Good morning, and welcome to First Mover. I’m Lyllah Ledesma, here to take you through the latest in crypto markets, news and insights.

Price Point: Bitcoin and Twitter shares are trading down Monday morning. More news unfolds from Three Arrow Capital's court documents, and traders think BTC could push back further in the short term.

Market Moves: Omkar Godbole reports that an on-chain indicator is suggesting bitcoin could be undervalued. Similar readings have marked bear market bottoms in the past.

Price point

Bitcoin (BTC) has been down 3.6% over the past 24 hours after trading $20,000 to $21,000 over the weekend.

The world’s largest cryptocurrency by market capitalization began to show signs of resilience last week as it briefly traded above $22,000, registering its highest valuation since mid-June.

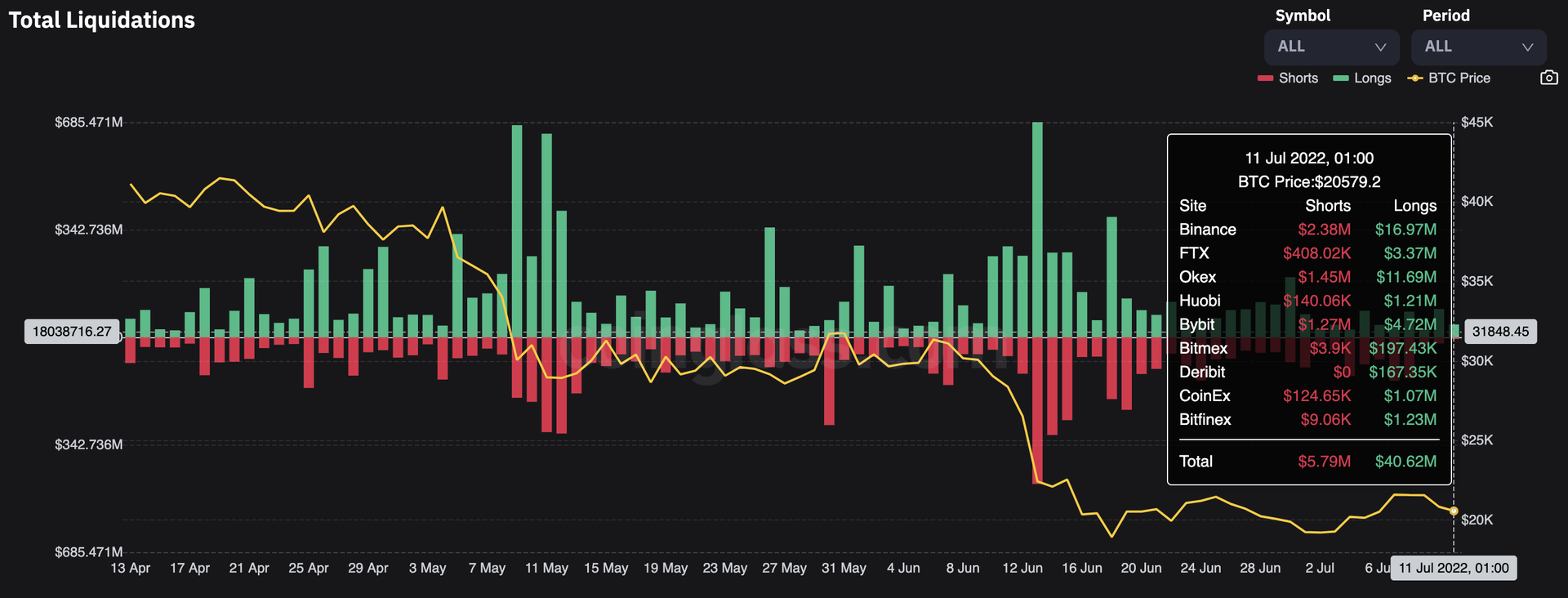

Bitcoin liquidations are showing longs to be substantially higher than shorts over the past 24 hours, data from Coinglass shows.

BTC total liquidations (Coinglass)

Shorts totaled $5.79 million and longs totaled $40.62 million.

“This could trigger sell orders at any time of the day,” said Laurent Kssis, head of Europe at Hashdex.

“We could test $20,000 before pushing back,” added Kssis.

Ether (ETH) is down 3% on the day, at $1,142. The only altcoins trading in the green Monday morning were privacy token monero (XMR) and tezos (XTC), up 5% and 3%, respectively.

Meanwhile, Twitter (TWTR) shares slipped in pre-market trading after Elon Musk decided to scrap his planned $44 billion takeover of the social media platform – causing fears that legal action could ensue.

TWTR shares on the New York Stock Exchange were trading down 6.55% at $34.40 at the time of writing.

Following the Three Arrows Capital debacle, the hedge fund recently got an emergency hearing as founders were failing to "cooperate."

In court documents filed late Friday in New York, lawyers acting on behalf of the creditors said that the founders of the fund “have not yet begun to cooperate with the [proceeding] in any meaningful manner.”

Creditors said that the fund’s remaining assets could be “transferred or otherwise disposed of” before creditors get their share. But first, creditors are requesting the court to obligate Three Arrows’s founders to list out the fund’s assets.

Terra developers migrate to Polygon

In other news, more than 48 projects previously on the Terra network have begun migrating to Polygon almost two months after the Terra ecosystem collapsed following the implosion of terraUSD (UST).

More than $20 million had been earmarked to help projects making the move.

Elsewhere, the Financial Stability Board (FSB), an international body that monitors financial systems and proposes rules with the goal of preventing financial crises, plans to present recommendations for regulating crypto in October, according to a Monday statement.

The FSB said it will propose recommendations for stablecoin regulation and submit a report on recommended rules for other crypto assets to the G-20.

Biggest Gainers

Biggest Losers

Market moves

By Omkar Godble

Bitcoin in 'Accumulation' Phase, On-Chain Indicators Suggest

It's time to start stacking bitcoin again. That's the message from indicators tracking tokens sold by miners and comparing the cryptocurrency's market value to its fair value.

The Puell Multiple, calculated by dividing the daily issuance of bitcoins in U.S. dollar terms by the 365-day average of the value, has dropped into a "green zone" below 0.5, indicating the newly minted coins are undervalued relative to the yearly average.

In other words, the current profitability of those responsible for minting coins is relatively low. In the past, that's indicated a perfect opportunity to build long-term exposure to the cryptocurrency.

"Entering the green zone is a good time to average in, and for those more conservative, you can also wait for confirmation with a move out of the accumulation zone," analysts at Blockware Intelligence said in a newsletter published on Sunday.

The daily issuance refers to coins added to the ecosystem by miners, who receive them as rewards for verifying a new block of bitcoin transactions. Recently, many miners have reduced their crypto holdings to stay afloat as the value of the reward has fallen.

Undervalued readings on the Puell Multiple have marked previous bear market bottoms.

"The Puell Multiple has reached a territory consistent with market bottoms in the past (below 0.5 and even touching levels below 0.4 a few weeks ago)," said Julio Moreno, a senior analyst at South Korea-based blockchain data from CryptoQuant.

Read the full story here: Bitcoin in 'Accumulation' Phase, On-Chain Indicators Suggest

Latest headlines

This web version of today's First Mover newsletter was produced by Sage D. Young.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments