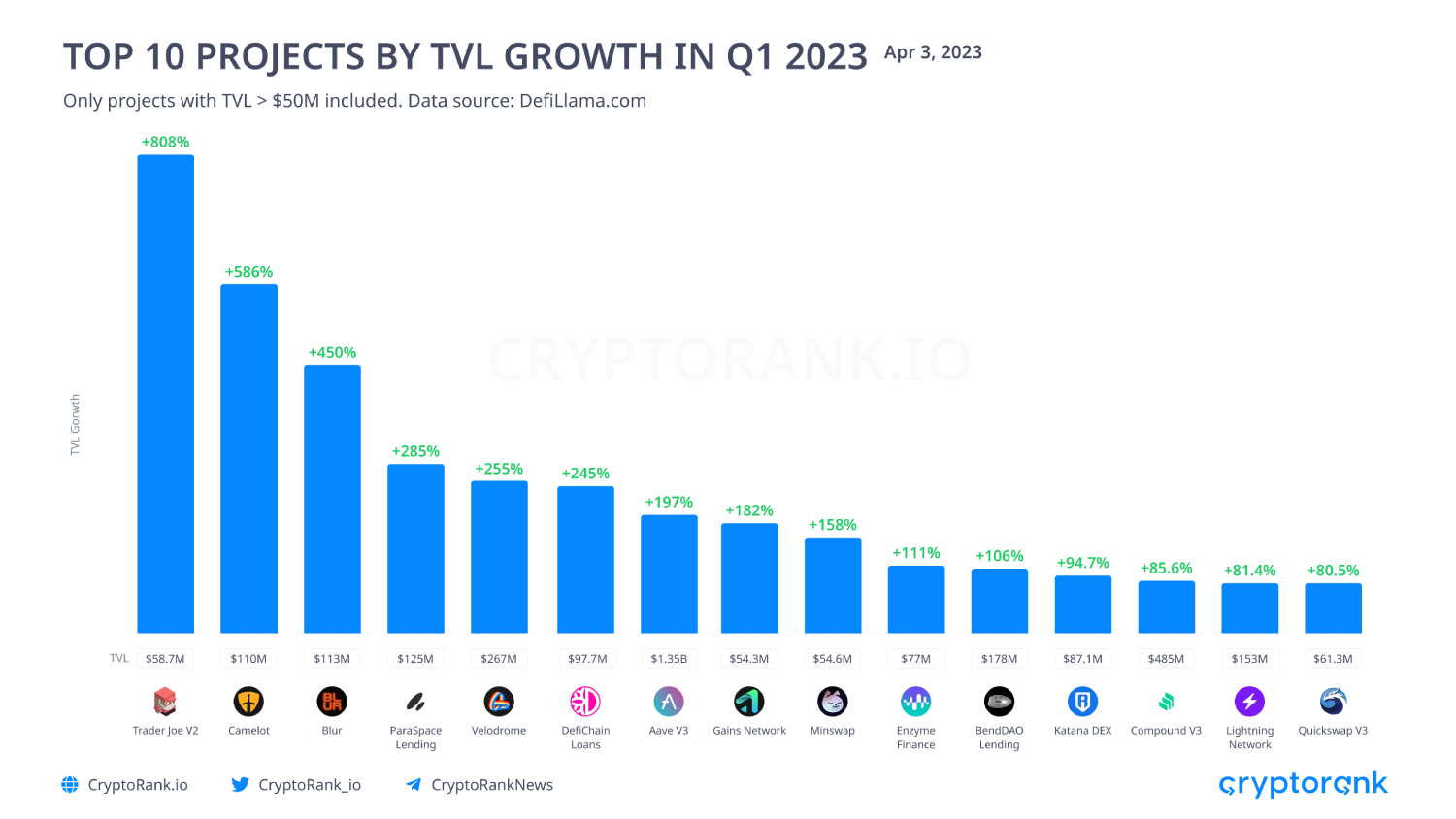

In Q1 2023, some protocols that launched on new networks saw a notable increase in TVL and garnered significant attention. Layer 2 technology has played a crucial role in driving the substantial surge in TVL for protocols such as Camelot, Velodrome, and Gains Network. The Lightning Network protocol has shown remarkable growth among the top 15 protocols, primarily fueled by the increasing use of Bitcoin as a payment option.

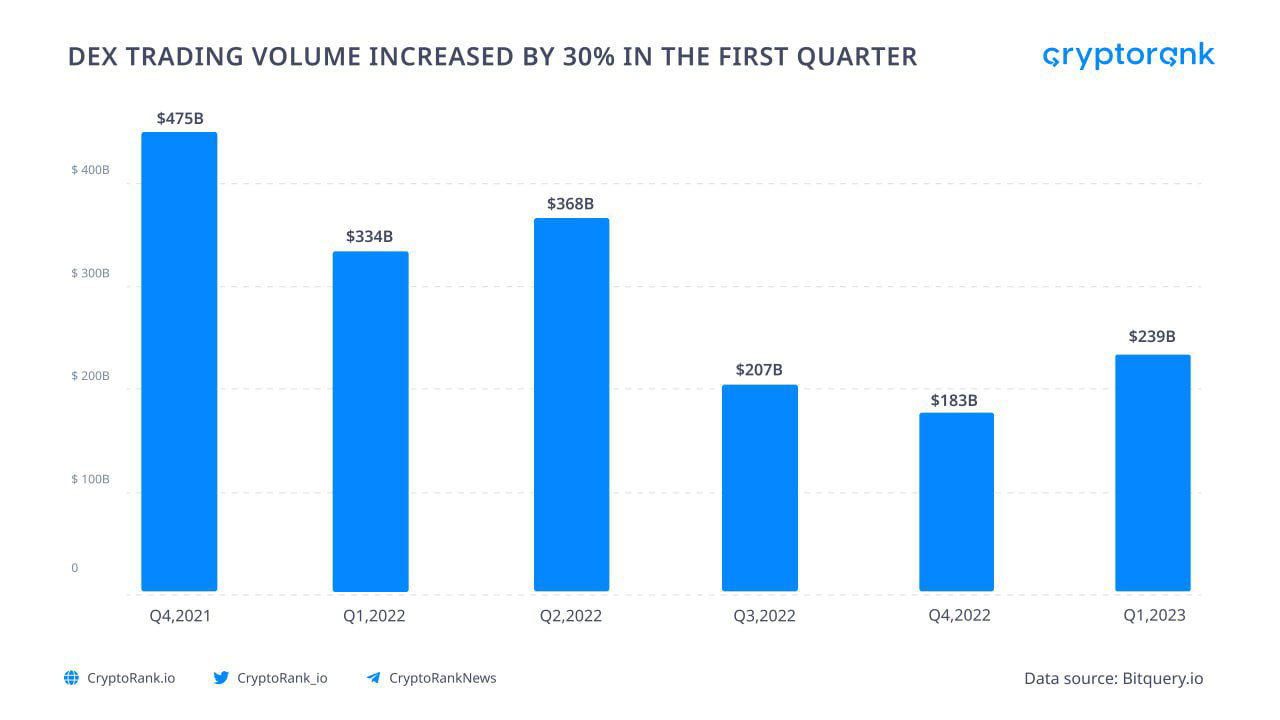

DEX trading volume showed a remarkable increase of nearly 30% after two consecutive quarters of decline. The DEX/CEX ratio also increased, nearing November 2022 levels. In the current market conditions, DEXs are in a favorable position to maintain their growth trajectory due to factors such as low gas fees and increased awareness among Web3 users.&

Despite the DEX/CEX ratio still being 4% below the all-time high of January 2022, the growing popularity of blockchain could propel this metric to new heights in the future.

Layer 2 Solutions: The New Frontier of Blockchain Scaling

2022 saw a significant increase in the adoption of Layer 2 blockchains. In 2023, this trend is expected to reach new heights, as the broader crypto community recognizes the potential benefits of these solutions.

Optimism gained significant public attention through its substantial airdrop. Later that year, Arbitrum, an optimistic rollup, introduced the Arbitrum Odyssey, incentivizing users to engage with the network. The program proved to be so popular that it exceeded the capacity of the network. The launch of L2 blockchains was timely and well-received, offering users all Ethereum features but with faster transaction times, lower costs, and increased capacity.

Arbitrum gained significant traction in H2 2022, with several leading projects being launched on the network. This year, the buzz around Arbitrum's airdrop provided the perfect opportunity for other projects to launch their mainnets and testnets.&

Following the ARB airdrop, zkSync introduced the first mainnet of zkEVM, known as zkSync Era. This launch garnered significant attention and resulted in a surge in transaction volumes.&

A few days later, Polygon launched its much-anticipated zkEVM as a mainnet beta. Several other Layer 2 projects are also garnering interest not only from the crypto community but also from major venture capital firms.

Various companies have been following in the footsteps of Polygon by expanding zero-knowledge technologies and developing their own blockchains. For example, ConsenSys, a significant player in the crypto industry, has recently launched "Linea," its public testnet for zkEVM.&

Coinbase has also launched its L2 network, ”Base” - a reminder that we're still in the early stages of Layer 2 adoption, with many more innovative rollups to come. The race for developing better Layer 2 solutions continues as the crypto community strives to enhance the scalability and functionality of blockchain networks.

NFT Sales Skyrocket to $19.4 Million&

The NFT market witnessed a robust uptick in Q1, displaying a remarkable 137.04% surge in trading volume. This record-breaking feat translated into a whopping $4.7 billion in total volumes, a staggering amount not seen since Q2 2022.& NFT sales reached a noteworthy milestone of $19.4 million in Q1 2023, showcasing an 8.56% increase from the previous 2022 quarter. These figures indicate the sustained and robust growth of NFTs in the current market, bolstered by the increasing interest of mainstream investors and institutions.

Inflated by the Blur token farming period, the NFT market experienced a dip in March, with a 15.65% decrease in trading volume compared to the previous month. As to the number of NFT sales, they remained relatively stable. A total of 2.7 million NFTs were sold, declining by only 4.63%, compared to the previous month.&

Looking at the bigger picture, Q1 2023 was a success for the NFT market, with a total of 19.4 million NFTs sold, representing an increase of 8.56% from the last 2022 quarter.

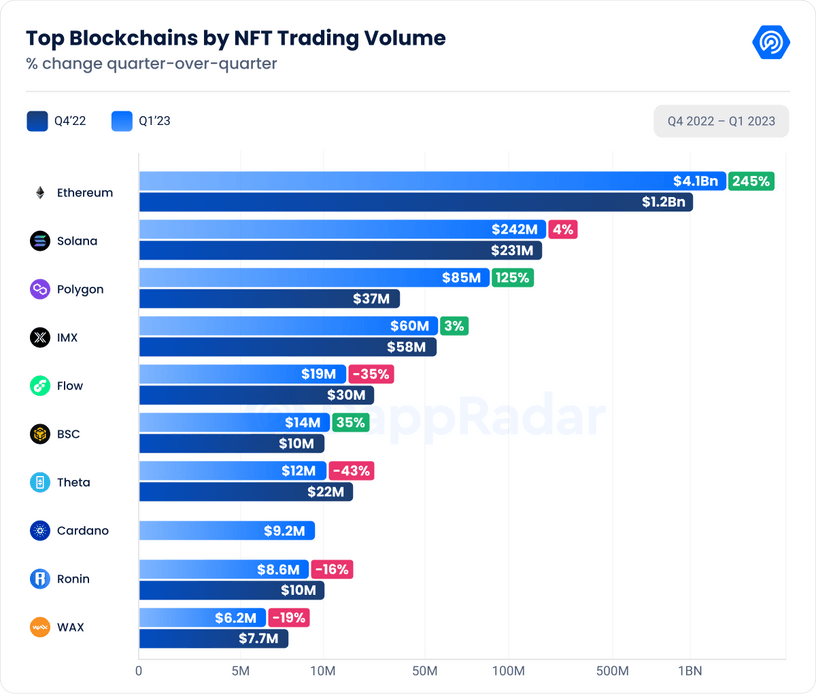

Ethereum maintained its stronghold in the NFT market, commanding a market share of 89.50% by volume. In Q1 2023, Ethereum's quarterly trading volume surged by 245.43%, reaching an impressive $4.1 billion.

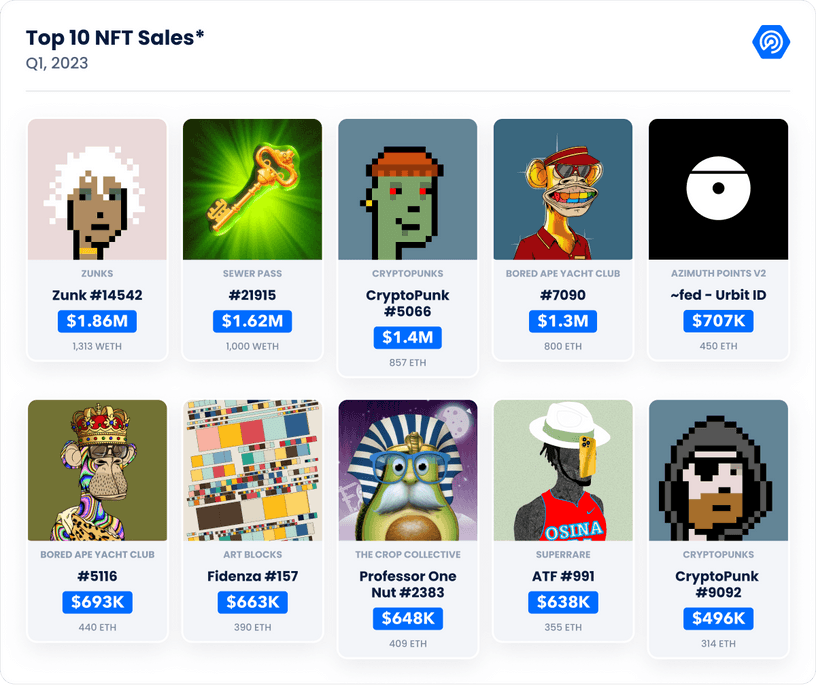

The highly popular CryptoPunks collection remained a top-performing asset in March, with a trading volume of $241 million, an increase of 1,214% from the previous month. Yuga Labs NFT collections have emerged as a major player in the Ethereum market, commanding a 38.61% share of Ethereum's NFT volume and 34.55% of the entire NFT industry.

Solana made a surprising entry into the NFT market by taking the second spot in trading volume, with $242 million and a 4.55% increase from the previous quarter.& The success of Solana's NFT protocol is largely attributed to the Monkey Kingdom collection, with its trading volume doubling from February to March, reaching $7.9 million. In December 2022, the two most popular NFT collections on Solana announced their plans to bridge to Ethereum and Polygon, which was a significant milestone for the blockchain. The successful launch of the y00ts sale on Polygon was announced on March 27th by the co-founders of DeGods and y00ts. The event marked a significant milestone in the implementation of the bridge for one of the collections.

Polygon has been steadily gaining popularity in the NFT market. It had an impressive start to the year, with a trading volume of $29.8 million in March, despite a 24.20% decrease from the previous month. When looking at the quarterly data, the blockchain recorded a remarkable 125.04% increase in trading volume, totaling $85 million in Q1 2023. This surge in activity can be attributed to Polygon's fast transaction times and low fees, which make it an attractive option for NFT creators and traders. In addition, Binance NFT, the non-fungible token arm of Binance, added support for the Polygon network in its marketplace, further boosting its popularity among NFT enthusiasts.

DApp Industry Overview

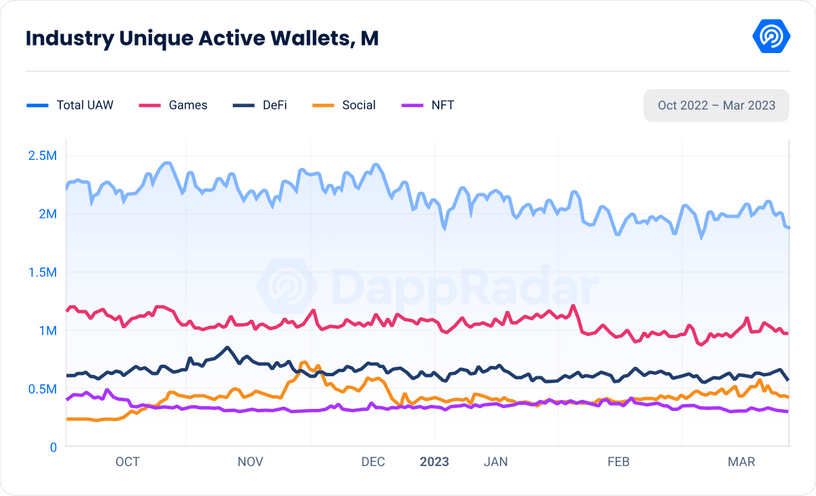

Following a dynamic quarter in the decentralized application (DApp) industry, the daily Unique Active Wallets (dUAW) interacting with decentralized applications decreased by 9.7% compared to the previous quarter, with an average of 1,735,570 wallets connected to DApps daily. However, despite this overall decline, certain categories and blockchains have demonstrated growth.

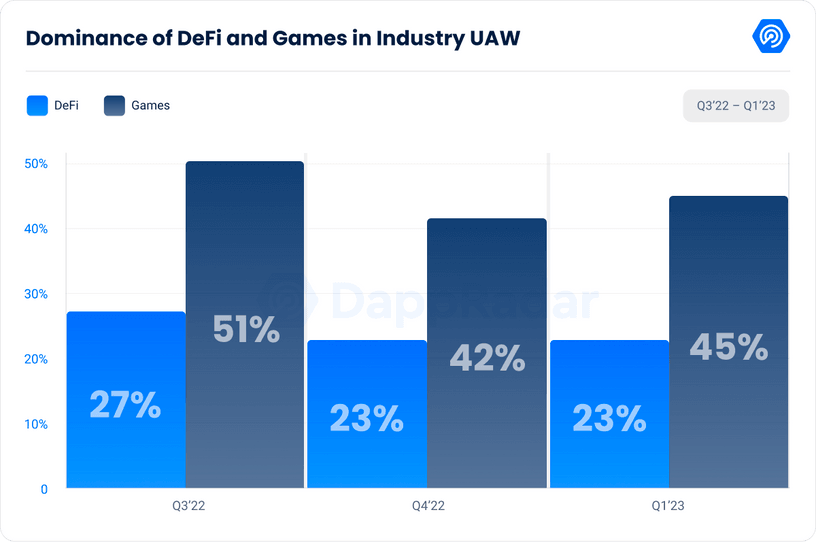

The blockchain gaming category remains the dominant vertical in the DApp industry, accounting for its 45.6%, with an average of 791,474 daily Unique Active Wallets (dUAW) in Q1, a decline of 8.58% compared to the previous quarter. Meanwhile, DeFi had an average of 399,522 dUAW in Q1 2023, representing a decline of 14.73% from the previous quarter, but still holding a 23% dominance over the industry.

Social DApps have emerged as a popular vertical, with an average of 210,644 dUAW in Q1 2023, a decrease of 4.9% from the previous quarter but an impressive growth of 2,250% since Q3 2022. Currently, social DApps account for 12% of the on-chain activity tracked by DappRadar.

In Q1 2023, NFT DApps, comprising marketplaces, recorded an average of 139,350 daily Unique Active Wallets (dUAW), accounting for 8% of wallet activity. This reflects a 0.2% increase from the previous quarter and marks a notable surge from the 6% dominance observed in Q4 2022.

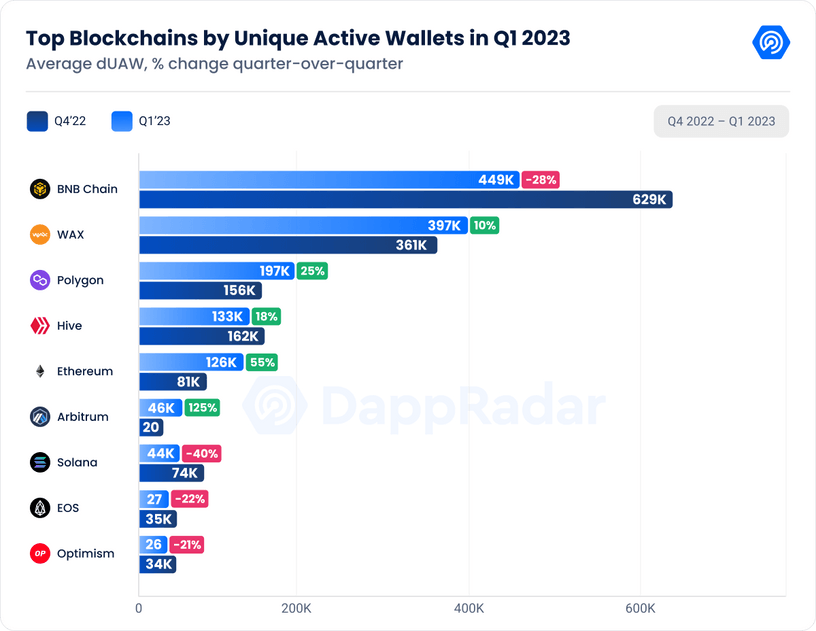

In this quarter, BNB Chain remains the most active blockchain with an average of 449,543 daily Unique Active Wallets (dUAW), still an 28.62% decrease from the previous quarter. Wax is the next most active blockchain, with an increase of 9% over the past three months, averaging 397,273 dUAWs. Meanwhile, Polygon experienced a strong quarter and saw its daily Unique Active Wallets rise by 25.93% to reach an average of 197,343.

Arbitrum was the top performer of the quarter, with an impressive increase of 125.83% with an average of 46,071 dUAWs due to the Arbitrum airdrop in March. Later in this report, we'll delve deeper into these figures and explore the Arbitrum ecosystem.

Blockchain Gaming's Dominance In Q1 2023

The blockchain gaming industry has been experiencing a steady surge over the past few years, and this trend continued in Q1 2023. While the number of daily unique active wallets (dUAW) interacting with gaming DApps on-chain decreased by 3.33% in March compared to February, the industry's overall dominance increased in the past quarter.

However, it's worth noting that the industry is still in its nascent stages and is in continuous development. Despite the decrease in dUAW numbers, blockchain gaming's dominance increased from 42.87% in Q4 of 2022 to 45.60% in Q1 of 2023, indicating a bullish sign. This suggests blockchain gaming's growing significance for the Web3 ecosystem.

Fundraising's Upward Trend in the Crypto Market

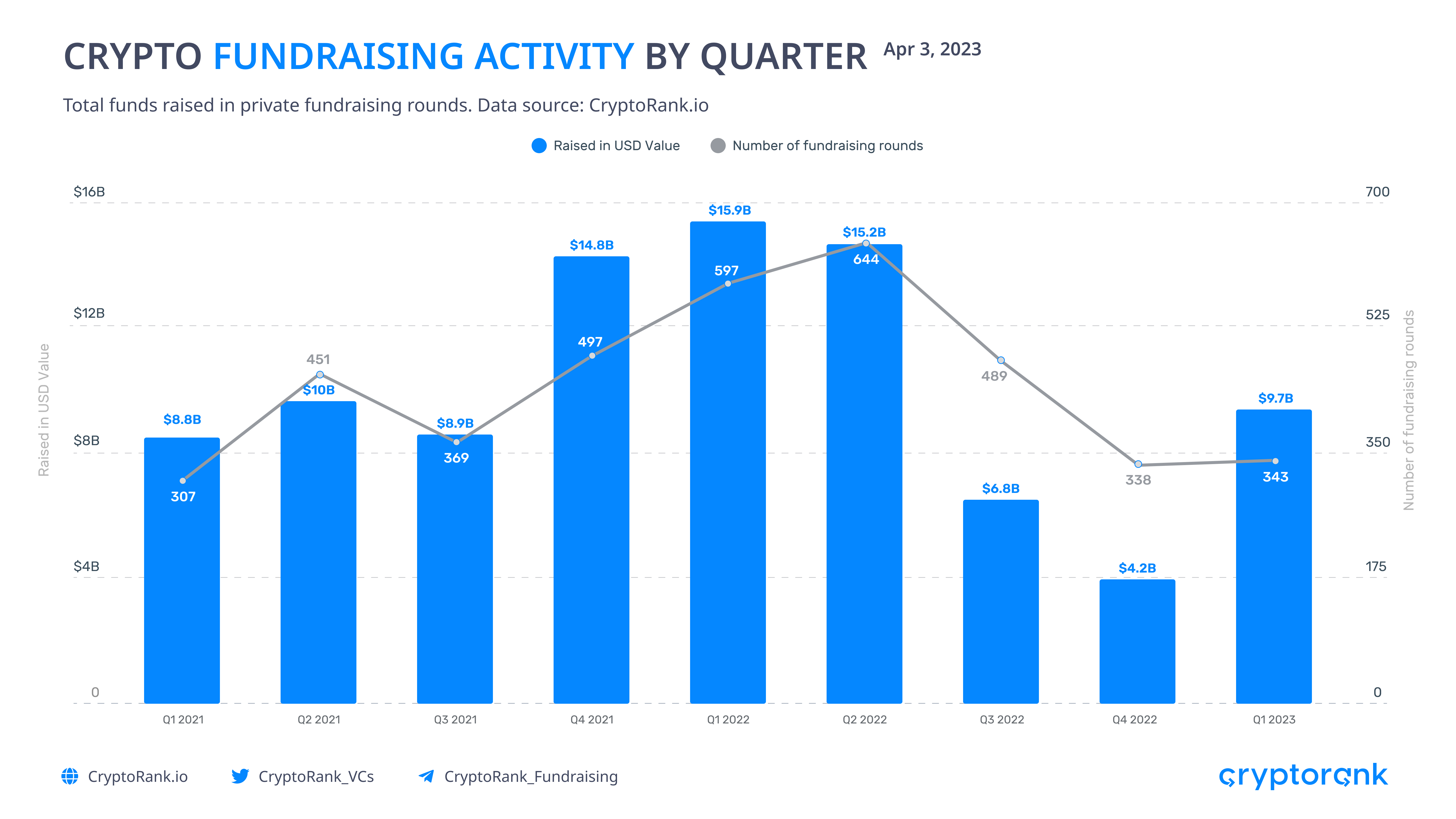

The bullish trend in the crypto market has led to a surge in fundraising activities. Venture capitalists and token sale launchpads are quick to capitalize on this opportunity as more investors are becoming aware of the crypto industry's potential.

Following the FTX collapse, there was a significant drop in fundraising activity due to the shutdown of Alameda and a lack of investment turnover. However, fundraising activity picked up in January, with a decent growth rate compared to December. March recorded even better results, indicating a positive trend in the industry.

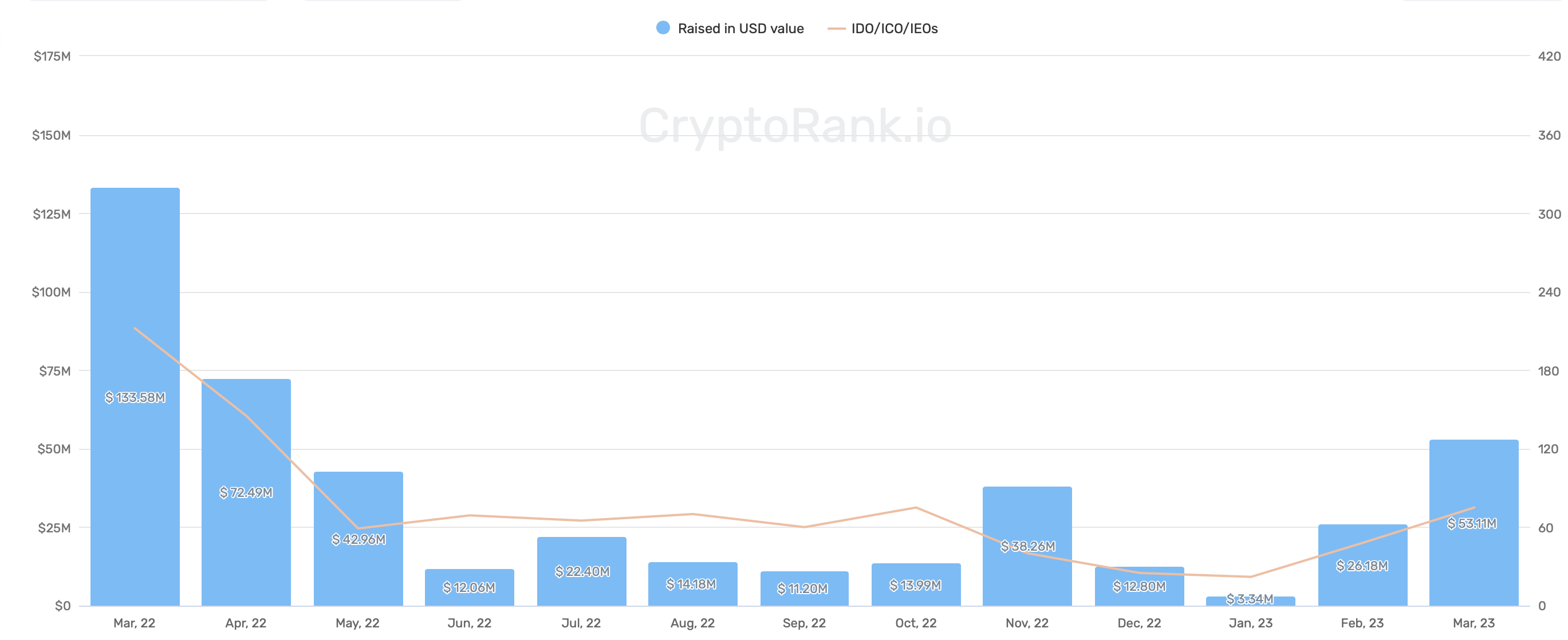

The crypto market has witnessed a shift towards infrastructure and service projects offering practical applications. In the public fundraising sector, there was a resurgence of token sale activity with successful launches in February 2023. This positive momentum has continued into March, with monthly fundraising totals surpassing those of May 2022.&

This encouraging trend reflects the growing confidence of investors in the crypto space and highlights the potential for promising projects to secure funding in the current market climate.

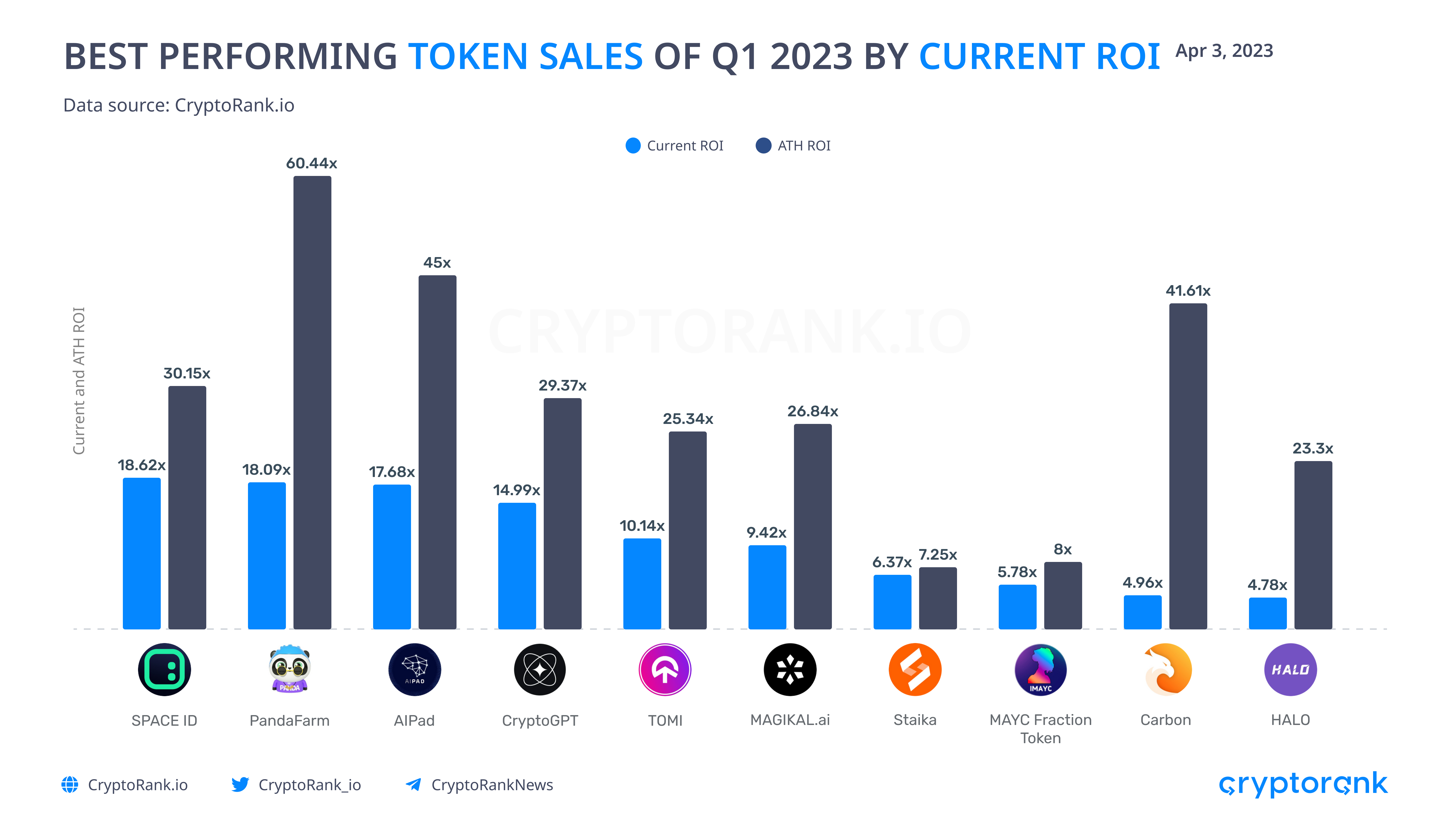

Initial Exchange Offerings (IEOs) from platforms such as Binance Launchpad, Bitget, and Gate.io Startup generated the highest returns for token sale investors. However, the number of Initial DEX Offerings (IDOs) outweighed that of IEOs. Among the top 10 projects ranked by current return on investment (ROI), AI-based projects performed particularly well. In particular, Space ID showed exceptional performance, demonstrating the effectiveness of the Binance platform.

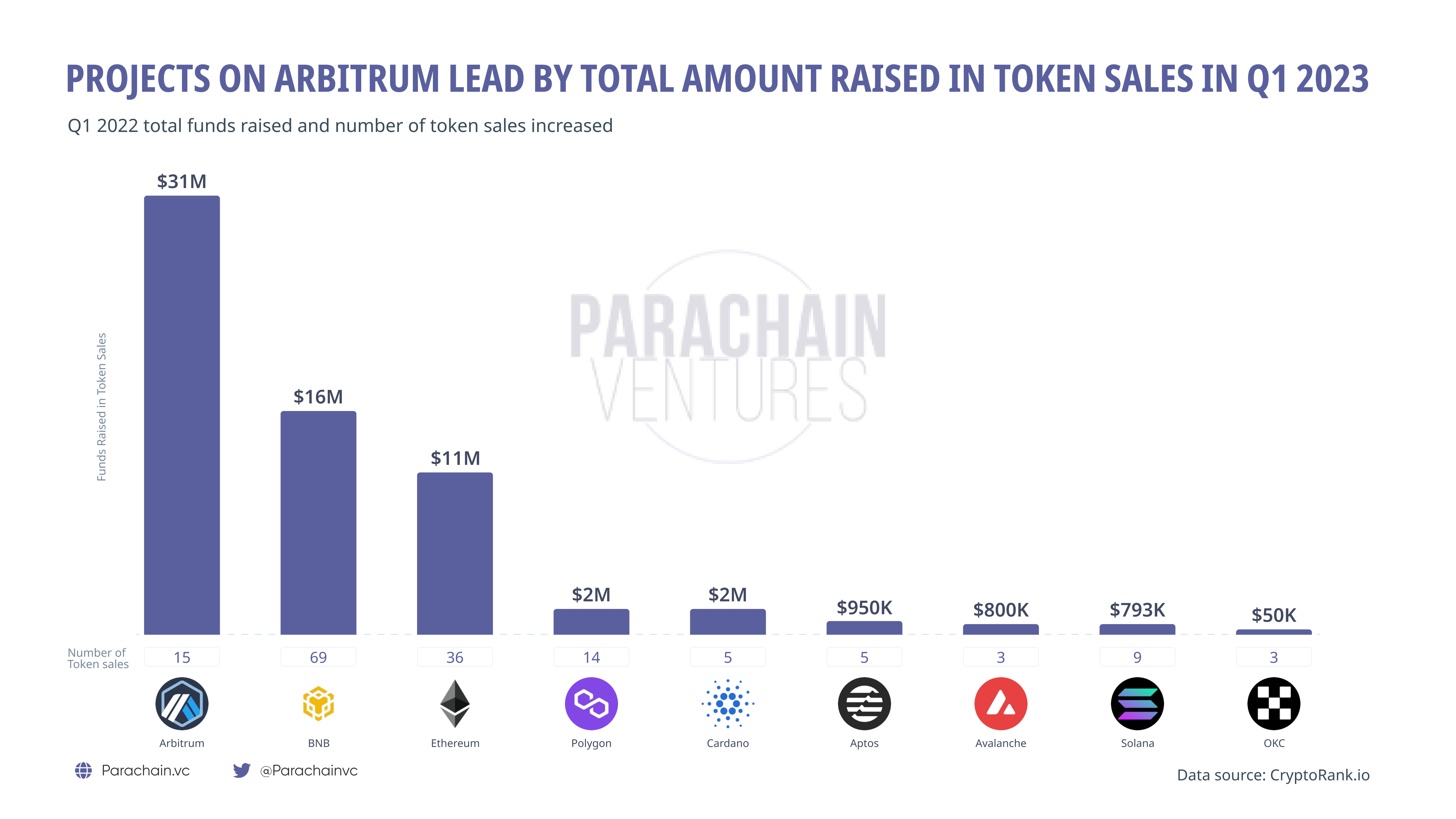

Arbitrum-based projects raised the highest amount of funds through token sales, with a significant portion of the success attributed to the multiple highly lucrative token sales on Camelot. However, while Arbitrum led in terms of total funds raised, Ethereum and BNB Chain had more projects holding public sales during the same period.

$373M in Crypto Losses From Hacks and Exploits

According to the REKT Database, Q1 2023 saw a 92.60% decrease in funds lost due to hacks and exploits, totaling $373 million. This is a significant improvement compared to the previous quarter, where the total reached a staggering $5 billion.

While this is a positive trend, it's crucial to acknowledge that the crypto space still faces security concerns.

The Euler Finance hack was one of the most prominent security breaches, resulting in the theft of millions of dollars in various cryptocurrencies. The hacker stole approximately $196 million, including DAI, USD Coin, staked Ether (StETH), and Wrapped Bitcoin (WBTC). It was executed via a flash loan attack that utilized a multichain bridge to transfer funds from the BNB Smart Chain to Ethereum. The funds were then moved to the crypto mixer Tornado Cash, making it challenging to trace and recover the stolen assets. While the Euler exploiter returned 51,000 ETH to Euler Finance in March, some of the stolen funds still remain with the attacker.

The BonqDAO and AllianceBlock exploit was another major hack during Q1. The attacker manipulated the price oracle to inflate the value of WALBT and minted over 100 million BEUR. This manipulation enabled them to liquidate multiple troves and withdraw illicit gains totaling 113.8 million WALBT and 98 million BEUR, worth over $10 million.

Notably, over half of the security breaches of this period were observed on the BNB Chain. Ethereum and Polygon accounted for 18.2% and 9.1% of the total hacks, respectively. These exploits highlight the need for enhanced security measures on these chains. Plus, users must exercise extra caution while transacting on them.

In the crypto industry, January 2023 marked a significant decrease in hacks compared to 2022, with only $14.6 million lost in total. This suggests that the industry is increasingly prioritizing security and adopting more effective measures to prevent hacks and exploits.

Regulatory Call for Stablecoins Following Silicon Valley Bank Collapse

The recent Silicon Valley Bank (SVB) collapse has raised concerns about the need for stablecoin regulations. Stablecoins are digital currencies backed by a reserve asset, such as the US dollar, to maintain a stable value. USD Coin (USDC) from Circle Financial is a leader in the stablecoin market worth over $100 billion. However, when SVB failed, Circle revealed it had $3.3 billion in deposits at the bank, causing USDC to trade below its $1 peg for three days, reaching as low as 88 cents.

This incident has shed light on the lack of guidelines in the stablecoin market. While Circle and other stablecoins claim to hold collateral equal to every digital dollar they issue, Circle had $11 billion in uninsured bank accounts. In contrast, Tether has openly stated that billions of its stablecoin reserves are in corporate bonds, secured loans, precious metals, and even other cryptocurrencies.

The incident highlights the urgent need for clear and comprehensive regulations to protect investors and maintain stability in the stablecoin market.

The Bottom Line

To summarize, the start of 2023 has been encouraging for the crypto market, with positive indicators in the DeFi and NFT sectors. The reduction in funds lost to exploits points to an improvement in blockchain security.

The NFT market's upward trajectory and the DeFi platform's expansion provide cause for optimism over the crypto market's future. Considering these promising developments, we can anticipate a recovery and continued growth in the forthcoming months.

Disclaimer: All information provided in or through the CoinStats Website is for informational and educational purposes only. It does not constitute a recommendation to enter into a particular transaction or investment strategy and should not be relied upon in making an investment decision. Any investment decision made by you is entirely at your own risk. In no event shall CoinStats be liable for any incurred losses. See our Disclaimer and Editorial Guidelines to learn more.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments