Expectations of stringent regulation and further contagion from FTX continue to weigh on ETH price, but derivatives are showing a modest improvement in sentiment.

Ether (ETH) rallied 5.5% in the early hours of Nov. 29, reclaiming the critical $1,200 support. However, when analyzing a broader time frame, the 24% negative performance in the past 30 days significantly impacts investors' sentiment. Moreover, investors’ mood worsened after BlockFi filed for bankruptcy on Nov. 28.

Newsflow remained negative after the United States Treasury Department's Office of Foreign Assets Control (OFAC) announced a settlement with crypto exchange Kraken for "apparent violations of sanctions against Iran." In a Nov. 28 announcement, the OFAC said Kraken had agreed to pay more than $362,000 to settle its potential civil liability.

Moreover, on Nov. 28, institutional crypto financial services provider Silvergate Capital denied rumors of significant exposure to BlockFi's bankruptcy. Silvergate added that its losses are less than than $20 million in digital assets and reiterated that BlockFi was not a custodian for its crypto-collateralized loans.

Traders are afraid that Ether could drop below $800 if the bear market continues. One example comes from Crypto Twitter trader Il Capo Of Crypto:

I have spent hundreds of hours analyzing the market to come to the conclusion that:

— il Capo Of Crypto (@CryptoCapo_) November 28, 2022

Capitulation is a matter of time. $BTC should reach 12ks, $ETH 600-700, altcoins should drop 40-50% and shitcoins 50%+.

I won't post any more here until confirmation or invalidation.

Good luck!

Let's look at Ether derivatives data to understand if the worsening market conditions have impacted crypto investors' sentiment.

Pro traders are slowly exiting panic levels

Retail traders usually avoid quarterly futures due to their price difference from spot markets. They are professional traders' preferred instruments because they prevent the fluctuation of funding rates that often occurs in a perpetual futures contract.

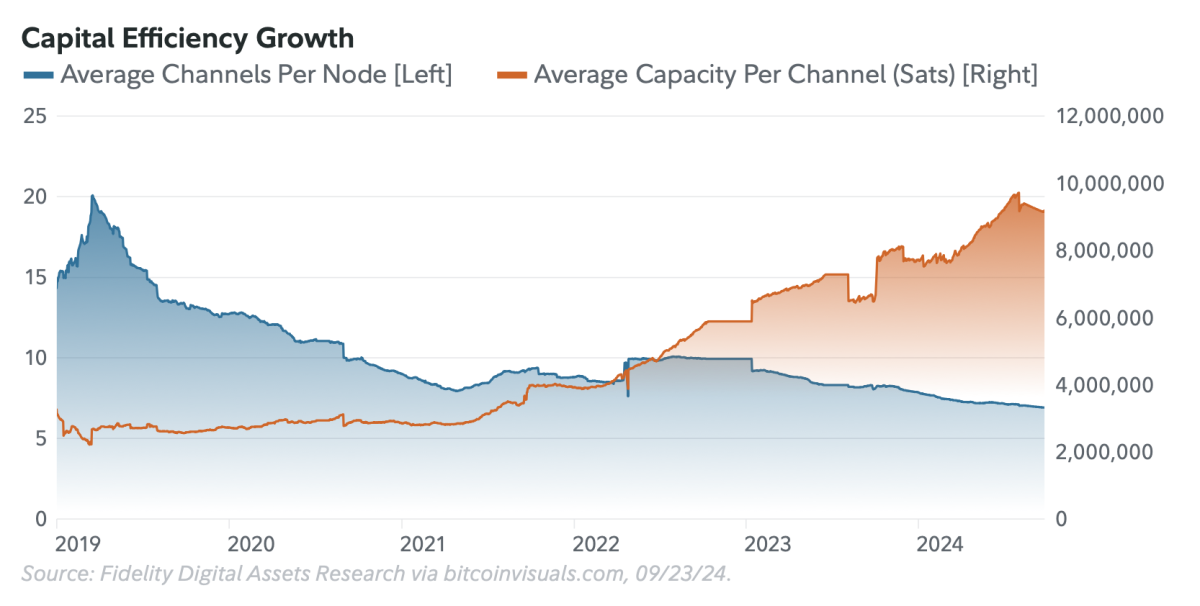

The two-month futures annualized premium should trade between +4% to +8% in healthy markets to cover costs and associated risks. Thus, when the futures trade at a discount versus regular spot markets, it shows a lack of confidence from leverage buyers — a bearish indicator.

The above chart shows that derivatives traders remain bearish as the Ether futures premium is negative. Nevertheless, it at least has shown some modest improvement on Nov. 29. Bears can highlight how far we are from a neutral-to-bullish 0% to 4% premium, but the aftermath of a 71% drop in one year holds great weight.

Still, traders should also analyze Ether's options markets to exclude externalities specific to the futures instrument.

Options traders do not expect a sudden rally

The 25% delta skew is a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, options investors give higher odds for a price dump, causing the skew indicator to rise above 10%. On the other hand, bullish markets tend to drive the skew indicator below -10%, meaning the bearish put options are discounted.

The delta skew has gone down in the past week, signaling that options traders are more comfortable offering downside protection.

As the 60-day delta skew stands at 18%, whales and market makers are pricing higher odds of price dumps for Ether. Consequently, both options and futures markets point to pro traders fearing a retest of the $1,070 low is the natural course for ETH.

From an optimistic perspective, data from on-chain analytics firm Glassnode shows that the November 2022 sell-off was the fourth-largest for Bitcoin (BTC). The movement has led to a seven-day realized loss of $10.2 billion.

Consequently, odds are the capitulation for Ether holders has passed and those placing bullish bets right now — defying the ETH derivatives metrics — will eventually come out ahead.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments