The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Modern Monetary Theory (MMT) is back in the spotlight, driven by a new film Finding the Money and a recent clip that went viral on Bitcoin Twitter and Fintwit. In the clip, Jared Bernstein, Chair of the Council of Economic Advisors to the US President, is seen not being able to describe the most basic concepts of government debt and money printing. He claims MMT is correct but some of the language and concepts (the most basic ones) are confusing to him. An absolutely shocking statement given his role.

In this post, I will outline several major flaws in MMT that perhaps you, dear reader, will be able to use to go forth and debunk MMT. The stakes are high, because MMT cultists are gaining positions of power in governments around the world, as exemplified by Mr. Bernstein. It is a very dangerous proposition to put these people in power, because they will rapidly destroy the currency and cause economic armageddon. As bitcoiners, we believe bitcoin will replace the credit-based dollar, but we want the transition to be natural and relatively uneventful. A collapse of a major currency without bitcoin being ready to take the reins, would be catastrophic for so many.

Introduction to MMT

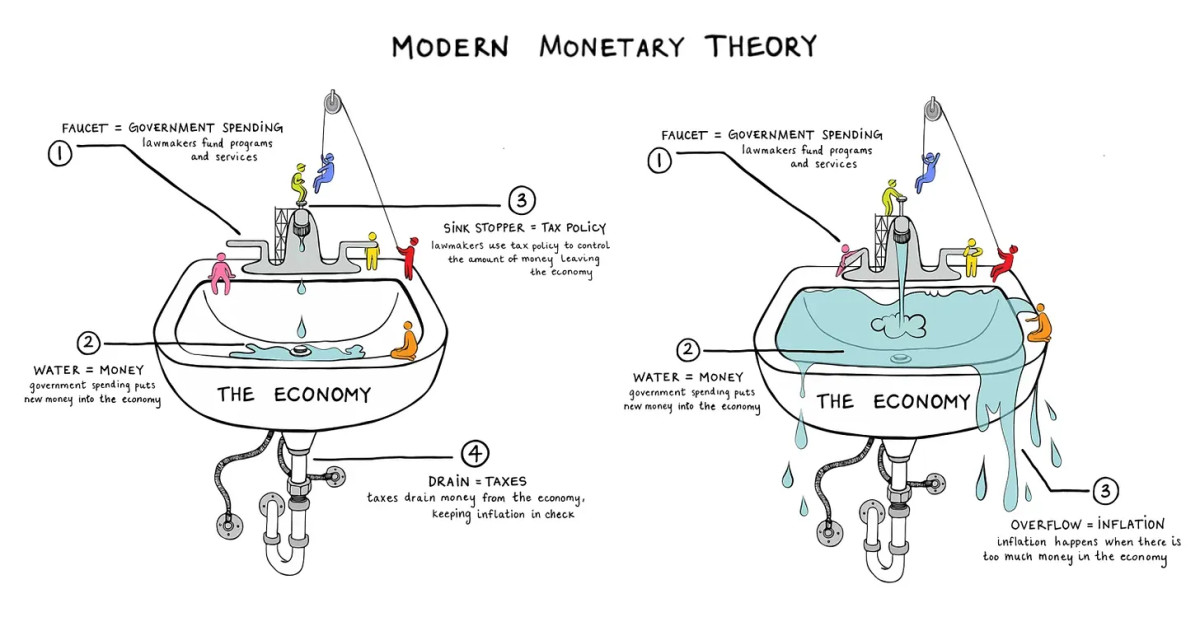

Modern Monetary Theory (MMT) is a post-Keynesian macroeconomic framework asserting that fiscal deficits are essentially inconsequential, monetary policy should be subordinate to fiscal policy, and monetary authorities ought to issue base money to finance massive government programs. MMT promises to eliminate involuntary unemployment and address social issues such as poverty and climate change. MMT is rooted in the belief that all money is a creation of the State, engineered through legal frameworks to facilitate governmental control over economic activities.

According to MMT, the government, which can issue its currency at will, cannot go bankrupt. However, there are obvious limitations to this power, like the inability to control the currency's value. MMT also redefines the traditional functions of money—medium of exchange, store of value, and unit of account—asserting that these functions are mere byproducts of government policy rather than intrinsic properties like scarcity and divisibility. This theory leads to the controversial notion that a government could dictate any item as money—be it acorns, IOUs, or Bitcoin—solely based on legal declarations, disregarding their properties, a concept starkly at odds with real-world economic dynamics.

No Coherent Theory of Value

The most significant shortcomings of Modern Monetary Theory is its approach to the theory of value. Instead of a subjective theory of value, where prices emerge through the preferences of individual actors, like personal spending or saving decisions, MMT replaces this with a democratic or collective theory of value.

According to MMT, the value of money is not derived from its utility in monetary functions—such as a medium of exchange, a store of value, or a unit of account. Instead, in MMT money's value originates from the collective acceptance and trust in the state that issues it. This acceptance then supposedly confers value onto the money. In other words, MMT reverses the traditional understanding: it is not that something valuable becomes accepted as money, but that something becomes valuable because of forced acceptance as money.

The value of money is reliant on the State being the economic calculator of sorts, instead of the individual market actors. The aggregate preferences of society along with central planning expertise go into an equation and full-employment is the result. This is not a joke. They don't have a theory of value beyond what was just explained.

The Mechanics of MMT: Taxes and Fiscal Policy

Modern Monetary Theory presents a skewed understanding of fiscal policy and taxation, proposing that taxes serve as the base load of demand for state-issued money. Without taxes, MMT adherents argue, government spending would lead to devaluation. This point reveals a notable contradiction: while MMT devotees fervently deny that deficits matter at all, they simultaneously argue that taxes are essential to counteract deficits’ adverse effects.

Furthermore, MMT believers overlook broader dynamics in currency markets. Taxes alone do not necessarily promote demand to hold a currency. Individuals may choose to minimize their holdings due to fears of depreciation, only converting other assets into cash when necessary to fulfill tax obligations. For example, a person might primarily operate using an alternative currency and only acquire the domestic currency in amounts needed to pay taxes.

In terms of fiscal policy, MMT contends the primary constraints on money printing are inflation, which in turn is due to the availability of real resources, such as labor and capital. In their school of thought, if they print money the result is economic growth until labor and capital are fully employed. Raising taxes is the mechanism to fight inflation by taking money out of the economy.

Another significant flaw in MMT is its required belief that the State can precisely manage fiscal policy outcomes. MMT overlooks the inherent limitations of central planning, particularly the circular reasoning that the information guiding fiscal policy is merely a reflection of previous government actions, assuming perfect policy transmission, without appreciation for real market data or external market dynamics. Are MMT planners in control or not? If so, it’s circular. If not, it’s wrong.

MMT does not acknowledge the existence of unintended consequences that necessitate frequent policy adjustments and undermine demand for the currency, because that would mean they aren’t in control. Moreover, market interest rates further complicate matters for MMT devotees. Micromanaging the economy would result in drastic declines in economic activity, lower demand for the currency and higher interest rates. Consequently, while MMT claims that the State can mandate the use of its currency, it does not have the power to control how the market values or trusts that currency.

MMT and Resource Allocation

MMT's approach to resource allocation emphasizes achieving "full employment" through top-down fiscal policies without addressing the efficiency of labor and capital use. Proponents of MMT argue that with the right fiscal policies, full employment of labor, capital, and resources can be guaranteed. However, they struggle to justify, using MMT principles, why seemingly unproductive activities like digging holes and then filling them back in are less beneficial than market derived employment of labor and capital. This often leads to ambiguous explanations about the differences in output, without a clear, consistent standard of value.

According to MMT, all economic activities that consume equal resources must be perceived as equally valuable, blurring the lines between productive investments and wasteful expenditures. For instance, there is no fundamental distinction made between using resources to build essential infrastructure or to construct "bridges to nowhere." This lack of an understanding of value leads to policies where the primary goal is employment rather than the value created by employment. The result is massive misallocation of labor and capital.

Conclusion and Implications

Modern Monetary Theory’s foundational principles and policy implications contain critical flaws. These range from its incoherent theory of value and reliance on circular fiscal policy logic, to its failure in competitive international currency markets and unworkable resource allocation strategies. Each of these risks could have profound consequences if MMT were widely implemented.

For those paying attention in the Bitcoin space, the similarities between MMT and Central Bank Digital Currencies (CBDCs) are particularly striking. CBDCs represent a shift from our current credit-based monetary system to a new form of fiat that can be tightly controlled through programmable policies—mirroring MMT's advocacy for pure fiat money managed by detailed fiscal policies. This alignment suggests that regions like Europe and China, which are advancing in CBDC implementation, may naturally gravitate towards MMT principles.

These transitions are monumental. A major economy cannot instantaneously switch to a new form of fiat money, despite what the MMT cultists would like you to think. The transition will span years, during which we'll likely witness the decline of traditional currencies. As MMT and these governments inadvertently champion Bitcoin, the choice for individuals, capital, and innovators will become clear. If people are forced to adopt a whole new form of money anyway, it will be a simple choice for capital, economic activity, and innovation to flee into Bitcoin.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments