| Undoubtedly one of the biggest hypes and trends during this prior bull market for Crypto has been, NFTs. We saw an exponential surge of NFTs for the first time in Crypto during this bull market with many old holders becoming millionaires. But it is sure that a market state where literal rock pictures are selling for over half a million is not sustainable at all. This is the literally bubble territory, but now with this bear market that bubble did burst. ETH Gas usage by NFTs divided in OpenSea, Blur and other marketplaces. Chart by James V. Straten Here we can see the bubble popping up in front of our eyes, an exponential surge of ETH gas usage for NFTs during the bull market, which was mostly due to OpenSea. Now with even the most popular NFT collections decreasing in floor price, no one is really doing any trading. And even Reddit Collectibles are not helping here. This is just another example that every bubble WILL inevitably burst one day, no unsustainable state of the market can be sustained. This is something really natural, but it obviously does not mean that the market can never go into a bubble again. Typo in the title: now instead of “not“, fuck spez for not allowing to edit titles. [link] [comments] |

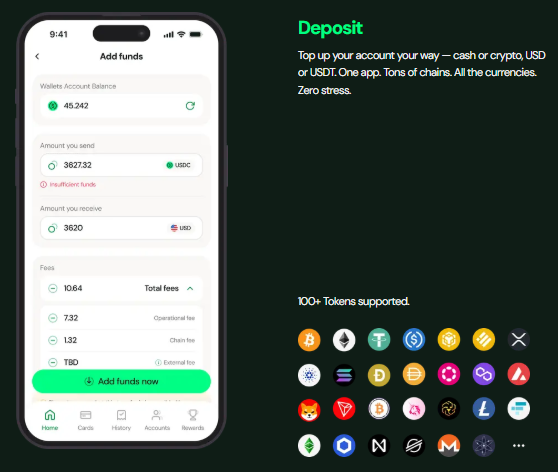

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments