Key Takeaways:

- In 2024, Ethereum’s fee income reached $2.48 billion, a 3% increase despite the Dencun upgrade aimed at reducing fees.

- Tron and Solana displayed substantial growth caused by stablecoins and memecoins.

- Base and other Layer 2 protocols are actively shaping Ethereum’s ecosystem and increasing the scaling landscape.

This report highlights how blockchain operations are influenced by a variety of factors. It also emphasizes that a multi-chain ecosystem is essential for achieving a comprehensive system analysis.

Ethereum Fee Earnings Rise in 2024: A Paradox of Profitability Amidst Decreasing Costs

The famous Dencun update was applied in March, which along with Layer 2 transactions, also made it an alternative to cut costs for users of the ecosystem. But on the contrary, Ethereum, despite the attempt to lower costs, increased the amount of receiving fees, moving up to $2.48 billion by the end of the year. The increase of 3% compared to 2023 leaves much room to consider network economics and Ethereum’s position as a foundational blockchain. This progress displays the sturdiness of the Ethereum network, which dumps the expectation of a decrease after the Dencun update, and makes us wonder how this can even happen.

The Dencun Paradox: Unexpected Growth in Ethereum’s Fee Revenue

In this case, the contradiction is caused by a problem with the nature of the blockchain itself. Despite Dencun’s well-intended goal to diminish gas fees on L2s, it becomes clear that the entire network and its attached ecosystems showed a growth in transactions during the year. This suggests that while the Dencun update aimed to reduce costs, user behavior and transaction patterns ultimately offset these theoretical reductions.

The increased traffic stemmed from various factors, including airdrop campaigns, memecoin frenzies, and new NFT collections. While these activities were indirectly related to the main chain, they funneled back to Ethereum for settlement. Notably, nearly half of Ethereum’s 2024 fee revenue—$1.17 billion—was generated in the first quarter, highlighting significant fluctuations in network activity. The Dencun upgrade, thus, did not slow down the overall activity as we had anticipated, but it made it necessary for further transactions to take place, thereby generating the unanticipated fee revenue.

One of the significant things is the disconnection between Ethereum’s network health and the market value of its token. Besides the fact that the blockchain’s fee revenue was growing strong, ETH price didn’t manage to break the market expectations, and its ETFs out of the many successful ones were the ones that did not match the strength of those for Bitcoin. The performance was not in a red zone, but remember this fact-Fee income and the token price do not always grow together, a most beneficial piece of advice for the traders.

Comparing Ethereum with Tron and Solana: A Tale of Two Growth Engines

Top earning blockchains 2024

Ethereum’s fee performance was fruitful; however, the growth stories of Tron and Solana showed a striking contrast. Tron’s fee earnings increased by an extraordinary 116.7%, with a total of $2.15 billion. This growth was majorly boosted by the growing adoption of stablecoins. That is one of the stablecoin sectors where Tron has established itself as one of the biggest players. The Tron monthly earnings from fees barely touched a sum of $38.36 million in January 2023, which is far off from $342.54 million in December 2024, what means that the growth of this crypto was calm and smooth. This good result shows that Tron is a major integrating element of the largest blockchain networks, so it can compete with Ethereum.

On the contrary, Solana had a staggering 2,838% growth from a $750.65 million increase with extra fees. Although this sudden high in prices was less consistent and was influenced by other reasons such as the memecoin age. In addition, Solana’s notorious charge commission was also one of the sources of price increase during a period of meme tokens congestion, which clearly pointed out a different kind of blockchain usage, i.e., it was far from the Ethereum trend characterized by more activities within a diversified, broader range. Both of the chains had an upsurge in deploying tokens on their chains, but Solana’s journey was more insecure and short, while Tron’s model line seemed more reliable because users found that it was suitable for them.

Another play on the ledger is seen in the case of Bitcoin, where the fee earnings of the famous cryptocurrency increased by 15.9% because of the applications based on the new technology. Nevertheless, this increase is neither as dramatic nor as variable as the one seen with Tron or Solana. It is possibly the case that these different growing trends are a consequence of the rare scenarios being underpinned by market segments that are coming up with the chains.

Layer 2 Scaling in 2024: Successes and Challenges.

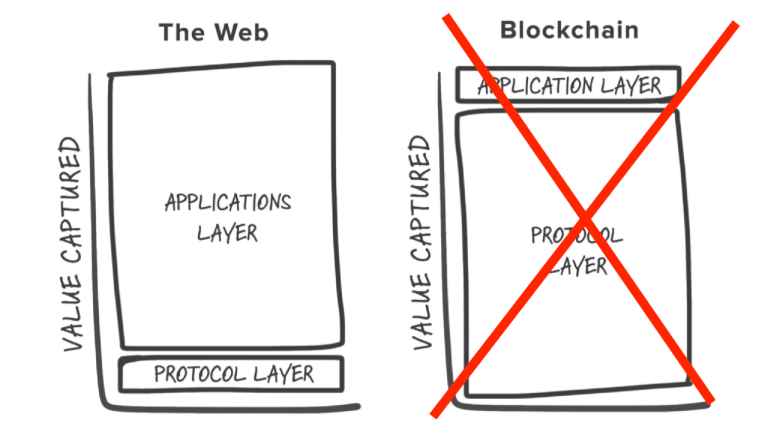

Layer 2 solutions are the focus of the 2024 blockchain topic. While Layer 1 protocols brought in $6.6 billion in fees, Layer 2 solutions are making their way with $294.92 million in revenue, showing that they are more important as an industry that is complex and competitive.

More News: The Explosion of Layer-2 Networks on Ethereum: Challenges and Opportunities

By far, Base has been the most successful L2 platform, with $84.78 million in fee revenue. Base’s expansion, on the one hand, was caused by the successful partnership with the major crypto exchange Coinbase, showing that traditional crypto businesses have a big say in the market. The doubling of Base’s average quarterly revenue highlights significant growth in user adoption and trading activity.

However, not all Layer 2s skyrocketed with such positive yields. The fee collection of the L2 solution of Arbitrum, which is well-known, reduced by 30.1%, while zkSync faced an even larger downward move of 59.6%. The fall is a sign of the L2 field moving towards a situation that is more competitive where the older ones face a new set of challenges from the newer and usually more specialized competitors. zkSync has recently gone through a roller coaster of earnings with their fees program and airdrop. Despite high token markdowns, the revenue model indicates that even minimal network usage can generate significant earnings. Also, This shows that airdrops cannot always guarantee long-term sustainability and it highlights how sustainable design is important for growth in the L2 world.

Conclusion: A Multi-Faceted Picture of Blockchain Economics

A recent study on the fee earnings of Ethereum for 2024 is a beautiful and rather complicated puzzle that needs to be solved. The change pursuant to the Dencun upgrade affects the revenue/fee earning side of the network however the network continues to be the go-to platform for decentralized applications and user activity has not decreased despite these cost-cuttings. This highlights a paradigm shift in Ethereum’s network dynamics, reflecting the interplay between implemented changes and future plans. The strong growths of both Tron and Solana, resulting from different reasons, portray the range of usage cases of blockchain technology. The changing success of the Layer 2 solutions indicates the competition of the blockchain industry among the winners and losers. All of these trends show how complex the blockchain ecosystem is for the various market participants to deal with.

The post Ethereum Fee Earnings Increase in 2024 Despite Dencun Upgrade appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments