In a groundbreaking decision earlier this month, the Southern District Court of New York determined that institutional sales of XRP conducted directly by Ripple constitute securities sales. However, intriguingly, XRP sales on secondary markets, specifically crypto exchanges, do not. A verdict that has sparked a ripple, pun intended, in the crypto space, potentially creating waves of disarray for the U.S. Securities and Exchange Commission (SEC).

The following opinion editorial was written by Joseph Collement, General Counsel at Bitcoin.com.

This legal ruling re-echoes the content of the now-infamous 2018 Hinman speech, a speech that the SEC passionately endeavored to keep out of the Ripple case’s evidentiary repertoire. This is the same speech whose author, Hinman, was meticulously wiped off the SEC’s official website in June 2023, much to the bemusement and consternation of the crypto community. The echo from Hinman’s 2018 address rings louder in the SEC’s now empty corridors.

Who Is William Hinman, and Why Does His Speech Matter?

William Hinman served as the Director of the Division of Corporation Finance at the SEC from 2017 to 2020. On June 14, 2018, Hinman, in a thought-provoking proposition, suggested that cryptocurrency startups could initially sell tokens as securities to raise funds before transitioning to non-security utility tokens once their networks are operational and the tokens have a functional use.

This perspective recognizes the dynamic nature of digital assets and how their classification can evolve over time, aligning with the economic reality of cryptocurrency projects. This adaptive approach to crypto token regulation, endorsed by SEC Chairman Jay Clayton in 2019, showcased an understanding of the “economic reality” that while some projects may satisfy the Howey test for securities at their inception, this status can evolve over time.

The SEC’s U-Turn and the Ensuing Saga

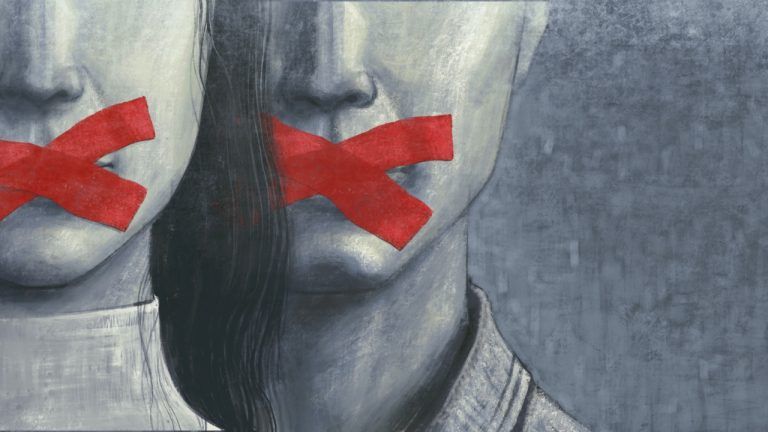

The SEC’s initial challenge to Hinman’s speech being admissible as evidence in the Ripple case was premised on two assertions. First, the speech was not a reflection of the SEC’s official stance. Second, the speech was privileged, owing to Hinman’s role as the Director of Corporation Finance. However, the court was unimpressed by SEC’s arguments and ruled the speech admissible on a limited basis.

In an eyebrow-raising move, the SEC decided to erase Hinman’s digital footprint from its official website on June 6, 2023, a decision that did not go unnoticed by the ever-vigilant crypto community. This deliberate purge underscored the lengths to which the SEC was willing to go to prevent Ripple from using Hinman’s insight as part of their defense.

What Are the Implications for the SEC?

The Ripple ruling, if used as a legal precedent in ongoing and future cases, could deal a devastating blow to the SEC. The court’s verdict implies that digital assets traded on secondary markets do not fall under the umbrella of securities, relieving crypto exchanges from the necessity to register with the SEC.

This means that the SEC’s hard-fought crusade for jurisdiction over crypto exchanges and digital assets could be rendered futile. Such an outcome is a hard pill to swallow for the regulatory body. However, it could open the door to a new era of thoughtful regulation. Regulation that seeks to safeguard consumers while simultaneously encouraging innovation, without burdening it with unwieldy and costly regulatory prerequisites.

The Ripple case not only highlights the ongoing struggle to define and regulate cryptocurrencies but also illustrates the potential for significant shifts in the regulatory landscape based on a single court decision. The SEC, on its part, needs to adapt to these ever-evolving realities of the crypto world rather than resort to prejudgment, erasure, and denial. After all, the crypto tide is not going to recede anytime soon.

What do you think about the implications for the SEC and the latest Ripple ruling? Share your thoughts and opinions about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments